Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

This is not the first correction $SMH semiconductors ETF is going through

Source: Trend Spider

iShares US Treasuries 20y+ $TLT forms a Golden Cross with an upward-sloping 200D moving average for the first time since January 2019!

The last one sent the ETF soaring by almost 50% over the next 2 months. Source: Barchart

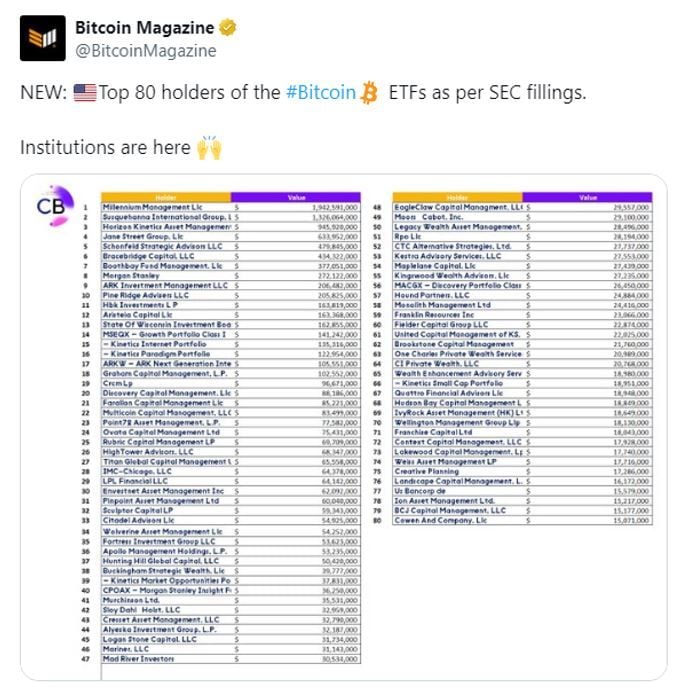

Even just combining the 80 companies found manually in SEC filings accounts for 17% of the total bitcoin ETF holdings.

While not all can be considered institutional investors, significant numbers are included - e.g Millenium, Susquehanna, Horizon Kinetics, Jane Street Group, Schonfeld, Morgan Stanley, Point72, Farallon, tc. Viewing ETF inflows solely as retail contributions seems inappropriate. Source: Ki Young Ju

Investing with intelligence

Our latest research, commentary and market outlooks