Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

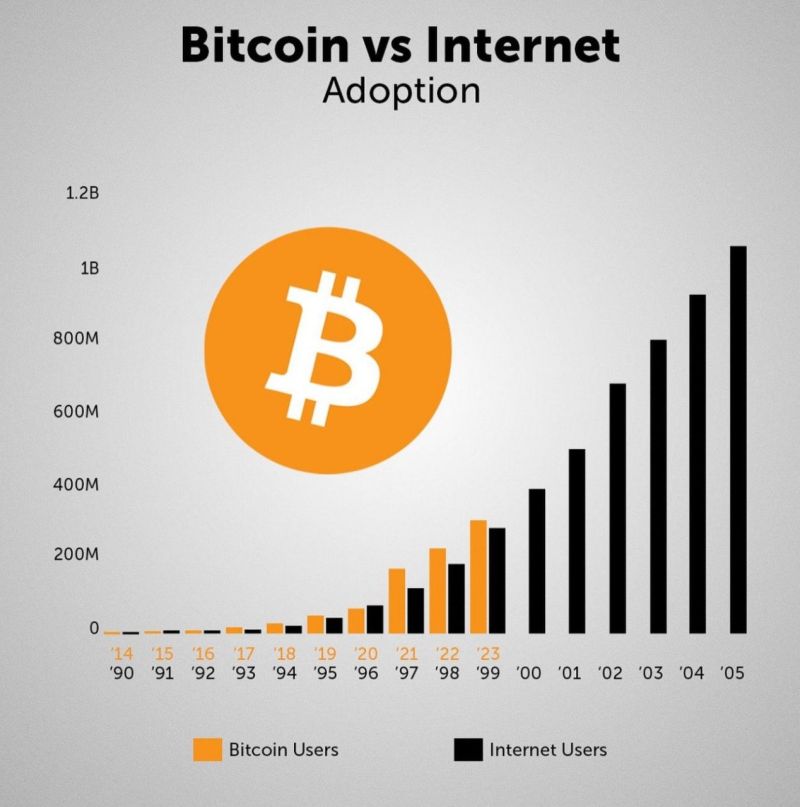

🚨CRYPTO ADOPTION 43% FASTER THAN MOBILE PHONES, 20% FASTER THAN INTERNET

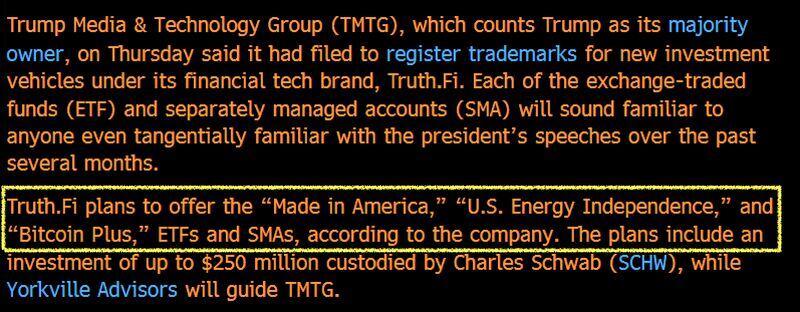

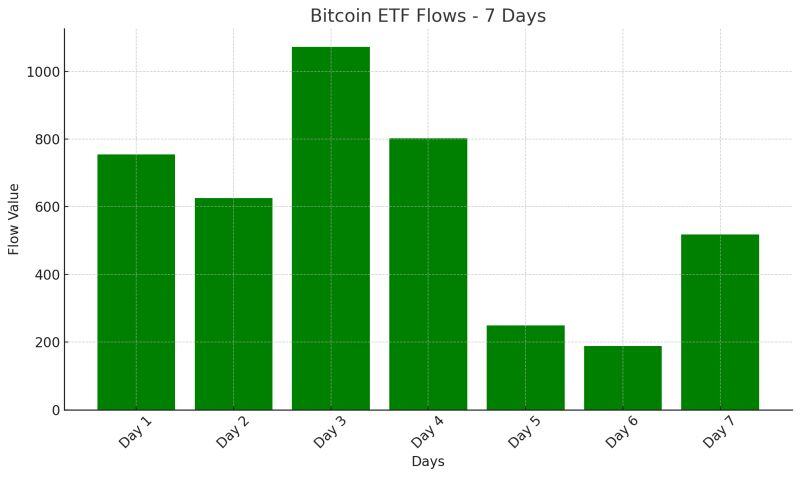

Crypto has hit 300M users in just 12 years—43% faster than mobile phones and 20% faster than the internet, per BlackRock. Younger generations, inflation fears, and Trump’s pro-crypto stance are fueling the surge. With bitcoin ETFs projected to hit $250B and regulatory wins piling up, crypto’s mainstream takeover is accelerating. Source: BlackRock thru Mario Nawfal on X

It seems semiconductors etf $SMH is finally breaking out after weeks of consolidation

Source: TrendSpider

Investing with intelligence

Our latest research, commentary and market outlooks