Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

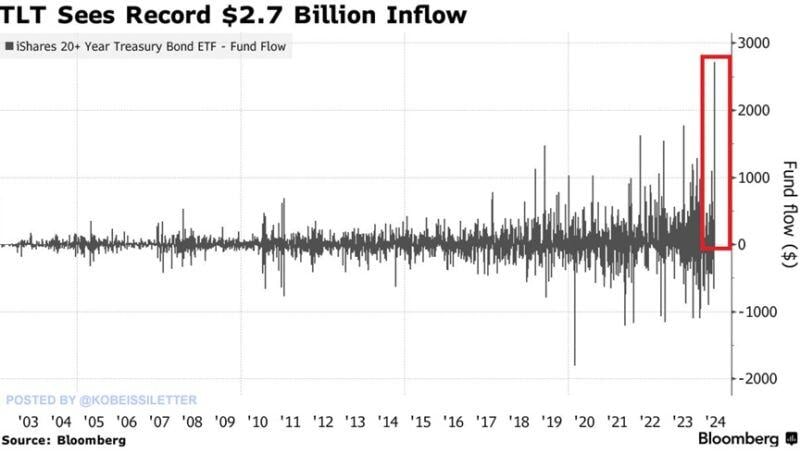

$TLT, a popular bond-tracking ETF recorded a $2.7 billion inflow last Monday, the largest inflow on record.

Year-to-date, the ETF has seen inflows of $4.4 billion, on track for its largest annual inflow on record. To put this into perspective, $TLT has $54 billion in assets under management. This is all despite $TLT falling -4% YTD and -37% over the last 4 years. Source: The Kobeissi Lettr, Bloomberg

Just in: BlackRock just launched a "buffer fund", a stock ETF with a 100% downside hedge.

The iShares Large Cap Max Buffer Jun ETF started trading on Monday under the ticker symbol $MAXJ What’s a buffer fund? These funds offer hedged exposure to stocks by limiting losses while also capping gains, and they’re not exactly a new concept. Since their inception, they’ve attracted industry giants like BlackRock, and they’ve drawn about $5 billion in inflows so far this year. But even before they came around, investment banks were offering their clients “structured notes” – a hybrid product that combines bits and pieces of different financial instruments into one to create customized risk-reward profiles. While there are many different types of structured notes out there, “buffer participation notes” are among the most popular. The notes and buffer funds work in the exact same way – they’re just packaged as different investment vehicles. Having said that, buffer funds are a lot more accessible for retail investors. Buffer participation notes, like most structured notes, are typically offered by investment banks only to sophisticated, high-net-worth clients. Buffer ETFs, by contrast, can be bought and sold just like any ordinary stock. Source: Finimize

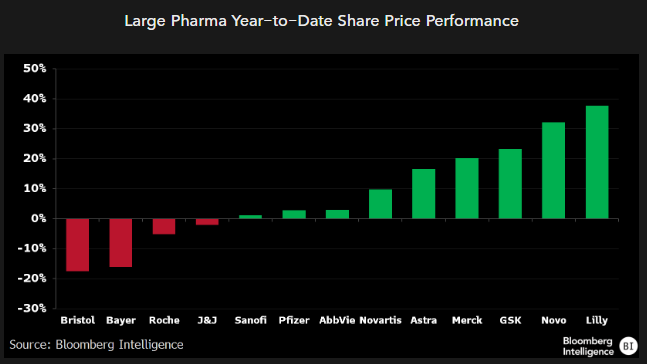

New weight-loss drug ETF

“Roundhill Investments' GLP-1 & Weight Loss ETF (OZEM), which began trading last week, pairs leaders Eli Lilly and Novo Nordisk with players developing new treatments for weight loss and diabetes. CEO Dave Mazza said his firm is capitalizing on explosive growth potential in the industry…Eli Lilly and Novo Nordisk each hold a roughly 20% weighting in the ETF. The three next largest positions are Zealand Pharma, Amgen and Chugai Pharmaceutical, each of which have a weighting under 5%”. Source: CNBC, Bloomberg

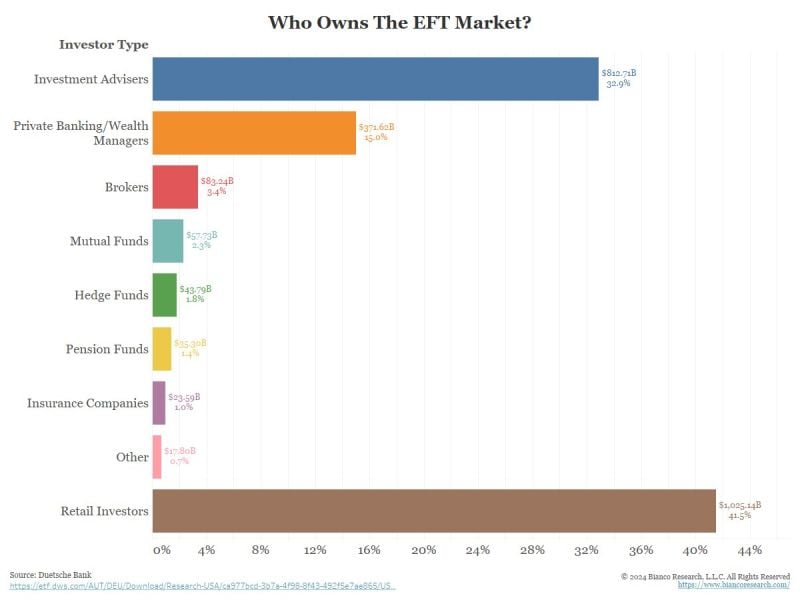

Good chart from Deutsche Bank / Bianco Research on the ownership of ETFs

Source: Deutshe Bank / Bianco Research

Investing with intelligence

Our latest research, commentary and market outlooks