Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

This chart shows either total management failure or how dismal things are in Germany as a business location with high electricity prices.

Thyssenkrupp's stocks have fallen by 62% over the past 5 years, while the competition, particularly from the US, has made strong gains. Source: Bloomberg, HolgerZ

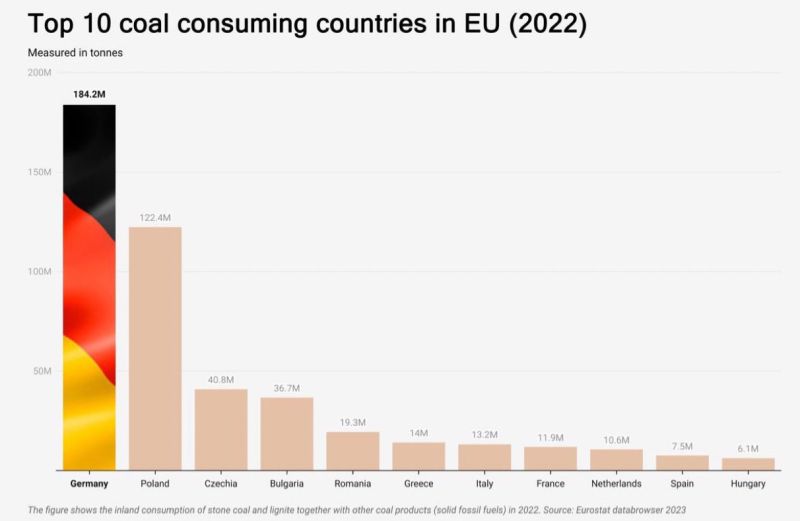

Believe it or not, Germany is the Number 1 coal consuming country in the EU...

If one really cared about climate, would one shut down nuclear or coal power plants first? Source: Michael A. Arouet

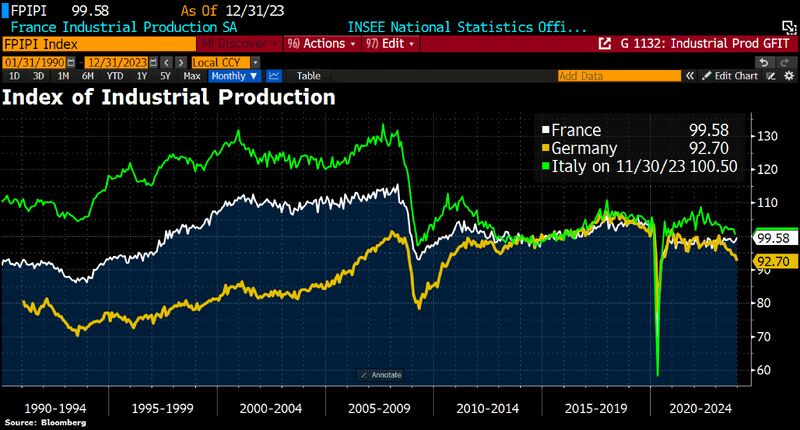

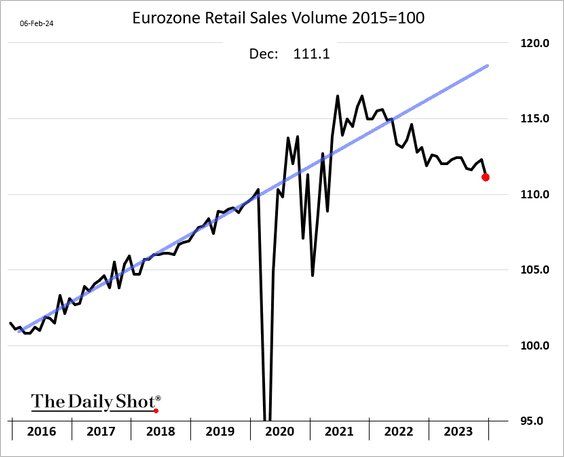

Europe deindustrialization continues

German industrial production fell for 7th consecutive month in December, the longest decline in the history of the data series. The 1.6% MoM decline came as a huge downside surprise. Source: Bloomberg, HolgerZ

German factory orders unexpectedly advanced at year end

GERMANY DEC. FACTORY ORDERS RISE 2.7% Y/Y; EST. -5.3% - BBG *GERMANY DEC. FACTORY ORDERS RISE 8.9% M/M; EST. -0.2% That jump —defying a median economist estimate of a 0.2% decline — was thanks to major orders, without which there would have been a 2.2% drop , Destatis said. Source: Bloomberg, C.Barraud

Germany's exports to Kyrgyzstan were up 1200% in 2023 vs before Russia invaded Ukraine...

Source: Robin Brooks

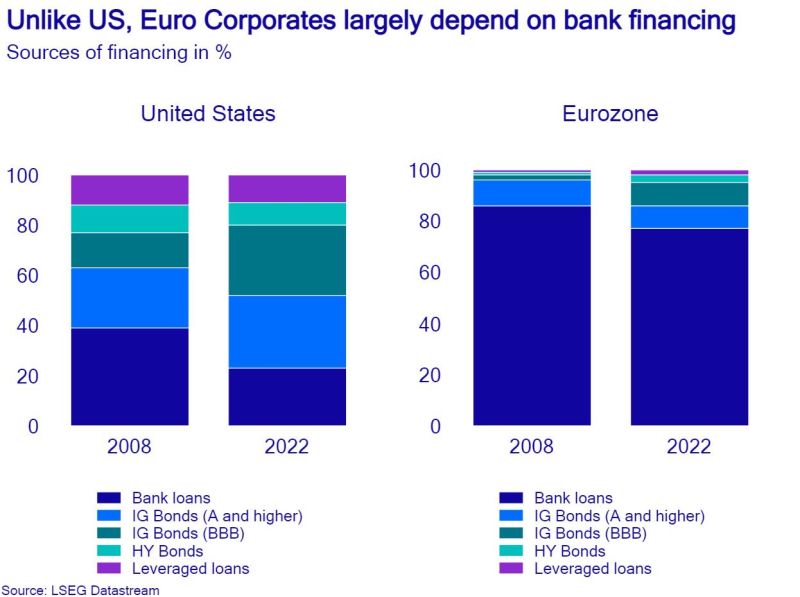

The reason why tighter bank lending conditions bite Eurozone economy faster, while US companies still don’t suffer under higher rates due to longer duration.

Source: Patrick Krizan, Michel A.Arouet

Investing with intelligence

Our latest research, commentary and market outlooks