Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

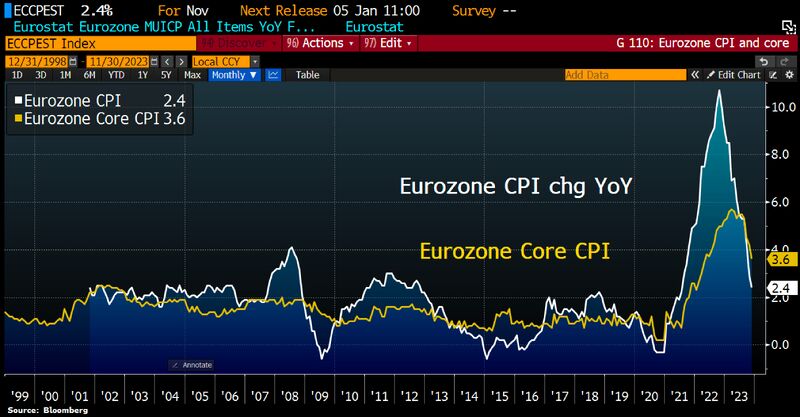

Eurozone inflation cooled more than expected, putting 2% target in sight:

Headline CPI rose 2.4% YoY in November down from 2.9% in October. Core CPI, which excludes volatile components like fuel & food, moderated for a 4th month to 3.6% from 4.2% in October. Markets are now pricing 1st ECB rate cut to take place at the April meeting. Source: HolgerZ, Bloomberg

ECB QT continues. ECB balance sheet back <€7tn, shrank by €5.3bn to €6,996bn, lowest since Jan2021

Total assets now equal to 50% of Eurozone GDP vs Fed's 28% & BoJ's 128%. And Lagarde has warned that the timeline for ending PEPP reinvestments and so QT could be accelerated. Source: HolgerZ, Bloomberg

German inflation sinks more than expected as energy retreats & costs of fuels & travel fell sharply from prior mth

Headline CPI slows to 3.2% YoY in Nov from 3.8% in Oct & vs 3.5% exp. Food inflation slows to 5,5% from 6.1%, Core CPI dropped from 4.3% to 3.8%, so a long way to go to 2% goal. Source: Bloomberg, HolgerZ

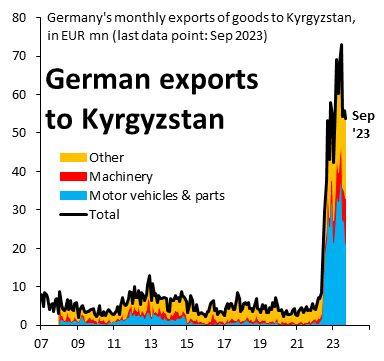

German exports of motor vehicles and parts (blue) to Kyrgyzstan are up 5500% since Russia invaded Ukraine

Is Kyrgyzstan suddenly in a massive boom or are these vehicles and parts just transiting through Kyrgyzstan? Source: Robin Brooks

Far-right lawmaker Geert Wilders, who wants a referendum on leaving the EU, is on course to win the most votes in parliamentary elections in the Netherlands

However, according to an exit poll, Wilders’s Freedom Party is projected to win 35 seats, substantially less than the 76 required to secure an outright majority. Source: FT

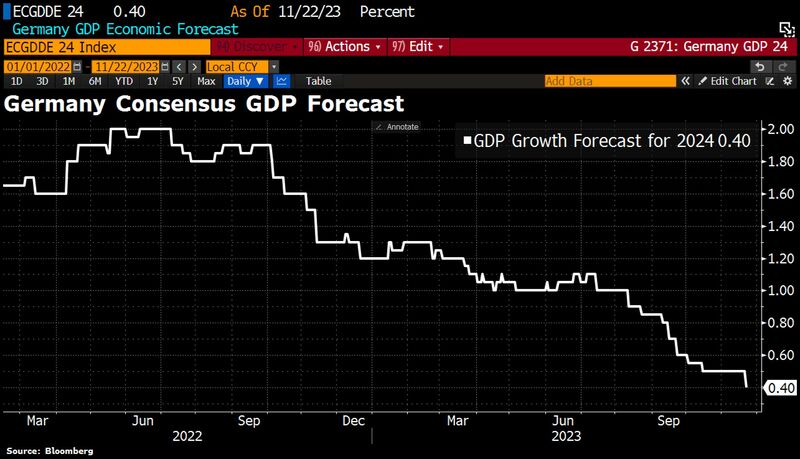

German growth forecasts for 2024 have been cut following the budget chaos after the Constitutional Court declared govt's spending plans unconstitutional

The consensus now expects GDP growth for Germany of just 0.4% for the coming year. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks