Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

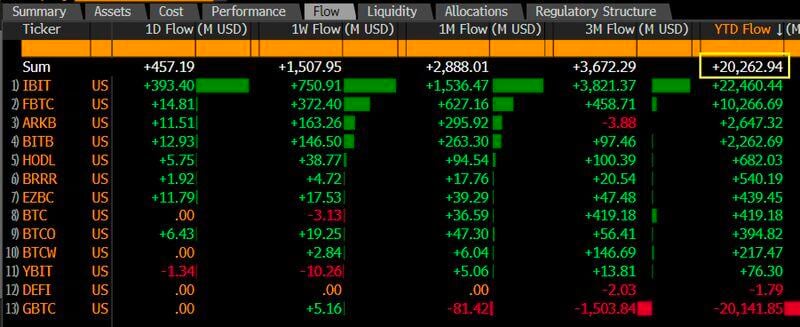

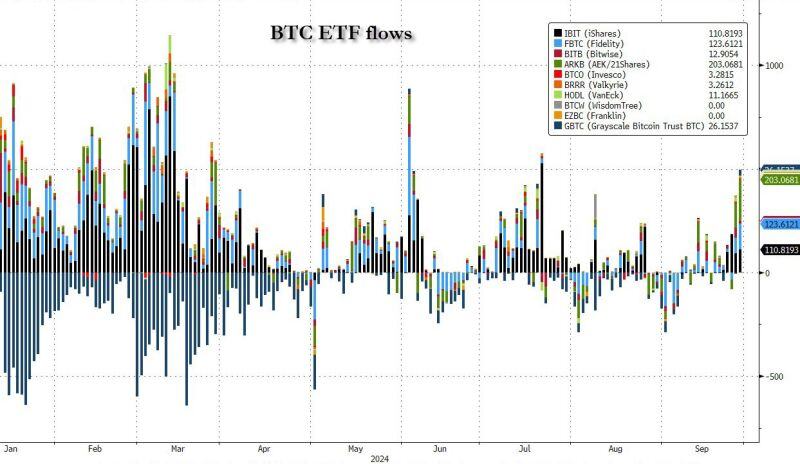

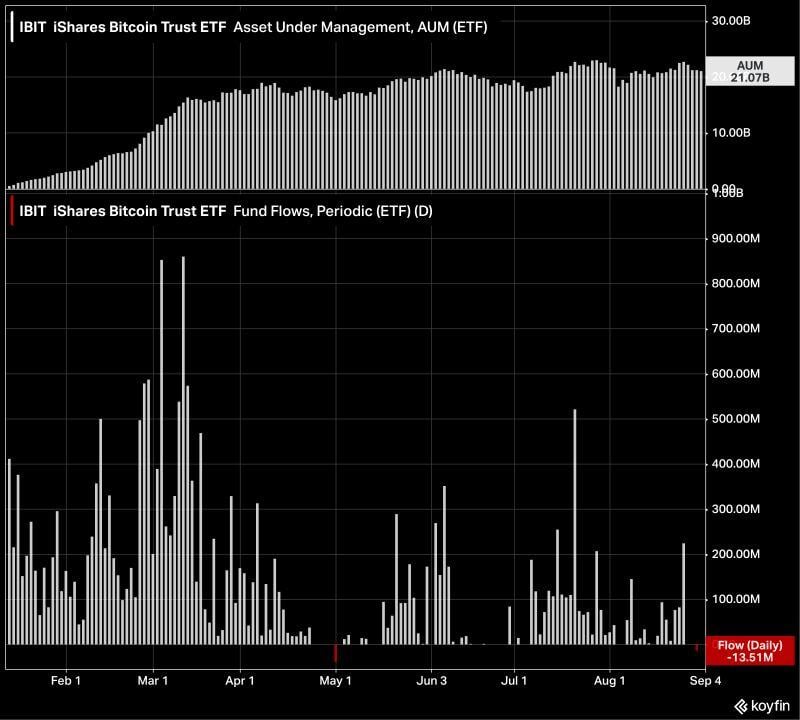

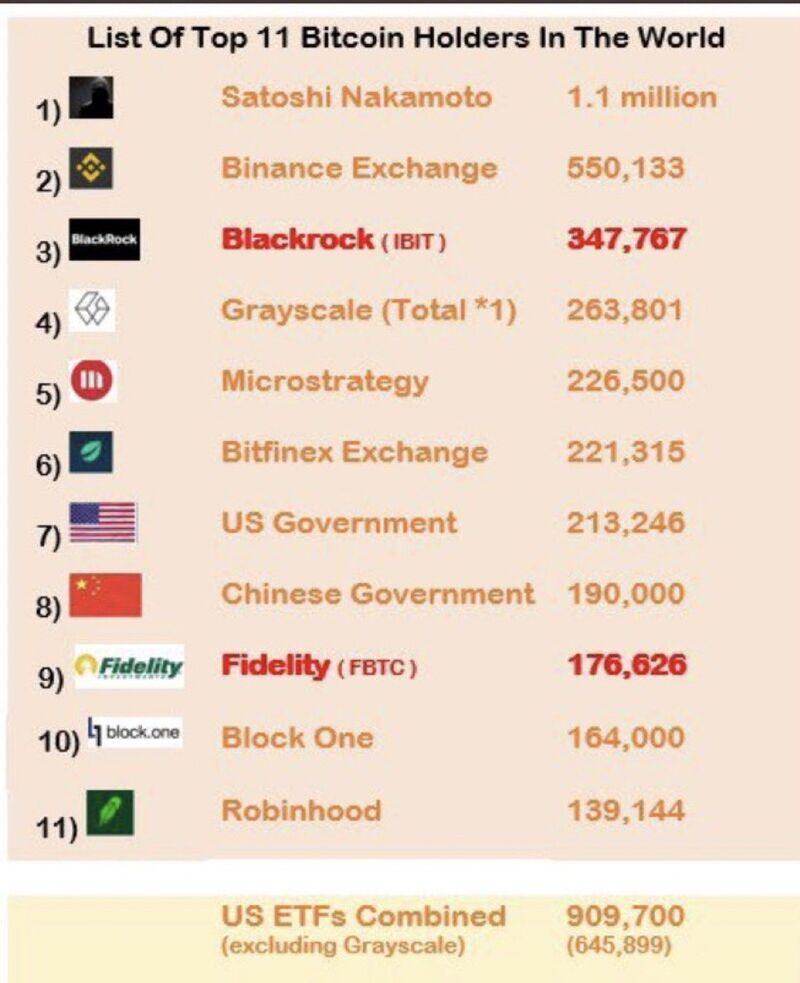

Bitcoin ETFs have crossed $20b in total net flows (the most important number, most difficult metric to grow in ETF world) for first time after huge week of $1.5b.

For context, it took gold ETFs about 5 years to reach same number. Total assets now $65b, also a high water mark. Source: Eric Balchunas, Bloomberg

BlackRock just put out a nine-page white paper that makes case for bitcoin ETF as a "unique diversifier" that can hedge against fiscal, monetary and geopolitical risks

