Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Europe's leading stock index reaches 500 points for the first time, 24 years following its achievement of 400 points

source : Bloomberg

France's 2023 Deficit 'Significantly' Above 4.9%' (BBG)

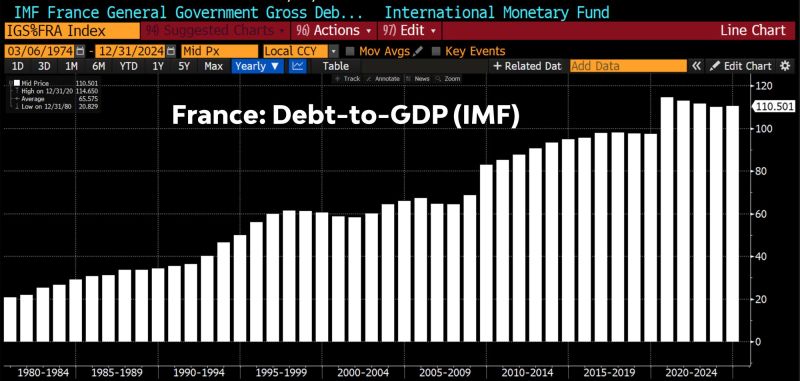

France's budget (in)discipline... Since the Great Financial Crisis in 2008, France managed to keep its budget deficit below the 3% threshold (remember the Maastricht Treaty) just once (2018). This is far worse than Italy. France's debt-to-GDP ratio is at 110%, up from 64% pre-financial crisis. With potential GDP growth at a paltry 1% and declining, structurally low interest rates is needed to keep the debt burden afloat. Source: Jeroen Blokland, Bloomberg

Germany Stock Exchange Firm Deutsche Boerse Launches Crypto Trading Platform

Germany-based Deutsche Boerse announced fully regulated crypto trading platform Deutsche Boerse Digital Exchange (DBDX). The spot trading platform is targeted for institutional clients said the Deutsche Boerse. The new Deutsche Boerse Digital Exchange is the latest step in its digital strategy to deliver a fully regulated and secure environment for institutional trading, settlement, and custody for this digital asset class. The German exchange group last year committed to introduce an integrated digital asset platform as part of its Horizon 2026 program. The initial trading will be request-for-quote basis and gradually moving to multilateral trading. Deutsche Boerse will offer trading venue and Crypto Finance (Deutschland) to provide digital asset clearing and settlement services. source : coingape

The stock market rally continues in Germany.

The Dax is heading for its 9th daily gain in a row. The rally is being driven by the Dax "Glory 5" stocks - an index consisting of SAP, Siemens, Allianz, Munich Re, and Deutsche Telekom. These 5 stocks have outperformed the Dax Price Index by almost 100%-pts over a 10 year period. Source: HolgerZ, Bloomberg

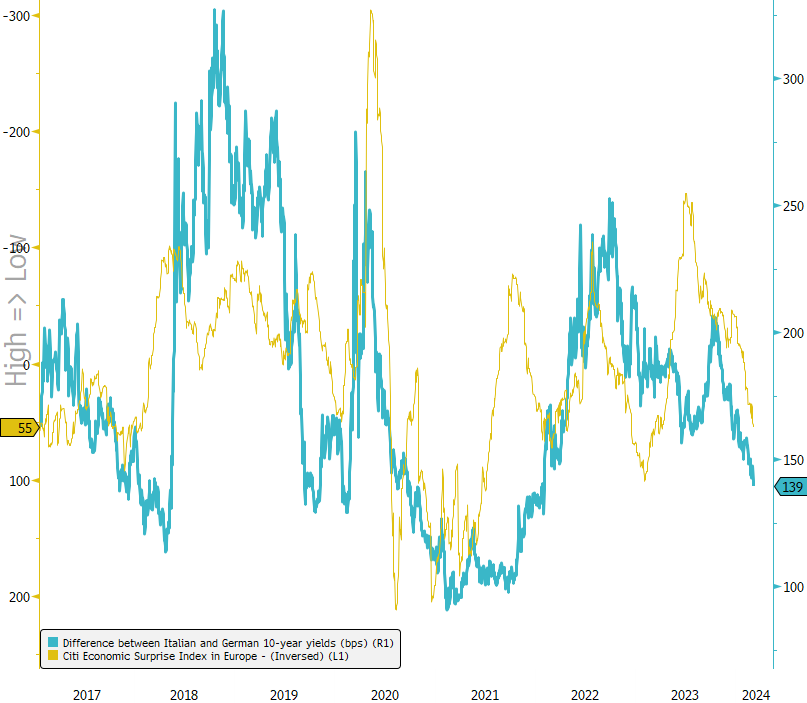

Italian 10-Year Spread Hits Lowest Level in Two Years!

