Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

What a year for ETFs ‼️

ETFs crack $800b in YTD flows, that's a $5b/day pace. That puts them on pace to hit about $1.2T this year, a new record. Source: Bloomberg, www.zerohedge.com

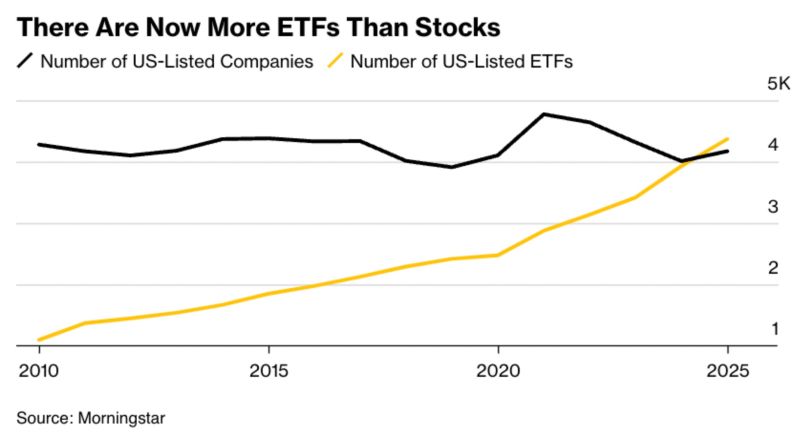

‼️ For the first time ever

There are now more ETFs in the United States than total number of stocks, data compiled by Morningstar shows - Bloomberg. ~4,300 - Total number of ETFs. ~4,200 - Total number of stocks. Source: Bloomberg, ETF Tracker

Gold ETFs Breach 92 Million-Ounce Threshold

Bloomberg's measure of total gold ETF holdings jumped to a two-year high. At 92.7 million ounces on Aug. 15, my graphic shows this metric surpassing the 92 million threshold first reached in 2020, but with a big difference - stock market volatility was rising then. Source: Mike McGlone, Bloomberg

It is often a very good sign when you see strong momentum & trend in a sector / segment of the market while fund flows are lagging.

This has been the case for gold miners (e.g VanEck Gold Miners ETF $GDX) - see chart below. We've seen the first significant inflow in the GDX in the last six months. Despite the great GDX performance of 45+% during this period, six-month net flows are still very negative at -$2.54B. 🪙👇 Source: Oliver Groß @minenergybiz

🔴 US President Trump says he is looking at reclassifying marijuana.

The weed stocks and AdvisorShares Pure Cannabis ETF ($YOLO) surged yesterday. ▶️ President Donald Trump said Monday his administration was “looking at reclassification” of marijuana and intends to make a decision in the upcoming weeks. ▶️ “It’s a very complicated subject base,” he said during a press briefing. “I’ve heard great things having to do with medical and bad things having to do with just about everything else.” ▶️ His comments come after a Friday Wall Street Journal report indicated Trump was considering reclassifying the drug as less dangerous. Source: Markets & Mayhem, Politico

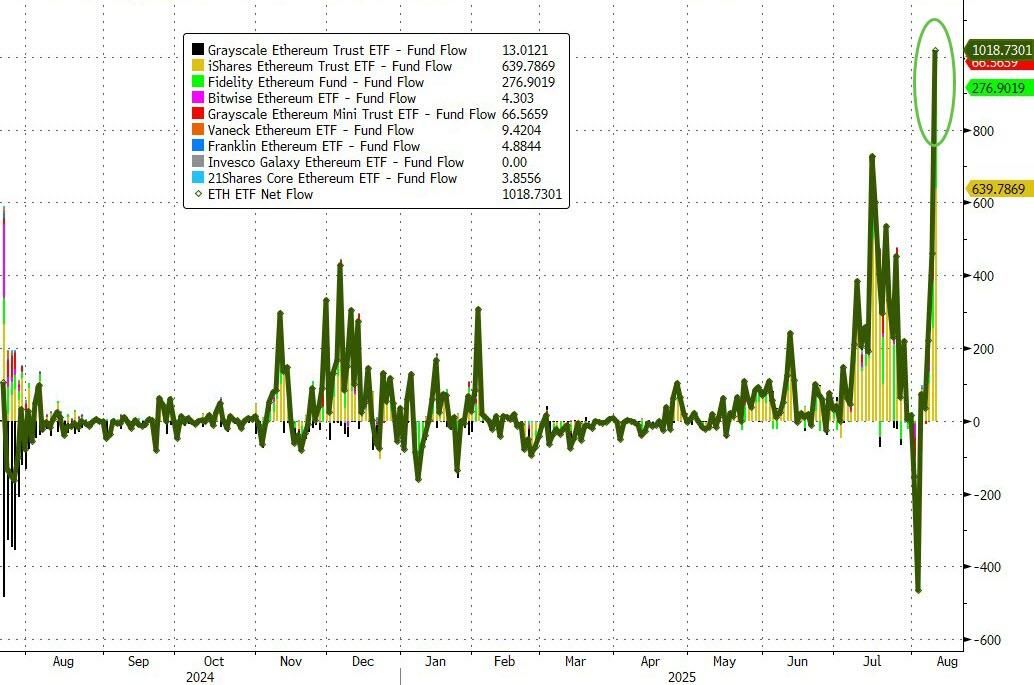

Ether ETFs See Record $1 Billion Inflows

👉 Inflows into Ether ETFs far exceeded those of their Bitcoin counterparts, which saw a net inflow of $178 million on Monday, according to Farside Investors. 👉 CoinTelegraph's Tarang Khaitan reports that for the Ether funds, BlackRock's iShares Ethereum Trust ETF (ETHA) attracted the lion’s share of flows, with a record $640 million going into the fund. 👉 The Fidelity Ethereum Fund (FETH) was the runner-up and also recorded its largest single-day inflow, taking in $277 million. Source: zerohedge, Bloomberg

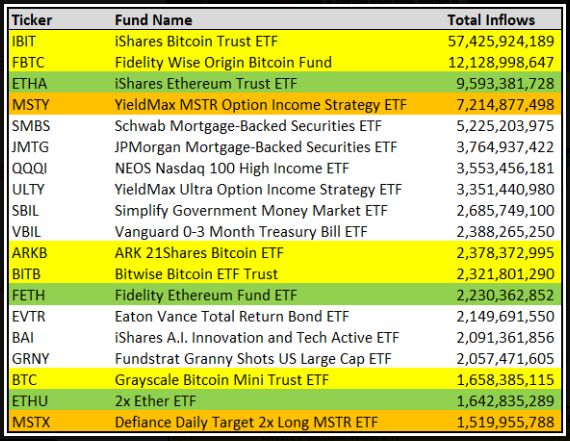

Out of all the 1,300+ ETFs that launched since the start of 2024 here are the top 20 that have gotten the most inflows

👑 $IBIT - iShares Bitcoin ETF 🥈 $FBTC - Fidelity Wise Origin Bitcoin Fund 🥉 $ETHA - iShares Ethereum ETF 4. $MSTY - Yield Max MSTR Option Income ETF 5. $SMBS - Schwab Mortgage Backed Securities ETF 6. $JMTG - JP Morgan Mortgage Backed Securities ETF 7. $QQQI - NEOS Nasdaq 100 High Income ETF 8. $ULTY - YieldMax Ultra Option Income ETF 9. $SBIL - Simplify Government Money Market ETF 10. $VBIL - Vanguard 0-3 Month Treasury Bill ETF Source: ETF Tracker @TheETFTracker thru @NateGeraci

Investing with intelligence

Our latest research, commentary and market outlooks