also including section called "bitcoin's path to $1 trillion market cap". Read whole thing here: https://lnkd.in/e8XVW9gG Source: Blackrock

Short Volatility etf $SVIX Assets Under Management are surging

Aug 2024: $600M Q1 2024: $140M Q1 2023: $88M Q1 2022: $22m Source: Bloomberg, Lawrence McDonald

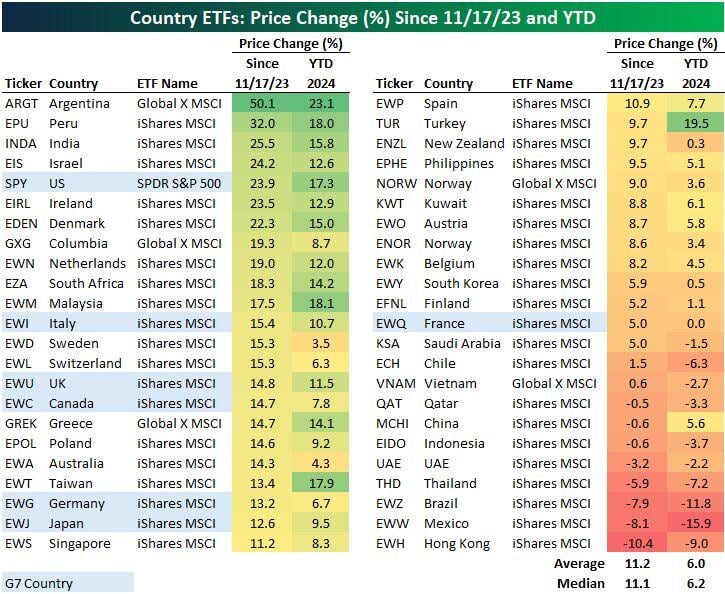

The Argentina ETF $ARGT has been the best performing out of 46 country ETFs since 11/17/23 prior to President Milei's election victory as well as year-to-date in 2024

Source: Bespoke

Investing with intelligence

Our latest research, commentary and market outlooks