Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

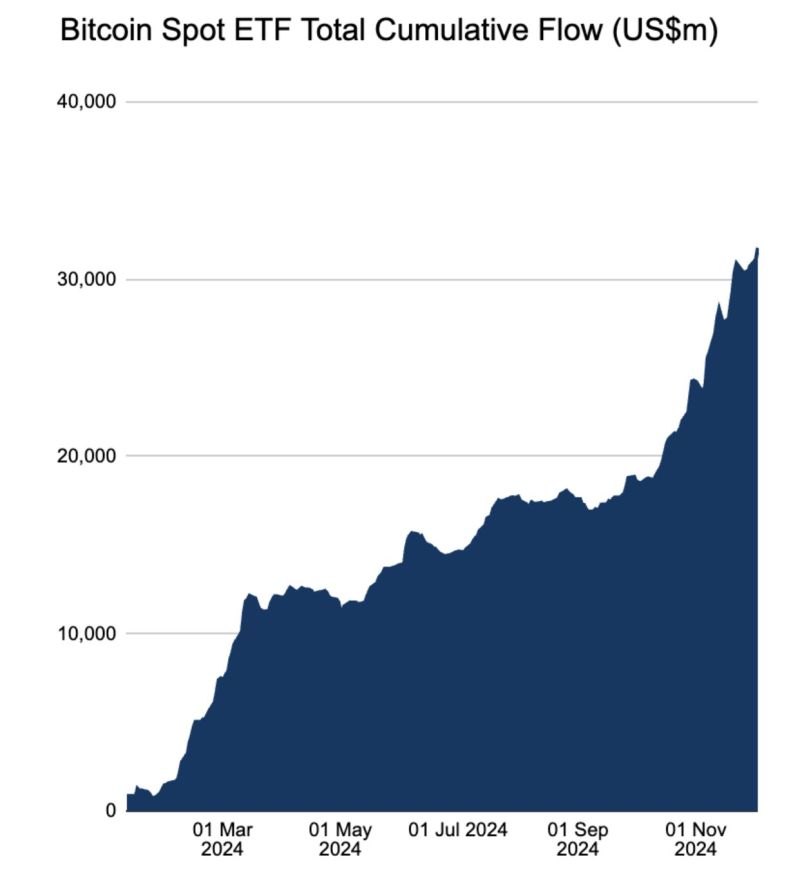

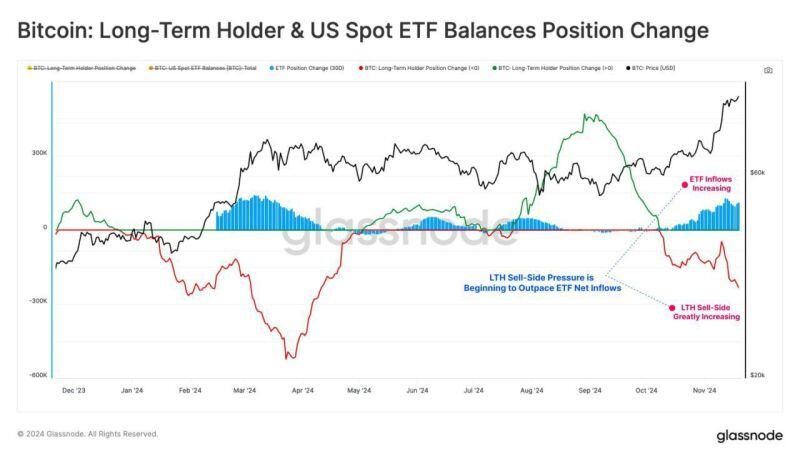

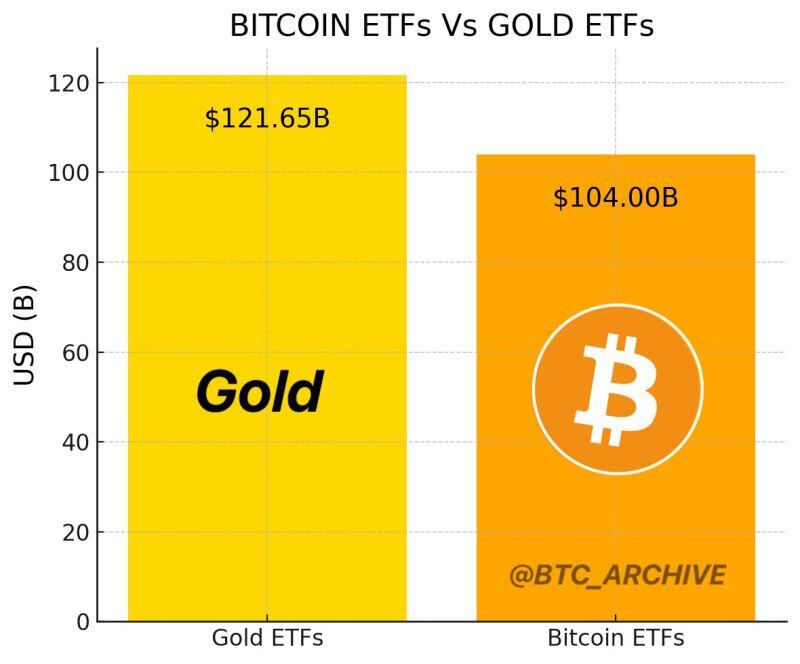

Data from glassnode show that some long-term BTC holders are offloading some of their bitcoins.

Long-term Bitcoin holders sold 128K $BTC, but U.S. spot ETFs absorbed 90% of the selling pressure. 🔥 Strong institutional demand is fuelling BTC’s rally, bringing it closer to the $100K milestone. 🚀💎 Source: Kyledoops

Investing with intelligence

Our latest research, commentary and market outlooks