Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

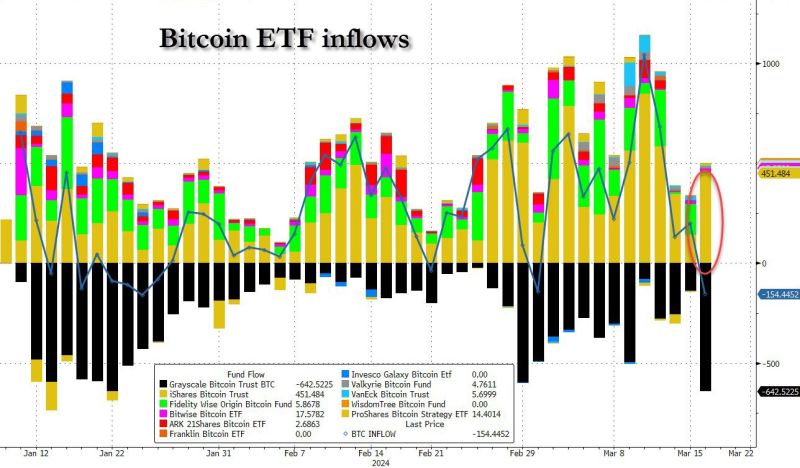

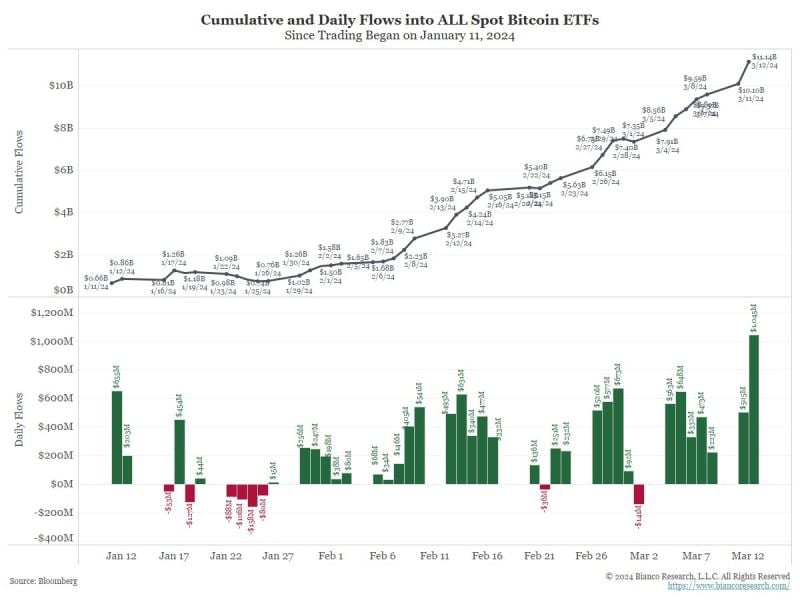

Here is the final daily breakdown of bitcoin etfs flows YESTERDAY

in a day when GBTC saw record liquidations (to meet bankruptcy obligations of Genesis and others) and when bitcoin tumbled, Blackrock's IBIT saw a surge of inflows. ETF demand still looks quite strong. Source: www.zerohedge.com

