Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

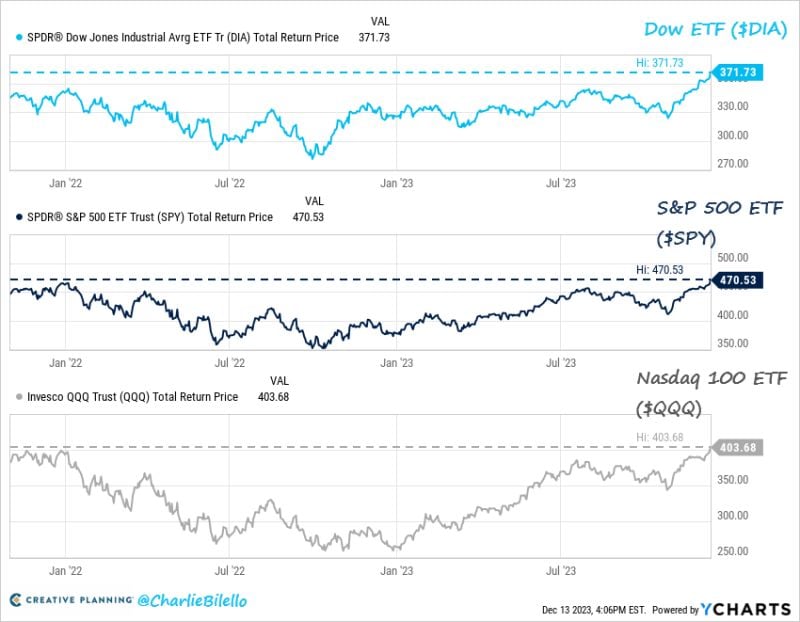

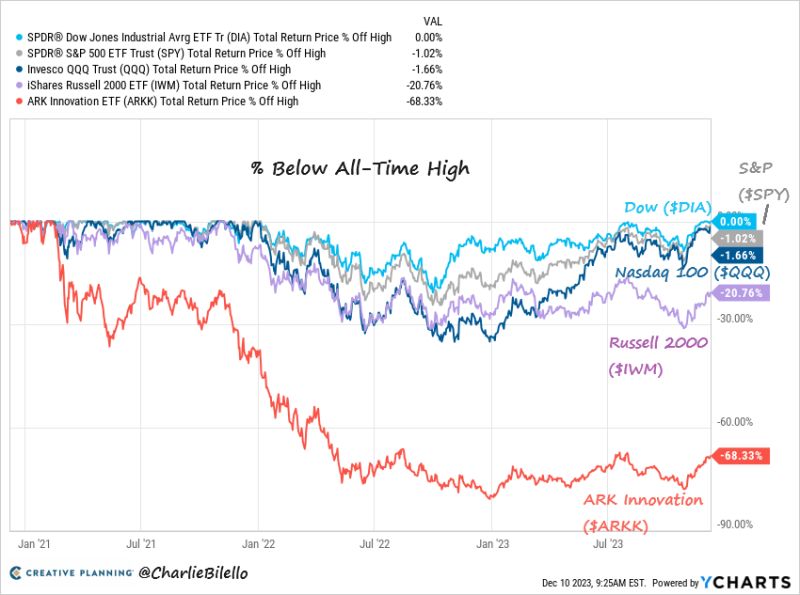

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

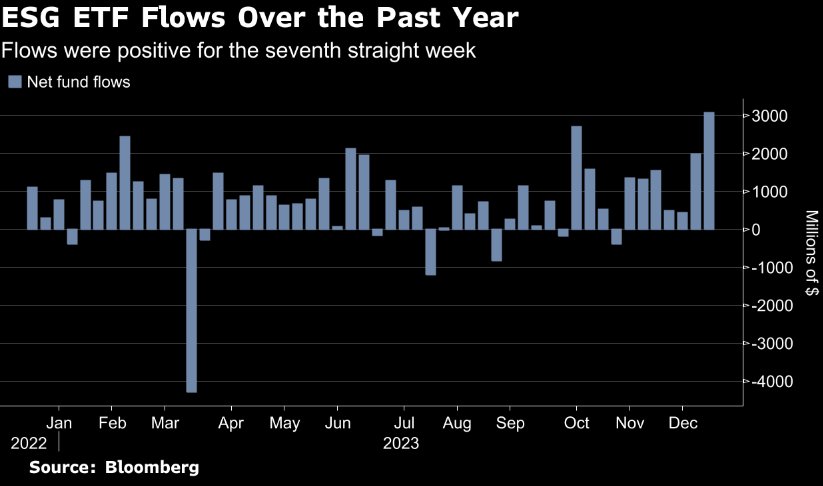

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Grayscale Bitcoin Trust $GBTC traded close to half a billion on Monday

which is more than 99% of the 3000 current ETFs, and reminder that they are bringing a (volume) gun to a knife fight if they launch with everyone else. That said, the 1.5% fee will act as a repellent at a time when the big asset managers plan to launch spot BTC ETF at 0% or super low fees. Source: Eric Balchunas, Bloomberg

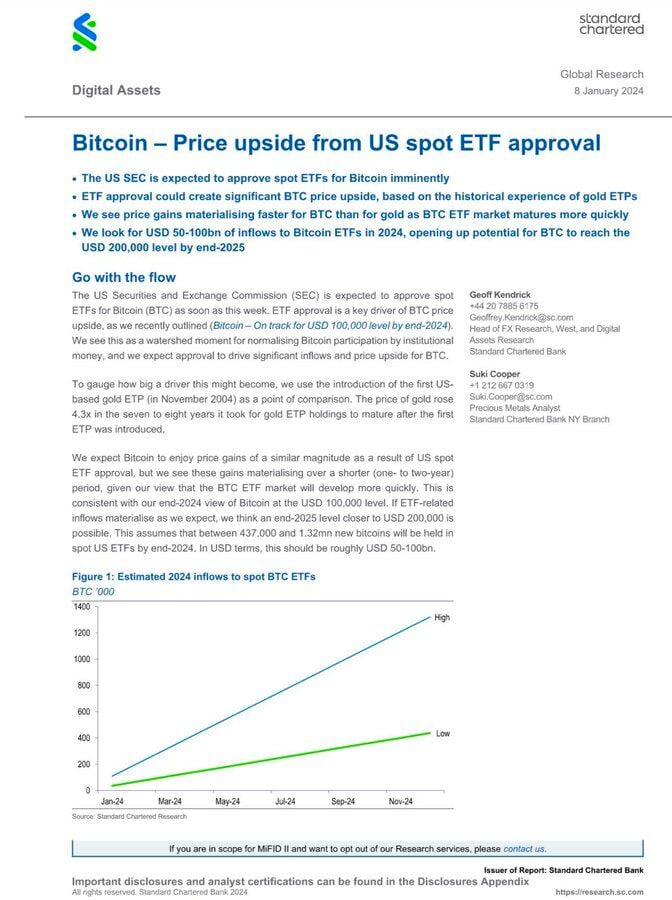

BREAKING bitcoin spot ETF: the fee war has begun

Bitcoin ETF applicants are filing last-minute amendments to lower their fees 👀 BlackRock's lowered to 0.30% 👀 ARK lowered lowered to 0.25% 👀 Wall Street is competing to offer cheap access to $BTC... Source: The Kobeissi Letter, Bitcoin Magazine

Investing with intelligence

Our latest research, commentary and market outlooks