Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Mind the gap...

France debt to GDP ratio ihas been diverging in a meaningful way vs. Germany debt to GDP. Rating agency Fitch already cut country's credit rating from AA to AA- last year, rating agency S&P has placed France under review... Source: Bloomberg, HolgerZ

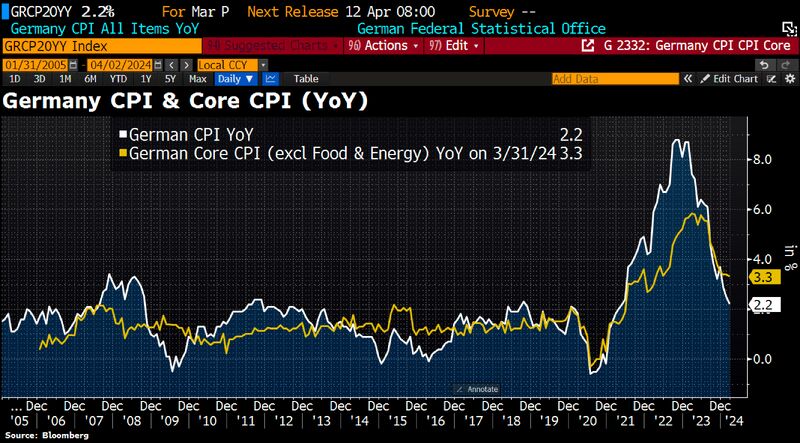

Eurozone inflation cools, setting stage for June rate cut:

Headline CPI slowed to 2.4% YoY in March from 2.6% in February below consensus forecast of 2.5%. Core CPI slowed to 2.9% from 3.1%, again below economists' expectations to reach lowest level in >2yrs. But there were signs that inflationary pressures have yet to ease in labor-intensive parts: Service Price inflation +4.0% YoY, unch from 4 preceding mths. (via DJ, Bloomberg thru HolgerZ).

German inflation slowed to 2.2% in March from 2.5% in February as expected but core CPI more sticky.

Core inflation slowed to 3.3% from 3.4% in Feb. Source: Bloomberg, HolgerZ

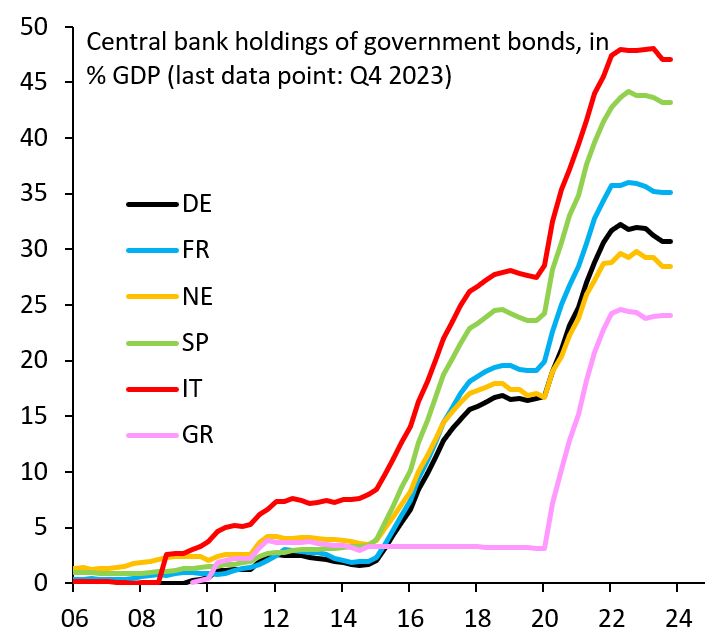

Below central bank holdings of government bonds...

Greece was excluded from ECB QE under Draghi, but was included in COVID QE, giving it a big boost (pink). Greece then undermined the G7 cap on Russia at every turn, protecting its shipping oligarchs at the expense of the EU. If you can't behave properly, there should be no QE... Source; Robin Brooks

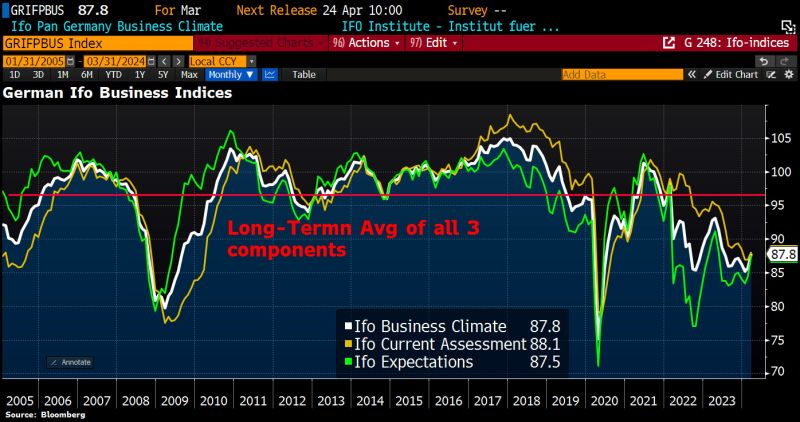

The worst seems behind the economy.

This is indicated by the Ifo Business Climate Index, which has jumped to 87.8 in March, highest level since June 2023 vs 86.0 expected. Current conditions rose to 88.1 in March from 86.9 in Feb, Ifo business confidence to 87.8 from 85.7 in Feb. Suggests that we could see a recovery as households begin to spend their real income gains. Employment is robust and nominal wage growth comfortably exceeds inflation again. There could be some green shoots in the export sector, and even the deep slump in construction may have bottomed out. Source: Bloomberg, HolgerZ

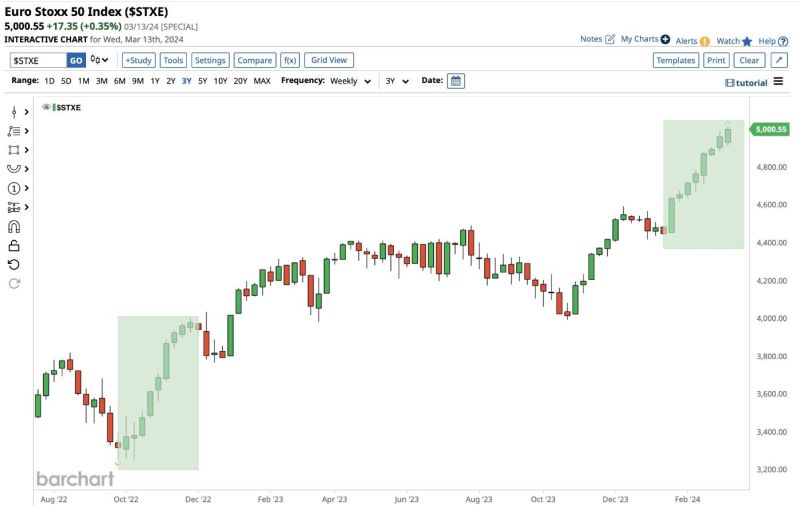

European Stocks are on track for their 8th consecutive green week which would be their longest winning streak since 2022

source : barchart

Disinflationary forces continue in Germany.

Wholesales Prices drop 0.1% MoM in Feb after +0.1% MoM in Jan, plunge 3% YoY which is a good leading indicator for German food price CPI. Sources: Bloomberg, HolgerZ

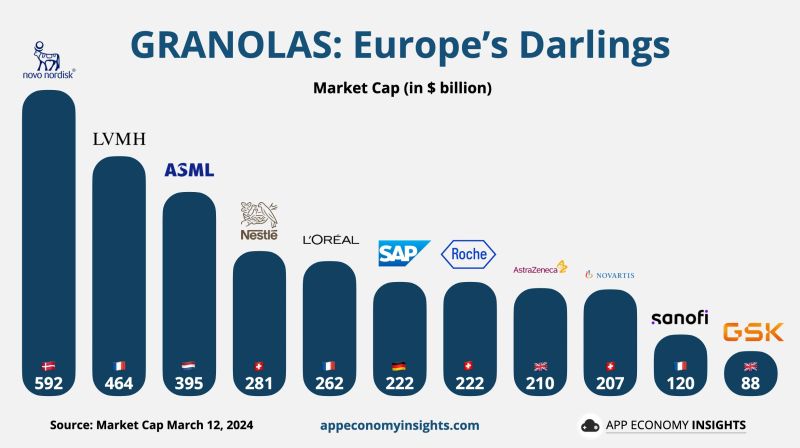

Who are Europe's GRANOLAS?

Novo Nordisk $NVO LVMH $LVMUY ASML $ASML Nestlé $NSRGY L'Oréal $LRLCY SAP $SAP Roche $RHHBY AstraZeneca $AZN Novartis $NVS Sanofi $SNY GSK $GSK Source: App Economy Insights

Investing with intelligence

Our latest research, commentary and market outlooks