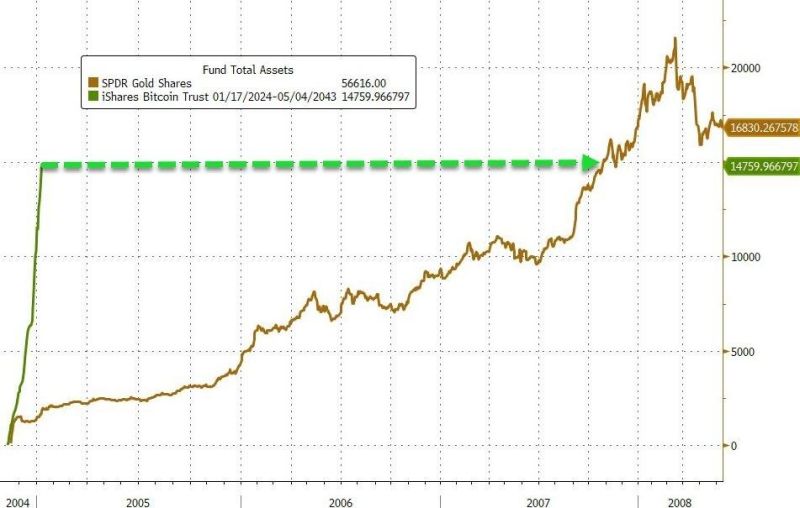

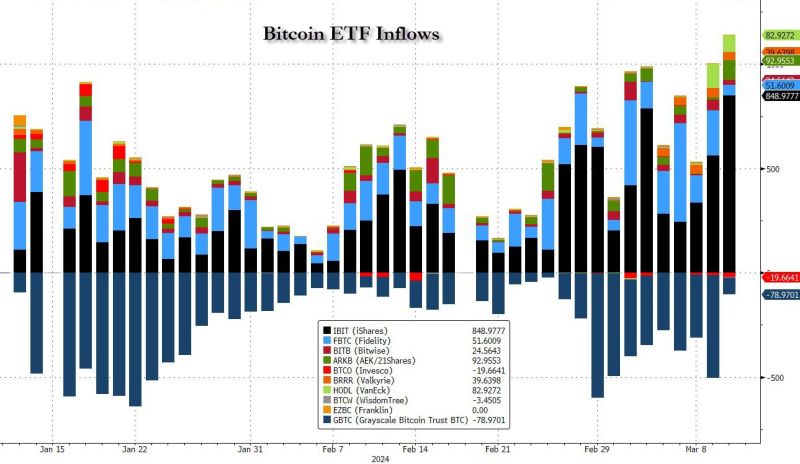

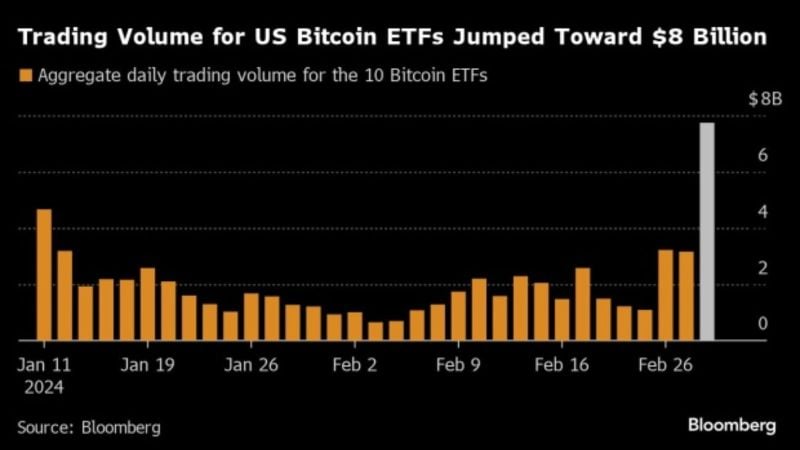

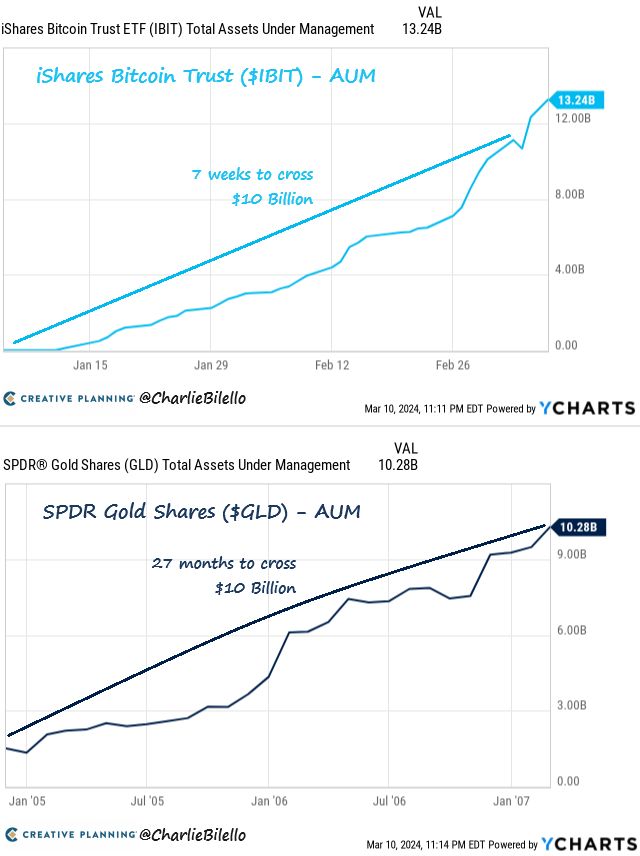

Trading volume in US Bitcoin ETFs hit YTD highs of $8B as Bitcoin prices are up 59% YTD, after reaching a new all-time high.

The surge follows regulatory approvals for spot-Bitcoin ETFs and comes ahead of the anticipated halving event, reflecting significant shifts in crypto accessibility and investor interest. Source: Bloomberg, Beth Kindling

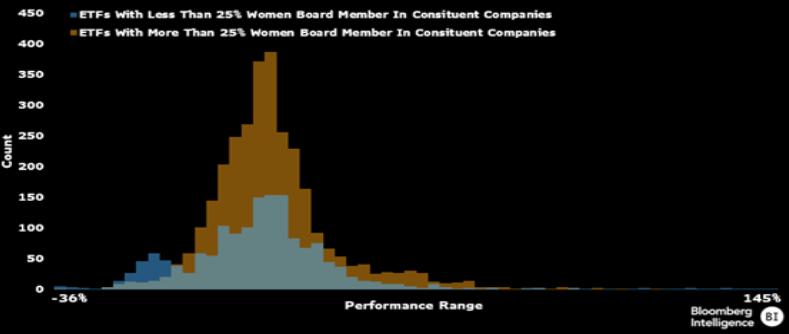

Higher female board presence may give ETFs 2.2% performance edge

ETFs that invest in companies with at least 25% women on their boards outperformed by 2.2% in 2023 rivals that invest in firms with fewer female directors. Statistical analysis suggests that relationship may be more causal than coincidental, adding to the value proposition of female corporate oversight.

Source: Bloomberg Intelligence

Investing with intelligence

Our latest research, commentary and market outlooks