Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

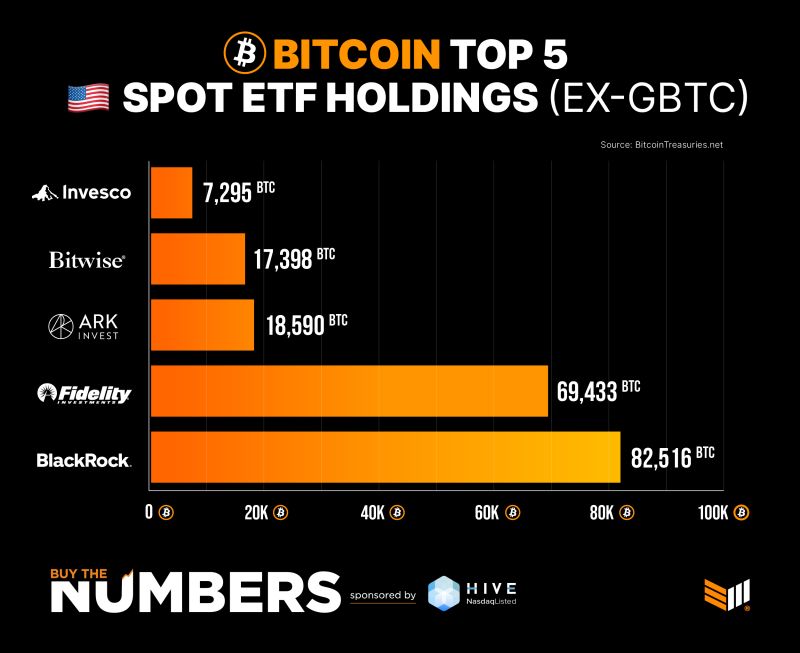

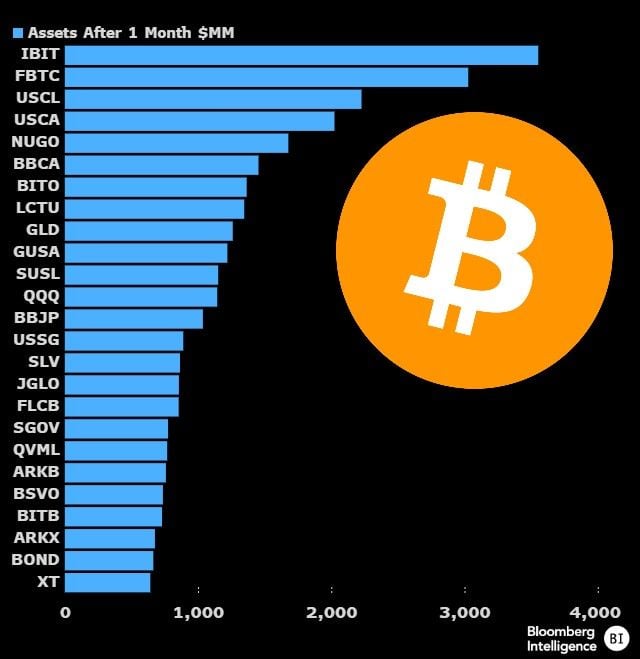

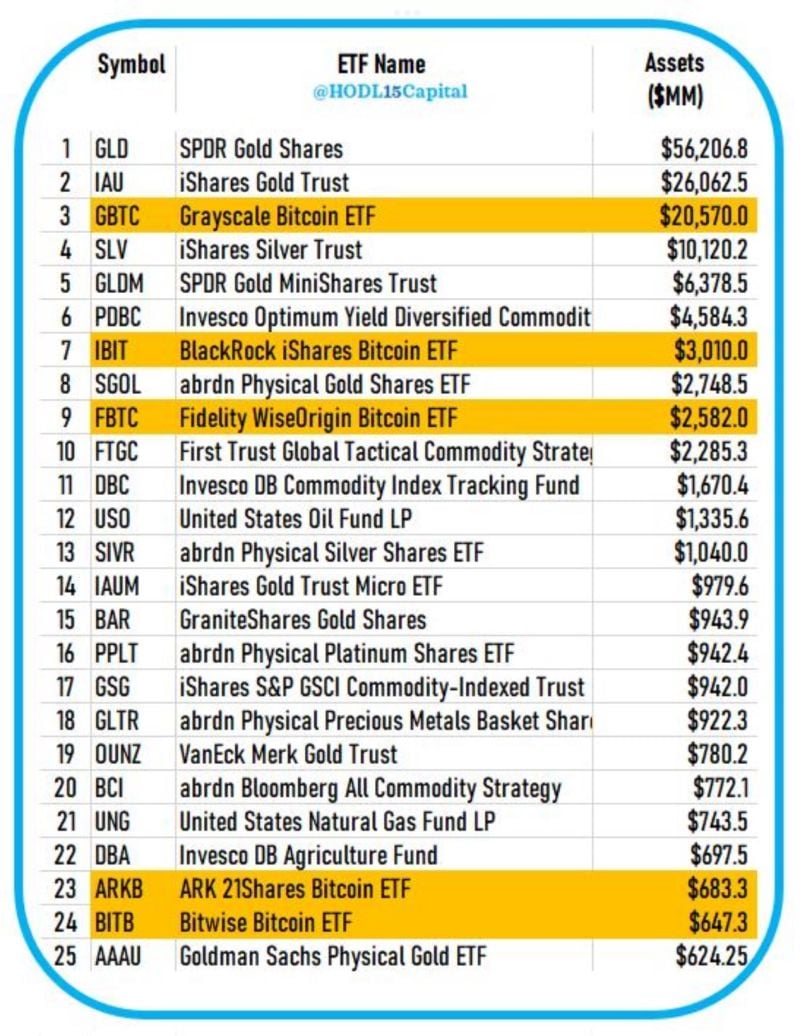

JUST IN: BlackRock and Fidelity spot Bitcoin ETFs dominate the top 25 ETFs by assets 1 month after launch

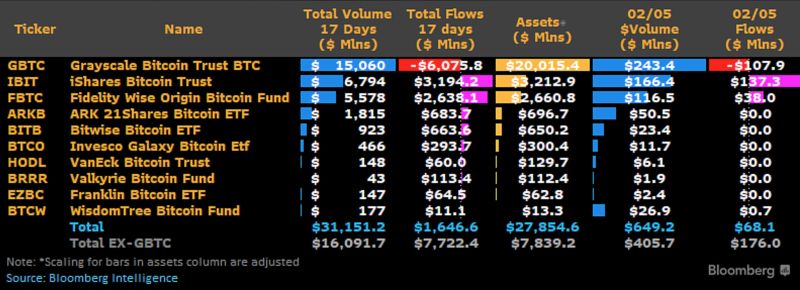

Here's a look at the Top 25 ETFs by assets after 1 month on the market (out of 5,535 total launches in 30yrs). $IBIT and $FBTC in league of own w/ over $3b each and they still have two days to go. $ARKB and $BITB also made list. Bloombergs Eric Balchunas

BREAKING‼️ BlackRock and VanEck Bitcoin ETF ads LIVE on Google

In accordance with Google’s latest policy regarding crypto, starting from January 29, 2024, advertisements on Bitcoin ETFs are allowed. Initially, the publication will be limited to the United States, but a subsequent expansion at a global level is planned.

Investing with intelligence

Our latest research, commentary and market outlooks