Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

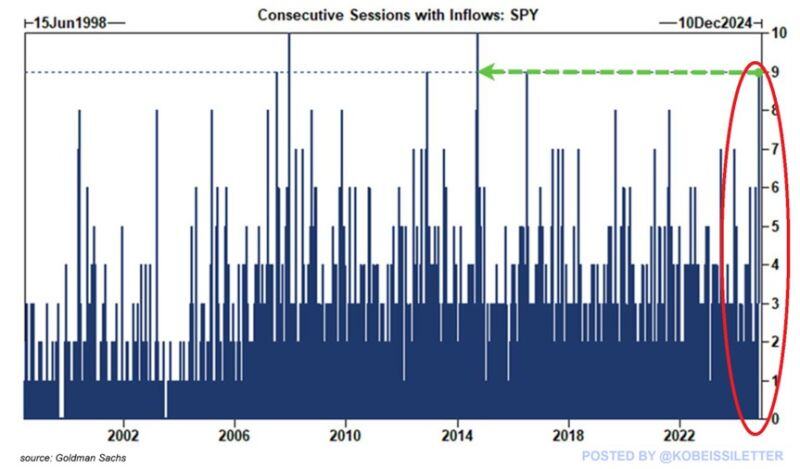

The S&P 500 ETF, $SPY, just saw 9 consecutive days of money inflows, the longest streak since 2014.

Investors have poured $18 billion into $SPY over these 9 days as post-election buying continues. Since 2000, $SPY has only seen 4 streaks with 9 to 10 straight days of inflows: in 2007, 2013, 2014, and 2016. Massive inflows supported the 5%+ run in the S&P 500 following the election. Over the last 13 months, the S&P 500 has now added more than $15 TRILLION of market cap. Source: The Kobeissi Letter, Goldman Sachs

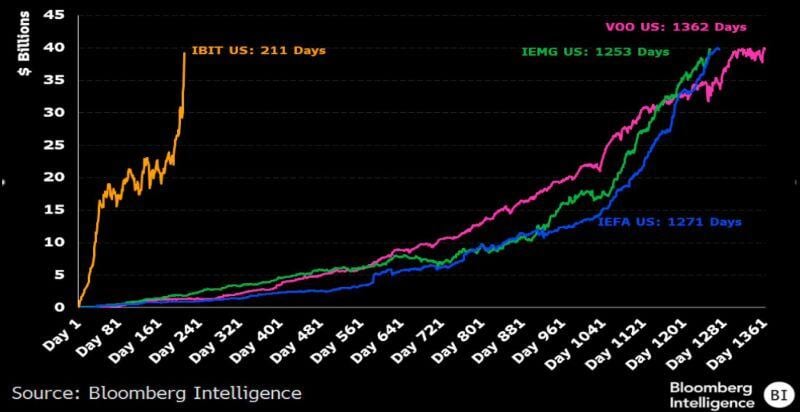

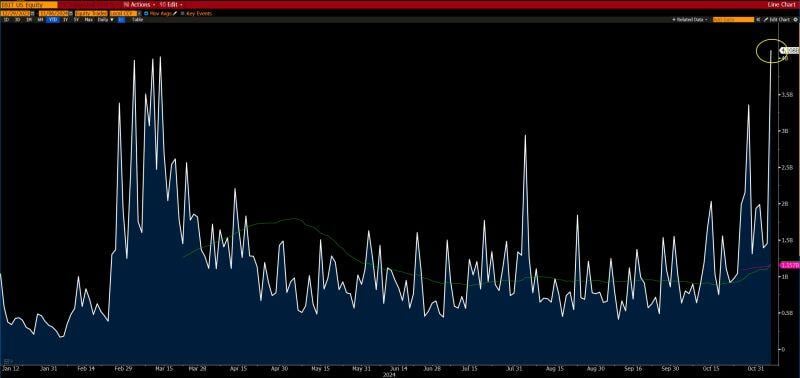

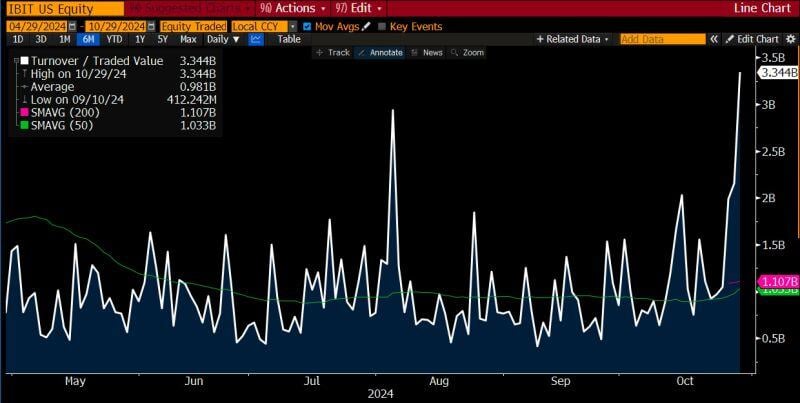

Eric Balchunas on X:

"$IBIT iShares Bitcoin ETF traded $3.3b today, biggest number in 6 months, which is a bit odd because $BTC was up 4% (typically ETF volume spikes in a downturn/crisis). Occasionally though volume can spike if there a FOMO-ing frenzy (a la $ARKK in 2020)". Given the surge in price past few days, his guess is this is latter, which means that inflows could be even bigger this week. Source: Eric Balchunas on X, Bloomberg

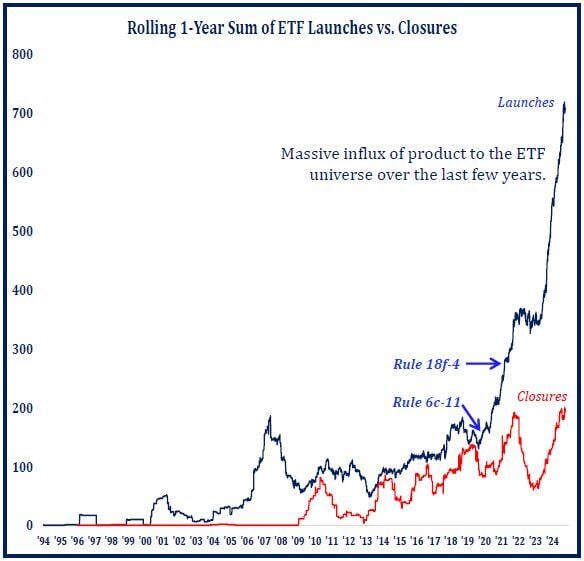

ETF launches have been going vertical over past few years…

700+ new ETFs have been launched just over the trailing 12 months. Source: Nate Geraci @NateGeraci via Todd Sohn

Investing with intelligence

Our latest research, commentary and market outlooks