The surge in investor confidence has propelled Italian spreads to their lowest point in two years. The gap between Italian and German 10-year yields dipped below 140 basis points for the first time since early 2022. The rebound in Citi's European Economic Surprise Index has undoubtedly contributed to this trend. In a reflection of the credit market, peripheral bonds are demonstrating strong outperformance compared to core government bonds. However, amidst this optimism, questions linger: Is this downward trajectory sustainable? #ItalianBonds #MarketTrends #InvestmentOpportunities 🇮🇹💼

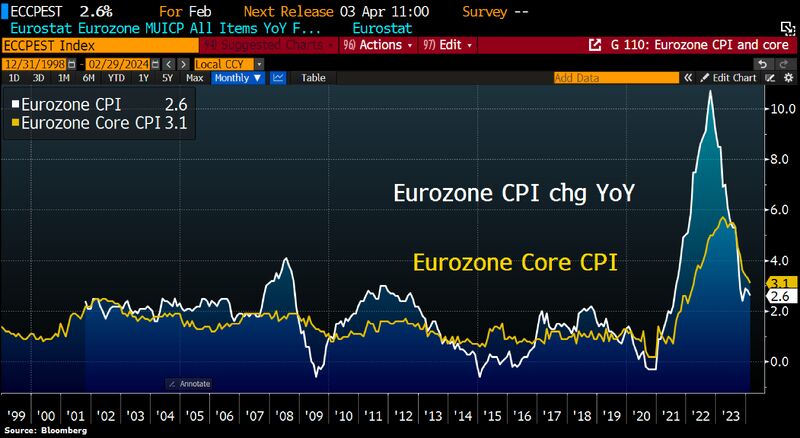

Eurozone CPI slowed less than anticipated in Feb, highlighting stickiness in inflation

Headline inflation eased to 2.6% YoY in Feb, above 2.5% consensus estimate in BBG survey. Core inflation came down by 0.2%-pt to 3.1%, also an upward surprise compared to 2.9% consensus estimate. Source: Bloomberg

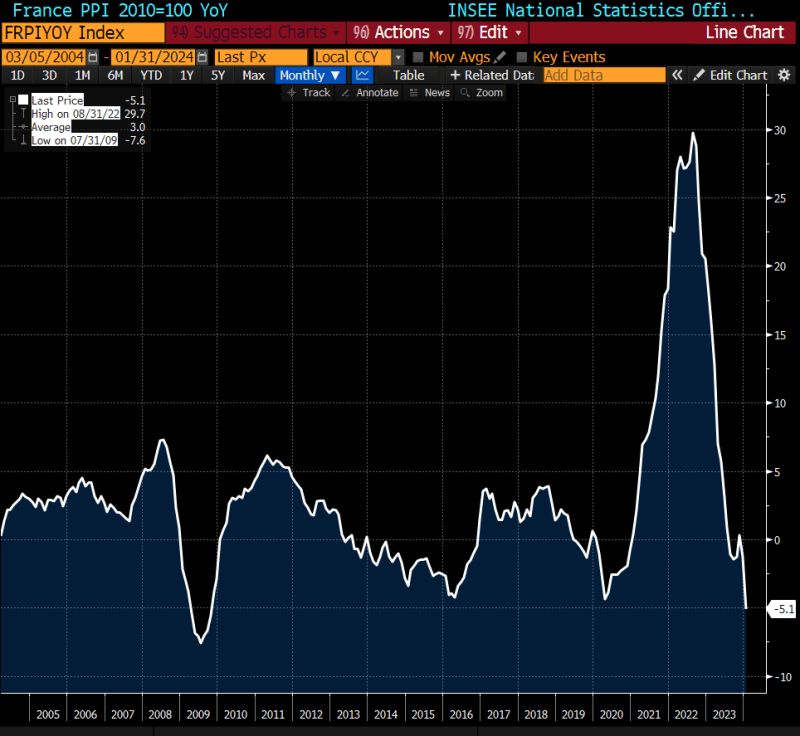

France PPI YOY is the lowest since 2009...

Source: Bloomberg, Alessio Urban

Germany economic challenges in one chart

Source: Statistisches Bundesamt

Investing with intelligence

Our latest research, commentary and market outlooks