Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

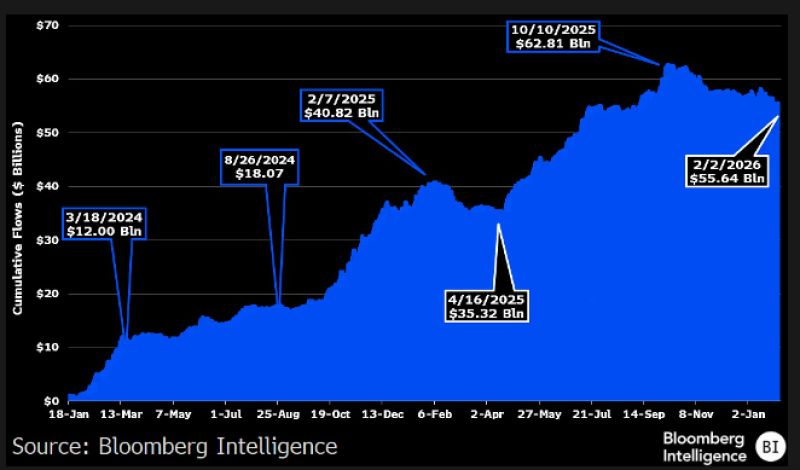

Bitcoin ETF's cumulative net inflows peaked at +$63B in October. Today (after the "massive" outflows) it's +$53B. That's NET NET +$53B in only two years.

Initially, most predictions were for $5-15B in the first year. This is an important context to consider when looking/writing about the $8B in outflows since 45% decline and/or the relationship between $BTC and Wall street, which has been overwhelmingly positive. h/t @JSeyff

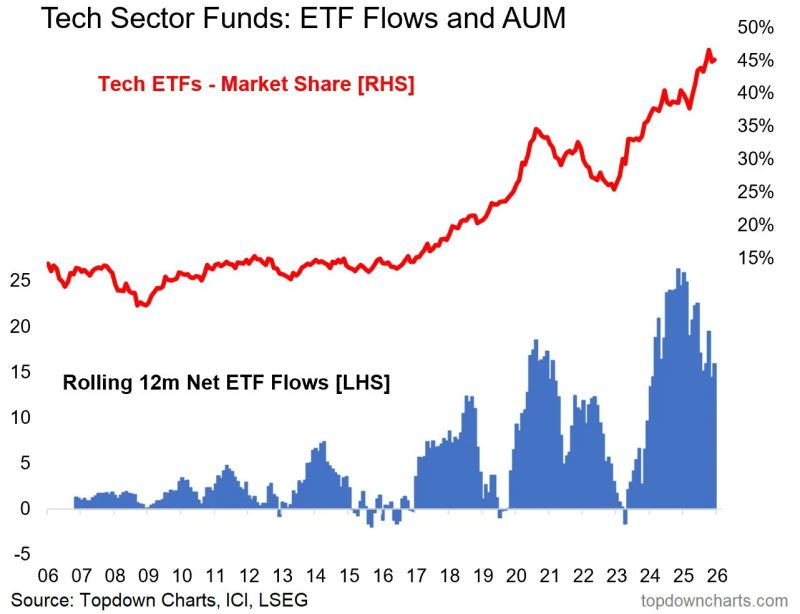

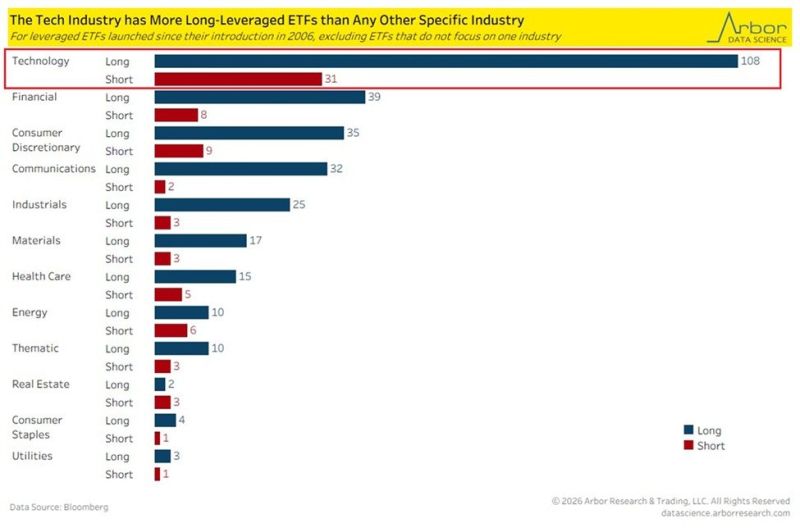

Is the tech sector building a house of cards?

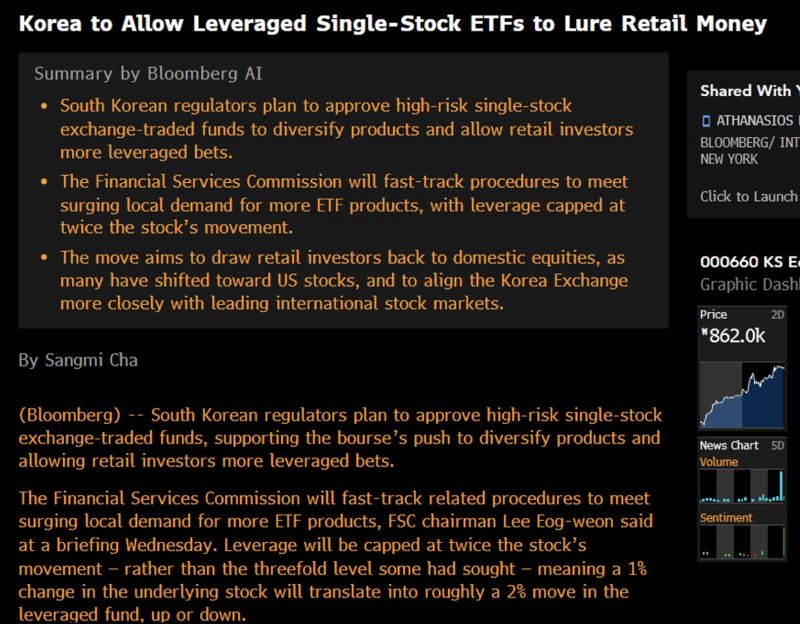

There are now 139 tech-related leveraged ETFs (108 long, 31 short). That is 3x more than the next largest sector (Financials). To put that in perspective: Tech now has more leveraged ETFs than Financials, Consumer Discretionary, and Communication Services COMBINED. 🤯 We’ve moved past simple indexing into a world of hyper-fragmented, high-octane gambling vehicles. Source: The Kobeissi Letter, Arbor Research & Trading

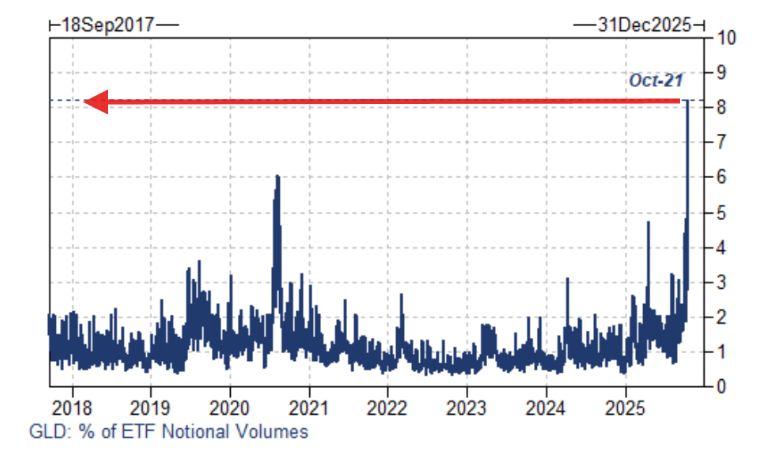

Goldman on gold's Tuesday flush:

"The best answer we have for the largest % move in 10 years is (simply) positioning, and that we’ve rallied for 9 consecutive weeks. The ease of trading an ETF for quick exposure has been on full display; as of [Tuesday's] close $GLD accounted for 8% of all notional US-listed ETF volumes, its largest share of activity in our dataset. Flows on the ETF desks skewed (unsurprisingly) strongly better for sale today". Source: Neil Sethi

Investing with intelligence

Our latest research, commentary and market outlooks