Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

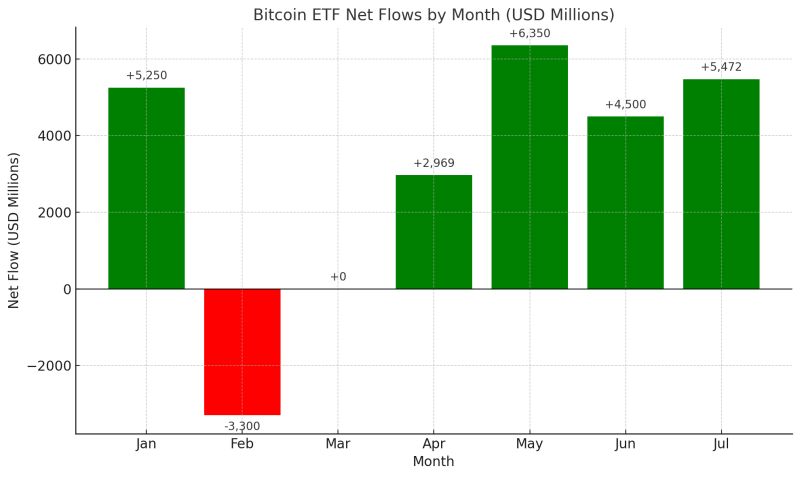

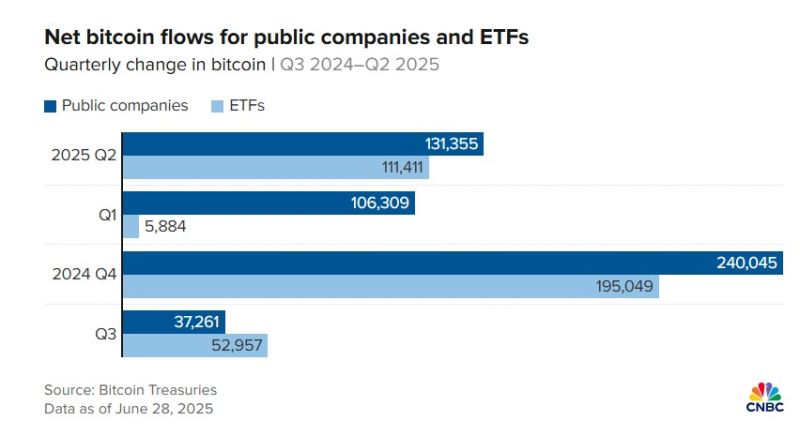

Bitcoin ETF Flows are still 2x the flows from MSTR and other Bitcoin Treasury companies.

If nothing changes, these together will generate $50 billion in new demand for BTC (without taking into account new bitcoin treasury companies being created, sovereign demand, new institutional demand, etc.) We now the supply variable in the equation. What we do NOT know is how much the whales will offload their bitcoin as the price keeps moving higher. But net net it looks like the supply-demand context remains rather favourable... Source chart: Fred Krueger

Value and growth are now even YTD

Source: Mike Zaccardi, CFA, CMT, MBA

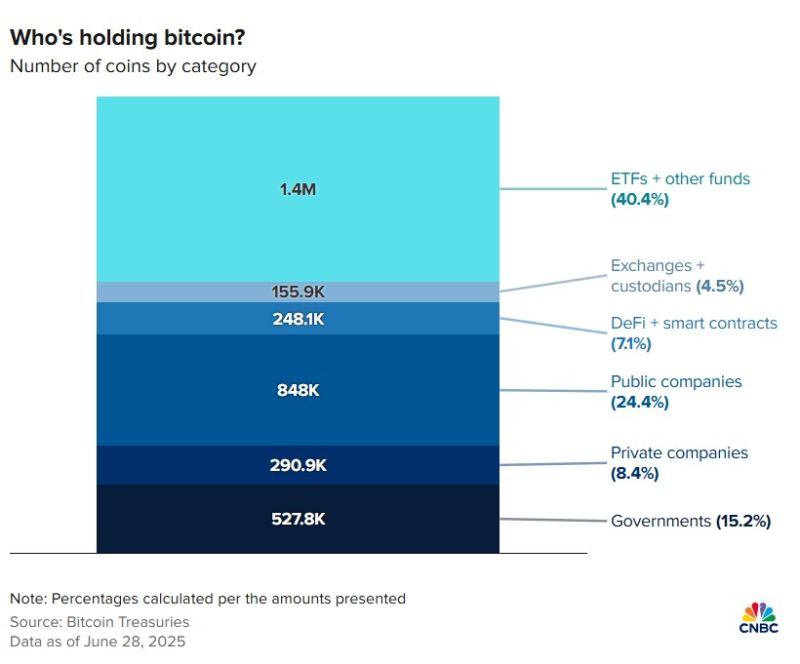

Who's holding bitcoin?

Bitcoin ETFs, whose collective U.S. launch in January 2024 was one of the most successful ETF debuts in history, still represent the largest holders of bitcoin by entity with more than 1.4 million coins held today, representing about 6.8% of the fixed supply cap of 21 million. Public companies hold about 855,000 coins, or about 4%. Source. CNBC

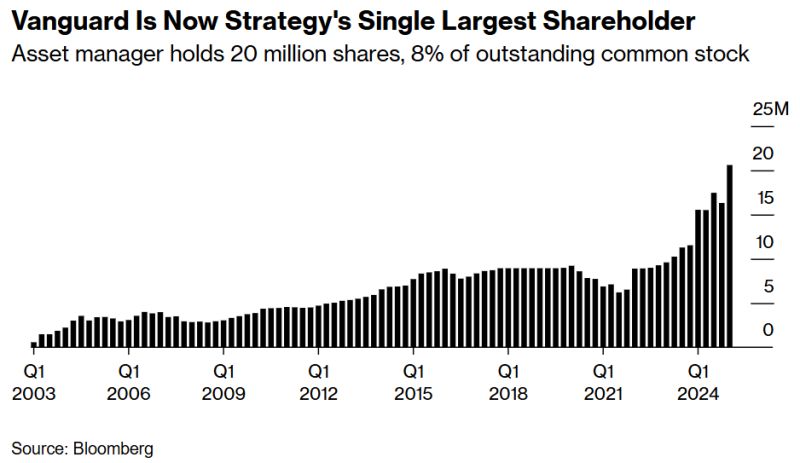

‼️ Public companies bought more bitcoin than ETFs did for the third quarter in a row

▶️ Corporate treasuries have surpassed ETFs in bitcoin buying for a third consecutive quarter as more companies try to benefit from the MicroStrategy playbook in a more crypto-friendly regulatory environment. ▶️Public companies acquired about 131,000 coins in the second quarter, growing their bitcoin balance 18%, according to data provider Bitcoin Treasuries. ETFs showed an 8% increase or about 111,000 BTC in the same period. ▶️Public company bitcoin holdings increased 4% in April, a tumultuous month after the market was rocked by President Donald Trump’s initial tariffs announcement, versus 2% for ETFs. Nick Marie, head of research at Ecoinometrics, suggested that 10 years from now, there probably won’t be so many companies committed to the bitcoin treasury strategy. Firstly, he said, the more that enter the category, the more diluted the activity at each firm becomes. Plus, bitcoin may be so normalized by then that proxy buyers are no longer constrained by rules and mandates around direct exposure to bitcoin. Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks