Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

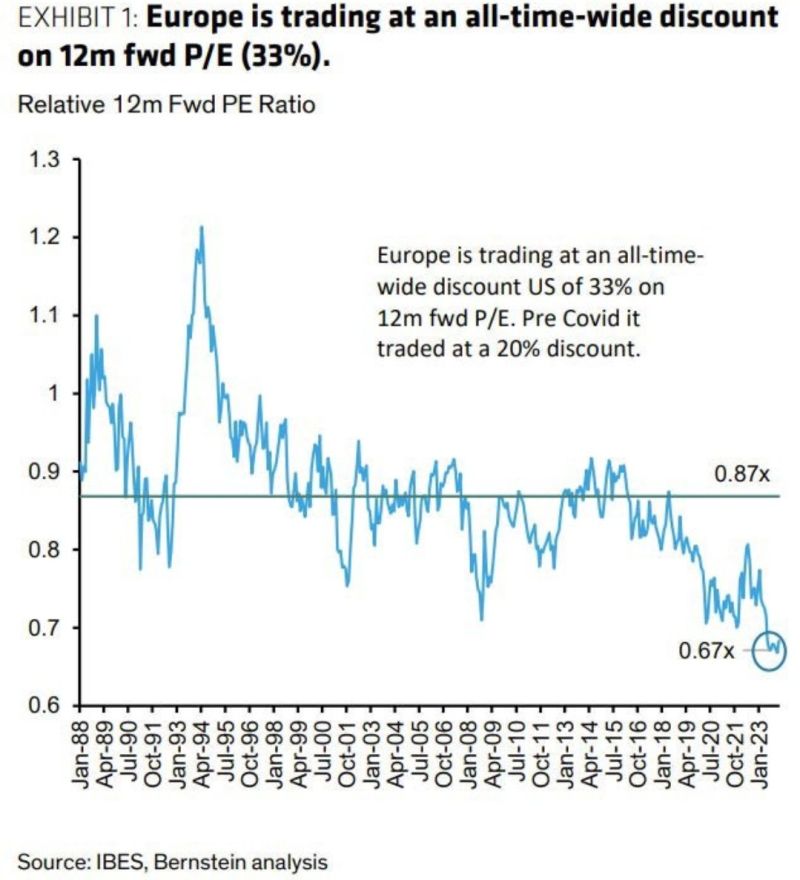

European stocks are currently trading at their lowest valuation relative to U.S. Stocks in history

Source: Win Smart, IBES

Germany troubles in one chart. Retail sales have fallen by 4.4% in Dec YoY.

This means that even Christmas sales fell through. Germans have gone on a buyers' strike since the outbreak of inflation & have even cut back on gifts for children during the Christmas season. This also explains why Germany has some of the toughest competition in the retail sector and the lowest profit margins there. Source: Bloomberg, HolgerZ

Greece is the third country in Europe, after italy and spain, to see energy security affected by Houthi attacks to tankers in the Red Sea.

At least 3 Qatari LNG cargoes have been cancelled over the last days, impacting the Greek prospects of becoming a gas hub in europe. Source: Francesco Sassi

German inflation slows to 2.9% in January from 3.7% in December, lowest level since June 2021

Core CPI slows to 3.4% in January from 3.5% in December, lowest level June 2022. Energy in deflation, hashtag#energy prices dropped -2.8% YoY, while Food CPI slowed to 3.8% from 4.5% in December. Source: HolgerZ, Bloomberg

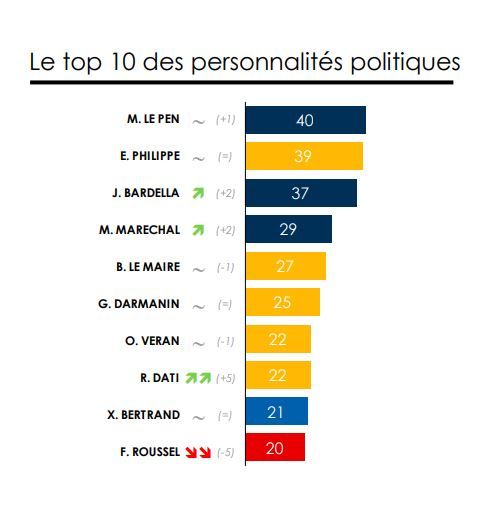

In France, 3 out of the 4 favorite political leaders are from the far right...

1) Marine Le Pen (RN) 40%; 3) Jordan Bardella (RN) 37%; and 4) Marion Marechal Le Pen (Reconquête) 29%. Source: Le Figaro Verian - EPOKA / February poll

The "Deutsche Mag 5" -> Germany has its version of Magnificent 7 stocks

An index consisting of SAP, Siemens, Allianz, Munich Re, and Deutsche Telekom has outperformed the Dax Price Index by almost 90ppts over a 10y period. Source: HolgerZ, Bloomberg, TME

Germany has its version of Magnificent 7 stocks">

Germany has its version of Magnificent 7 stocks">

Germany has its version of Magnificent 7 stocks">

Germany has its version of Magnificent 7 stocks">

Germany's Dax closed at fresh all-time-high just as hedge fund Qube built a $1bn short bet against top German stocks

Volkswagen, Deutsche Bank, Rheinmetall, Siemens Energy, Hellofresh, and Morphosys are among those being wagered against. Source: Bloomberg

German manufacturing had been in crisis well before Russia invaded Ukraine

Putin's invasion only made this structural decline worse. Europe has an easy offset to this: a weaker currency. Euro needs to fall well below parity to offset the crisis in European manufacturing... Source: Robin Brooks

Investing with intelligence

Our latest research, commentary and market outlooks