Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

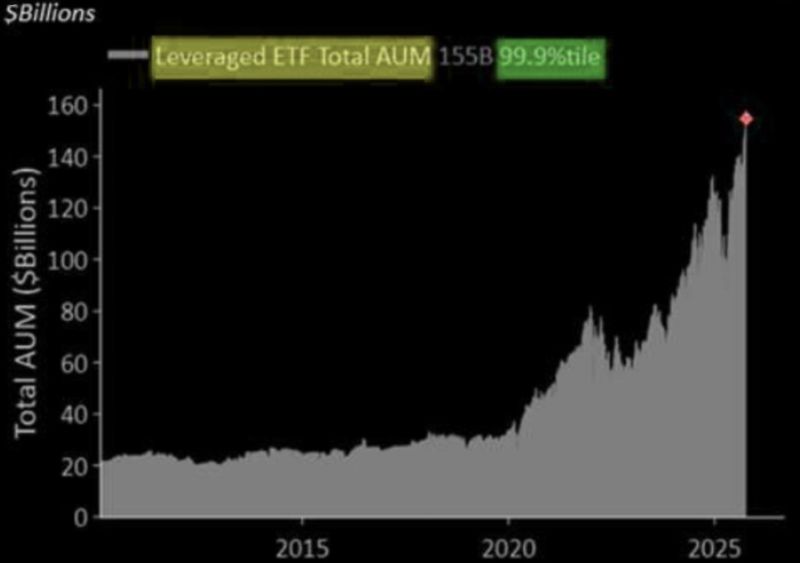

Leveraged ETFs now have almost $160 Billion in assets, a new all-time high 🚨🚨

Source: Barchart

IBIT Zero Date Option Covered Call ETF launching today.. $BITK

Source: Eric Balchunas, Bloomberg

Another month, another all-time record for ETF (aka tokens with benefits) launches w/ 74.

Total launches this year are now 55% ahead of last year’s record pace and likely headed towards 1,000 or 4/day. Head spinning. Chart via @SirYappityyapp Source: Eric Balchunas, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks