Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

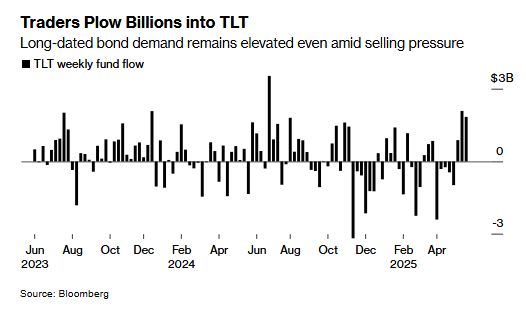

$TLT just saw a weekly inflow of $1.8 Billion, the highest inflow among all ETFs 🚨

Source: Bloomberg, Barchart

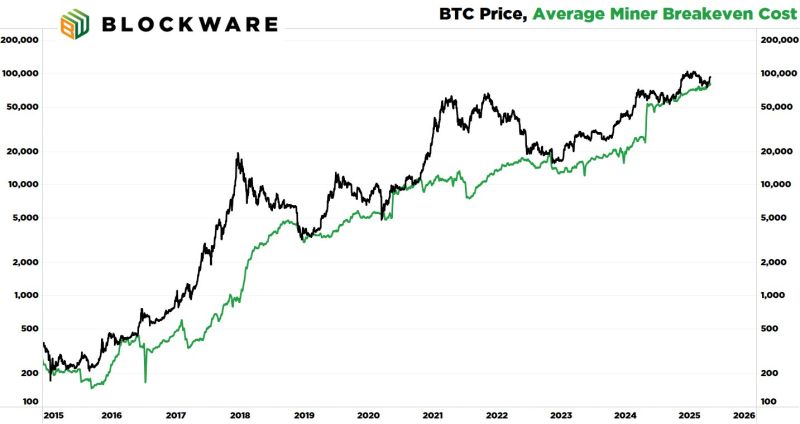

🔴 Some interesting perspectives on bitcoin by Blockware shared by Robert @reedlove on X.

▶️ Bitcoin is up 25% from its April 9th low and there’s a handful of indicators that show a major bull market around the corner. Starting with the Average Miner Cost of Production. ▶️ In a rational economy, assets rarely trade below their cost of production. Now, what it costs to “mine” a Bitcoin is different for every miner – machine type, electricity cost, and uptime all play a role — but the analysts @BlockwareTeam have aggregated data to create a metric called the “industry average”. ▶️ This metric has timed each of the past 6 Bitcoin bottoms: September 2024 November 2022 September 2020 March 2020 December 2018 April 2016 ▶️ This metric is signaling a bottom right now.

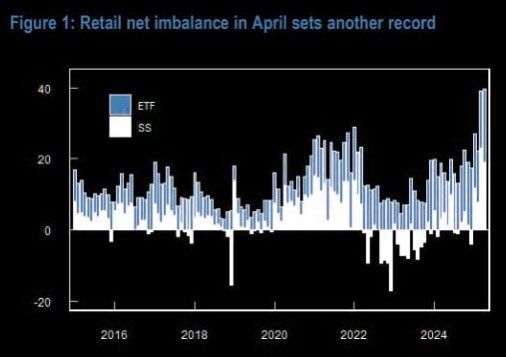

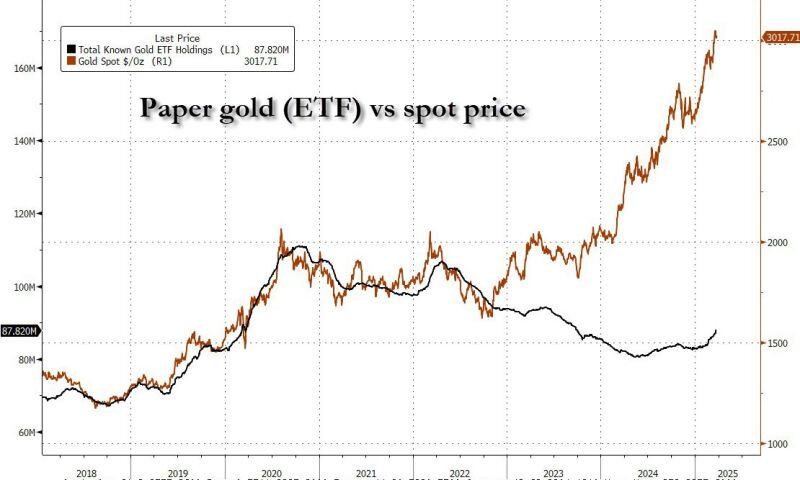

I think I already found my chart of the week...

