Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

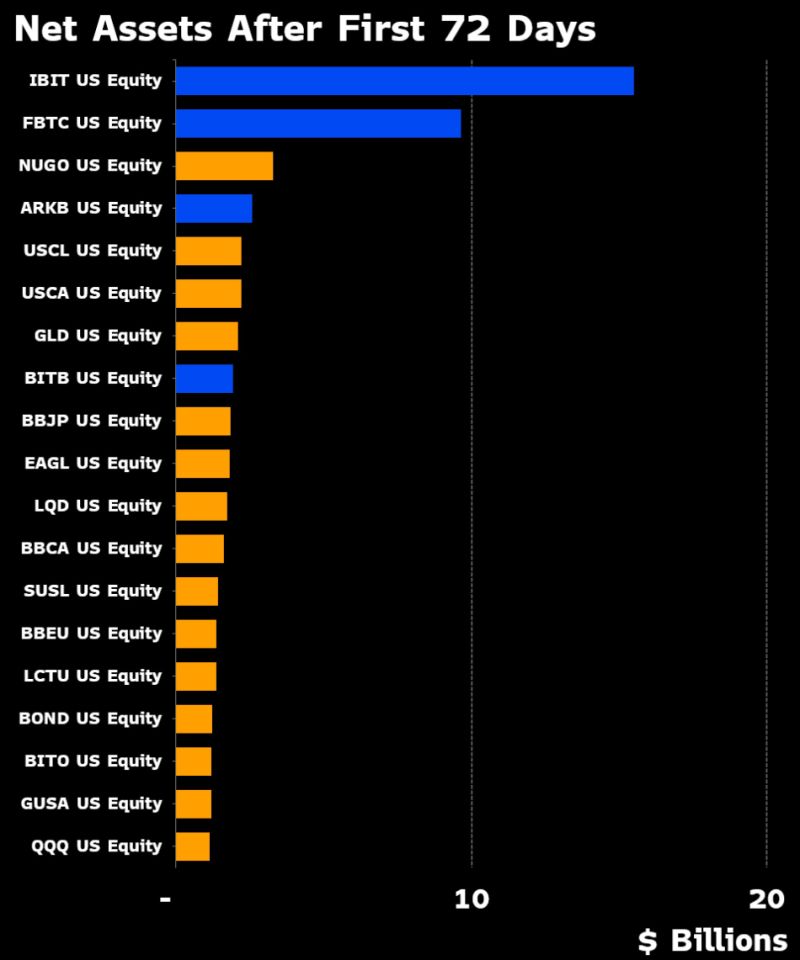

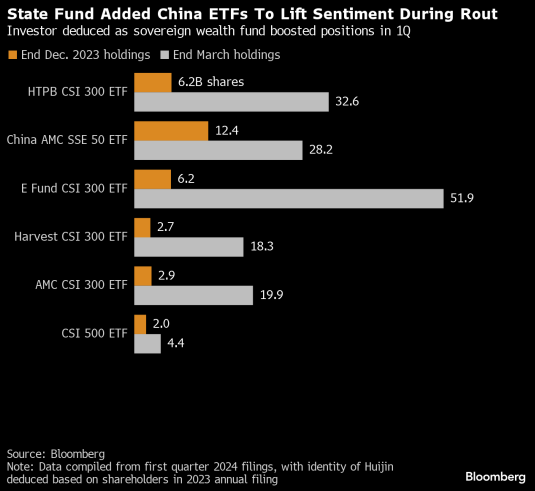

State Fund added China ETFs to lift sentiment during rout

According to Bloomberg, China’s sovereign wealth fund has “likely bought at least USD 43 bn of onshore exchange-traded funds in the first quarter” vs. USD 6.8 bn in the second half of 2023. The extent of the buying provides insight into the government willingness to stabilize the markets during challenging periods.

New Stock ETFs will offer the potential for capped upside gains with 100% downside protection.

Source: Barchart

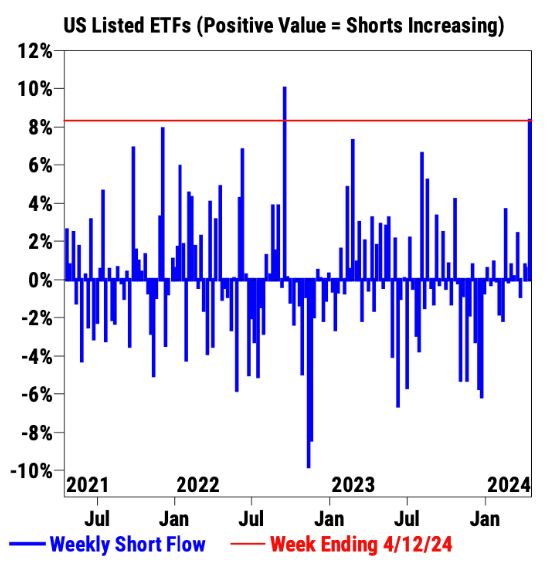

Hedge funds increased ETF short positions by largest amount in 20 months according to Goldman Sachs

Source: barchart

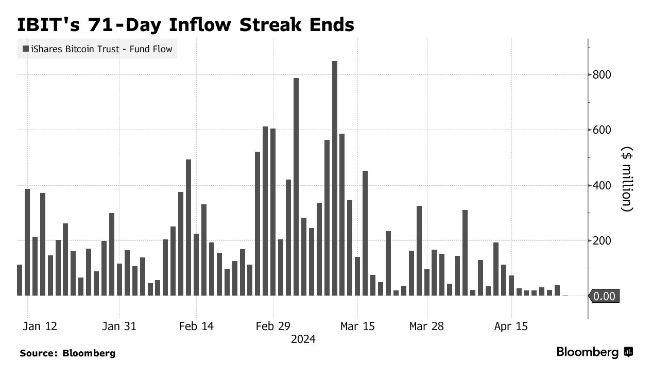

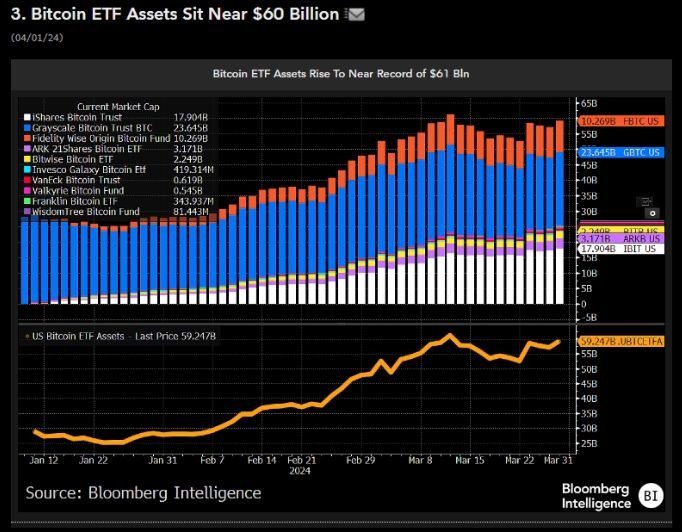

The first ever 2x and -2x spot bitcoin ETFs hit the market yesterday from ProShares.

$BITU and $SBIT (tickers could have been better). $BITX is 2x but it tracks futures and $BITI is -1x but is also futures. Fee 95bps on both. Haven't traded too much so far, under $1m. Source: Eric Balchunas, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks