Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

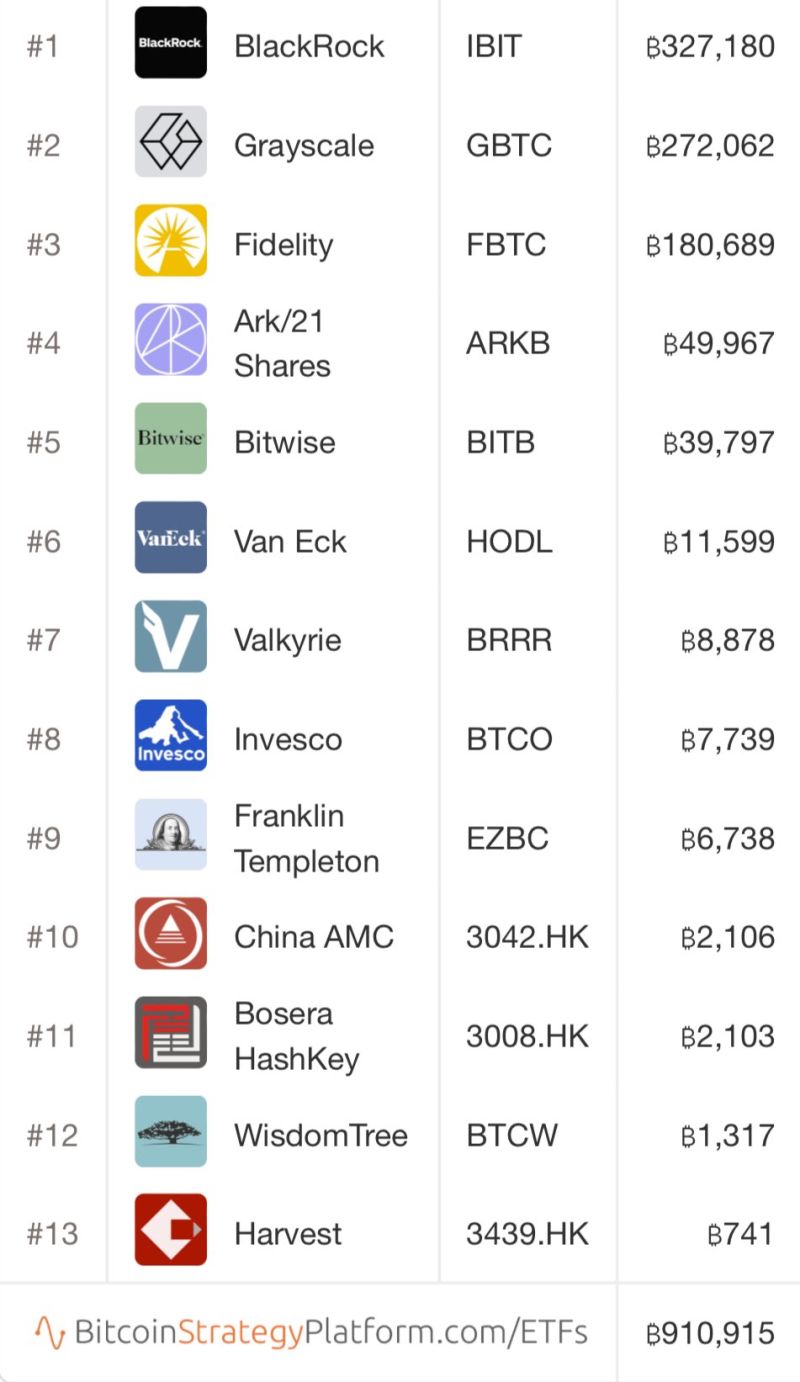

As highlighted by Eric Balchunas

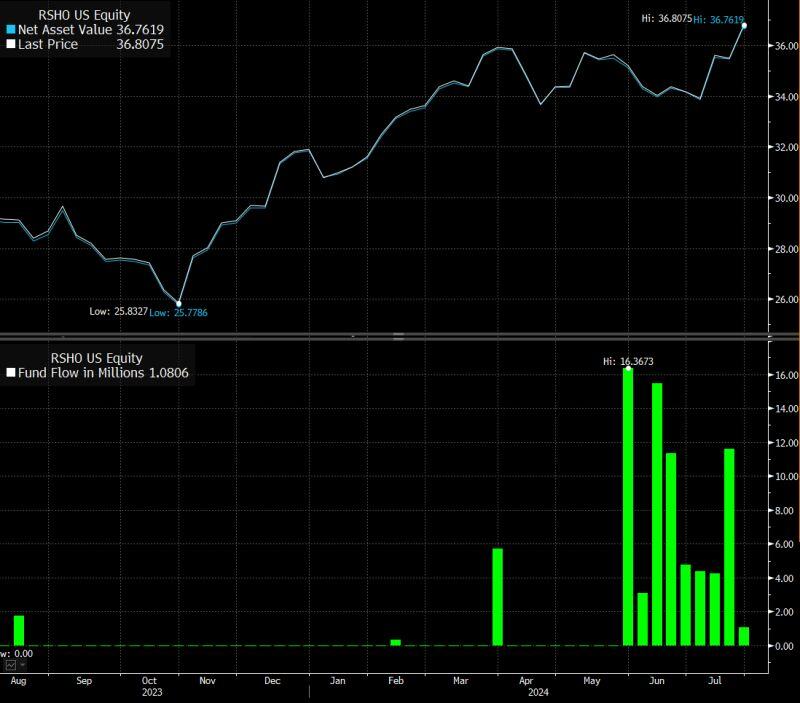

The Reshoring ETF $RSHO is quietly nursing a 9-week flow streak (after being ignored since birth) which boosted its assets under management 7x this year. The American Industrial Renaissance ($AIRR) 3ETF also saw AuM jump by $800m YTD. BlackRock noticed this and launched iShares US Manufacturing ETF $MADE. All these ETFS are exposed to Trump Trade 2.0 but this theme spans beyond politics. Source: Bloomberg, Eric Balchunas

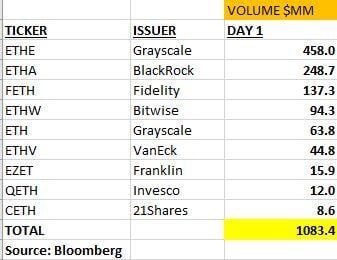

DAY ONE in the books for ETH ETFs who did $1b in total volume, which is 23% of what the spot bitcoin ETFs on their first Day and $ETHA did 25% of $IBIT's volume.

The gap between $ETHE and The Newborn Eight is a healthy +$625m (a sizable chunk of which *should* convert to inflow Source: Eric Balchunas

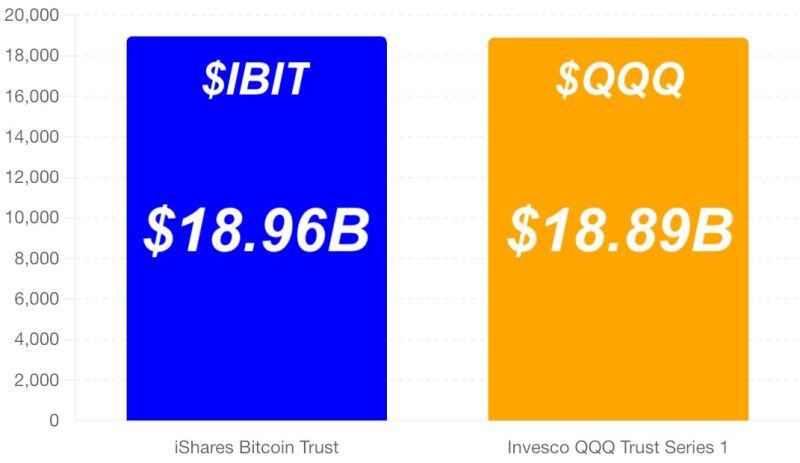

ETF YTD net flows ranking... iShares Bitcoin spot ETF $IBIT has passed Invesco Nasdaq 100 $QQQ into YTD net flows.

And could pass Vanguard's Total Stock Market ETF very soon too. Compare the net sizes of these ETF's vs. net inflows. Demand for Bitcoin via ETF has been relentless. Unprecedented really. Source: SpencerHakimian, Bloomberg

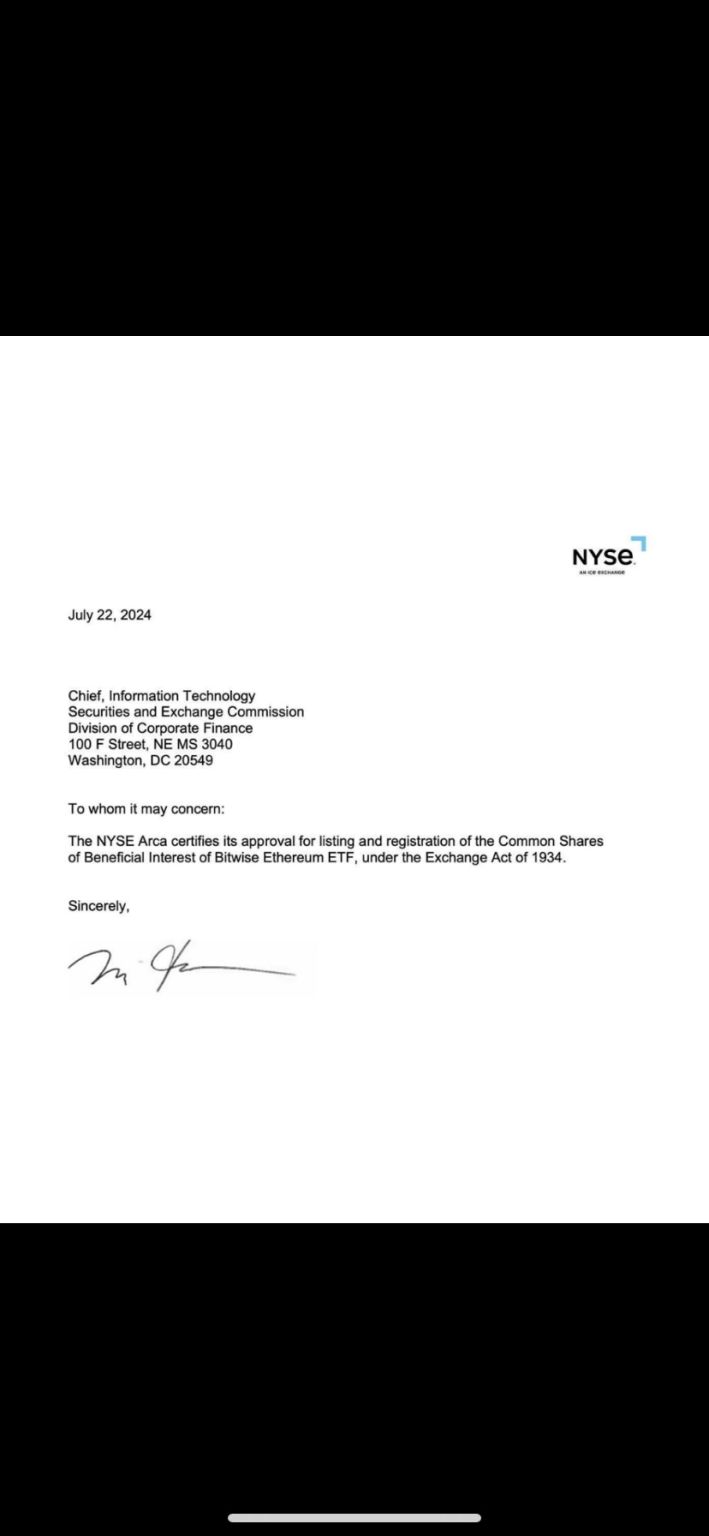

Ethereum spot ETF to start trading today (TUESDAY)

The United States Securities and Exchange Commission (SEC) has given final approvals to spot Ethereum ETFs, clearing the way for the funds to begin trading as soon as Tuesday, July 23. Such funds received initial approval in May in a surprise regulatory shift by the SEC, and have spent recent weeks sending in updated and finalized forms. Now, 424(b) approvals are coming in and spot Ethereum ETFs have been made effective by the SEC, which means they can begin trading. July 23 emerged as the likely target for the trading start early last week, as sources connected to fund providers told Decrypt that they were told to expect approvals ahead of that date, barring unexpected delays. "It’s official: Spot ETH ETFs have been made effective by the SEC," tweeted Bloomberg Senior ETF Analyst Eric Balchunas on Monday afternoon. "The 424(b) forms are rolling in now, the last step = all systems go for tomorrow’s 930am launch. Game on." Source: Decrypt

Investing with intelligence

Our latest research, commentary and market outlooks