The black line shows Total known Gold ETF Holdings while the brown line represents the Gold spot price. The ETF crew has finally woken up, but paper gold has a long way to go to catch up to physical buyers, who after the 2022 weaponization of the dollar are mostly central banks. Source: zerohedge

Gold ETFs drew largest weekly inflow since March 2022, says WGC

Physically backed gold exchange-traded funds (ETFs) registered the largest weekly inflow since March 2022 last week, data by the World Gold Council (WGC) showed on Monday. Gold ETFs store bullion for investors and account for a significant amount of investment demand for the precious metal, which hit a record high of $2,956.15 per troy ounce on Monday. Gold ETFs saw an inflow of 52.4 metric tons worth $5 billion last week, the largest amount since the first week of March 2022, when global markets were grappling with immediate consequences of Russia's invasion of Ukraine. This raised their total holdings by 1.6% to 3,326.3 tons, the largest since August, 2023. The U.S.-listed funds led the inflow last week with 48.7 tons. For comparison, in January they saw an outflow of 6.3 tons. source : reuters

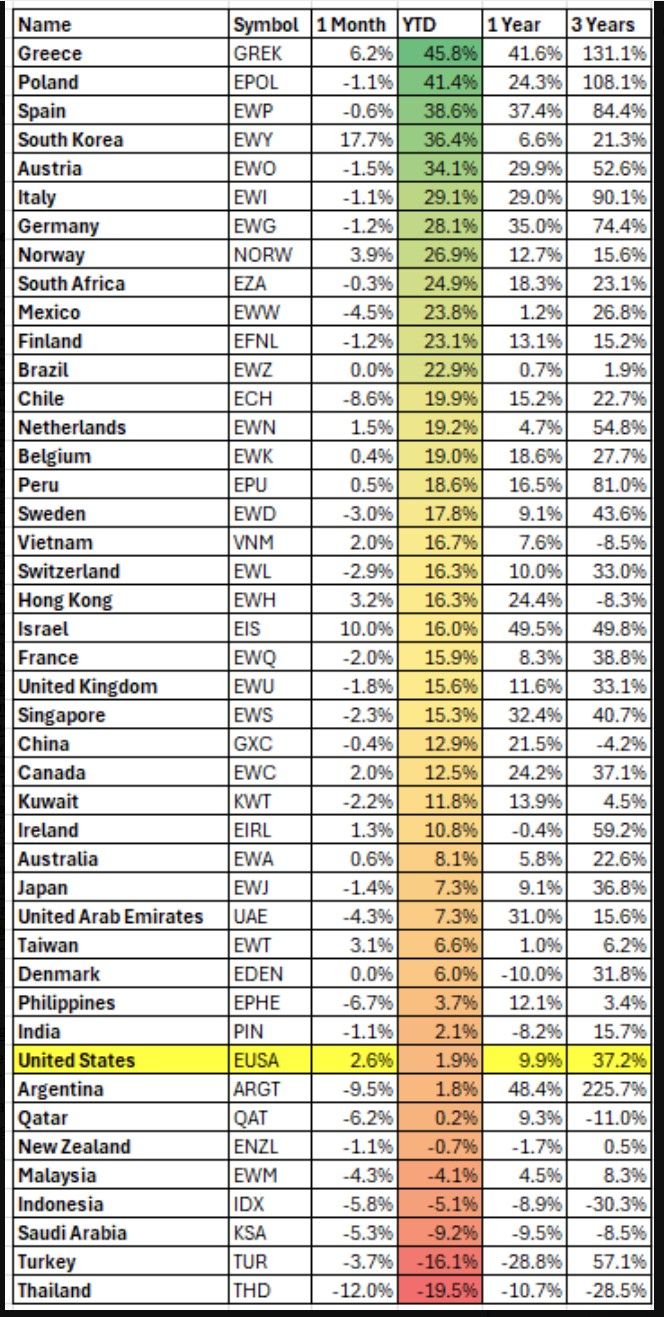

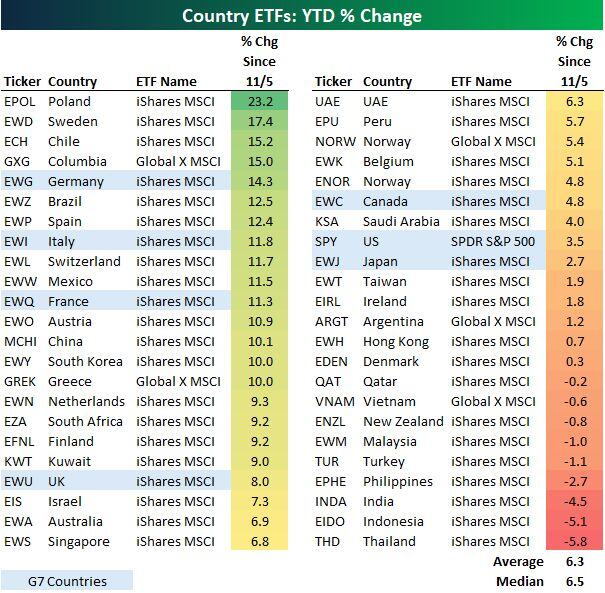

It's been awhile since the US S&P500 $SPY has been in the bottom half of country ETF performance.

That's where it is YTD though. Europe has been flying in 2025. Source: Bespoke

Investing with intelligence

Our latest research, commentary and market outlooks