Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

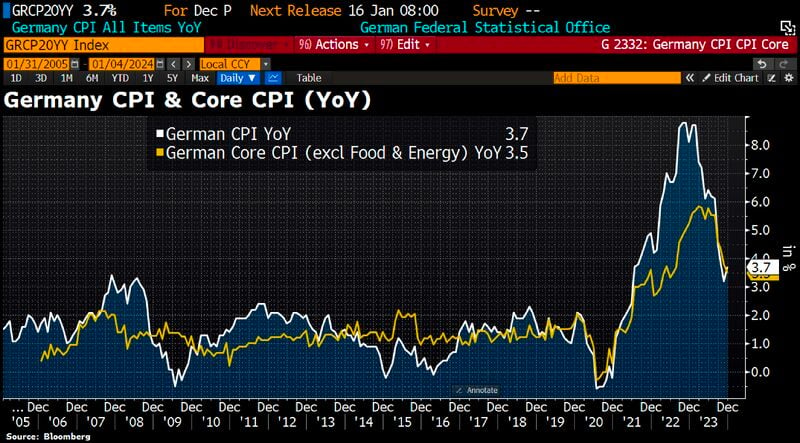

German inflation has accelerated again, at least the headline rate

CPI rose to 3.7% in December from 3.2% in November due to base effect. But Core CPI has fallen further to 3.5% in Dec from 3.8% in November. This means that core inflation is once again below headline inflation. Source: HolgerZ, Bloomberg

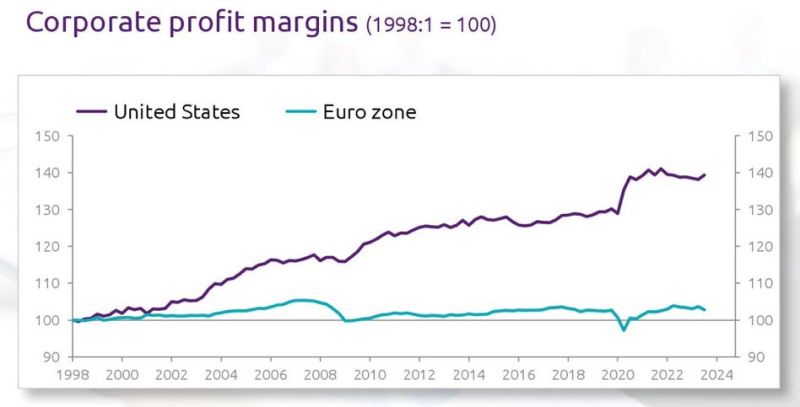

A remarkable chart. The sector composition probably does not explain everything

Source: Michel A.Arouet

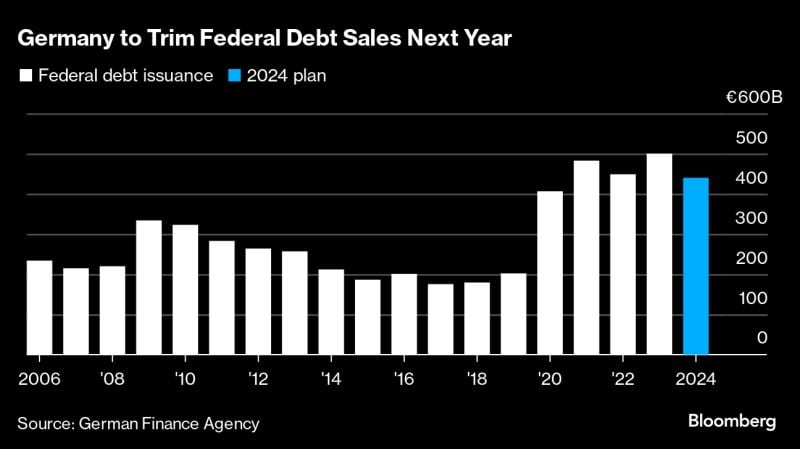

German federal government is set to trim federal debt sales next year following the German top court's 'debt brake' ruling. Berlin plans to issue ~€440bn in debt

That compares with a record volume of ~€500bn in 2023 Source: HolgerZ, Bloomberg

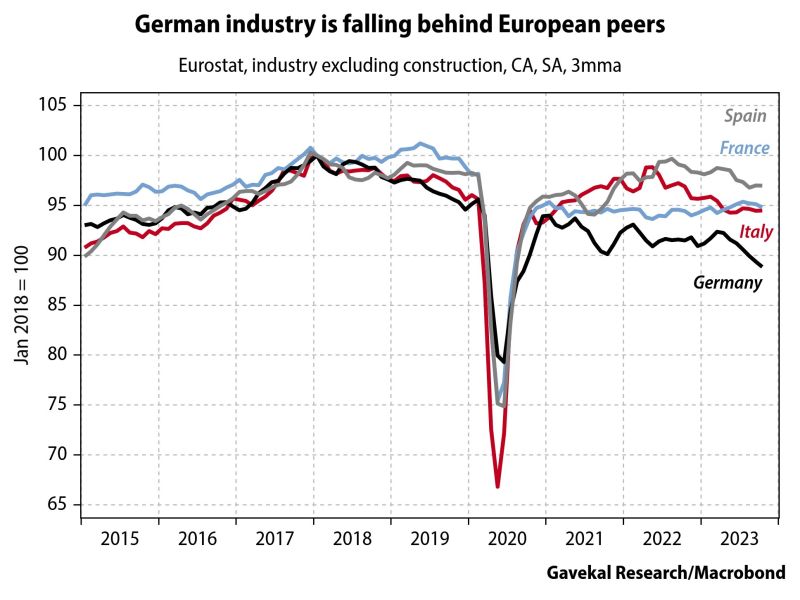

Times are tough for European industry, which is having to adapt to climate-friendly regulations, higher energy costs and increased competition from Chinese producers

German industry has seen production fall by -2.3% this year; worst of the four biggest eurozone economies. Source: Gavekal

An overview of European real estate price indices by Bloomberg / HolgerZ:

A shortage of housing has led to record real estate prices in ireland. The national property price index has now reached a value of 170.0, which is 3.9% above its bubble peak in April 2007. Property prices have increased by 113% in past 10yrs. Recent Dublin riots exposed the anger of Irish Youth facing a housing crisis resulting from the high housing & rent prices. Note the decline in German house prices (in purple) and steady markets in Italy / Portugal / Spain.

Most of this year's Dax rally is driven by higher EPS expectations, not P/E expansion. Dax has gained 18% year-to-date while Dax P/E has expanded only 6% from 11.5 to 12.2

Source: Bloomberg, HolgerZ

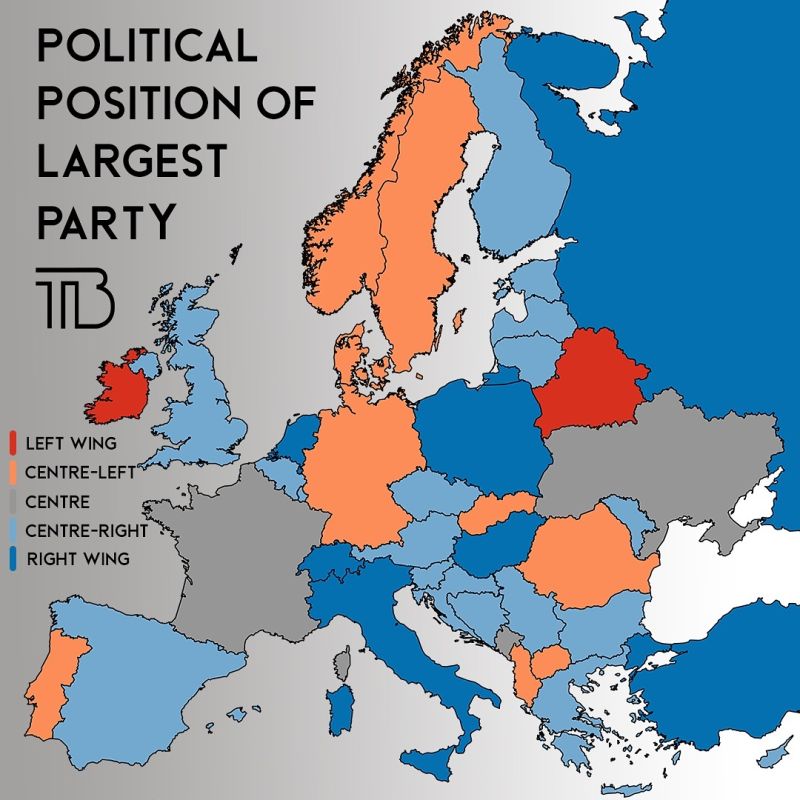

Political position of the largest party in each European country

(map by try.balkan/instagram) Source: OnlMaps

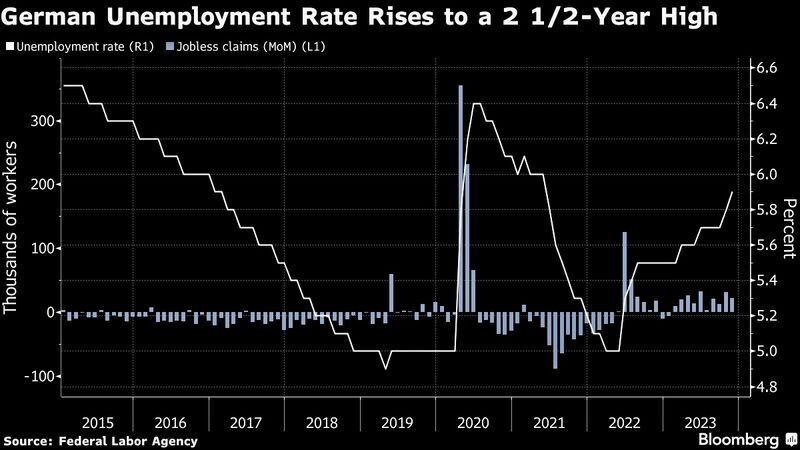

The German labor market is now sending out alarm signals despite the shortage of skilled workers

Germany’s unemployment rate unexpectedly rose to 5.9% in November, the highest level in 2.5 years. Joblessness increased by 22k. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks