Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

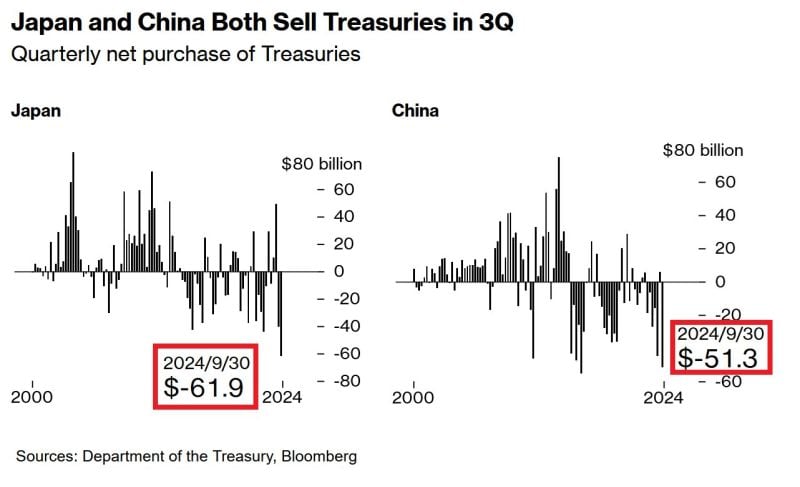

CHINA AND JAPAN ARE DUMPING US TREASURIES

Japanese investors sold $61.9 billion of Treasuries in Q3 2024, the most on RECORD. Chinese funds dumped $51.3 billion, the second largest on record. Japan and China are two world's biggest foreign holders of US government debt. Source: Global Markets Investor

Actually, bonds performed really well last week

$TLT $AGG Source: Mike Zaccardi, CFA, CMT, MBA

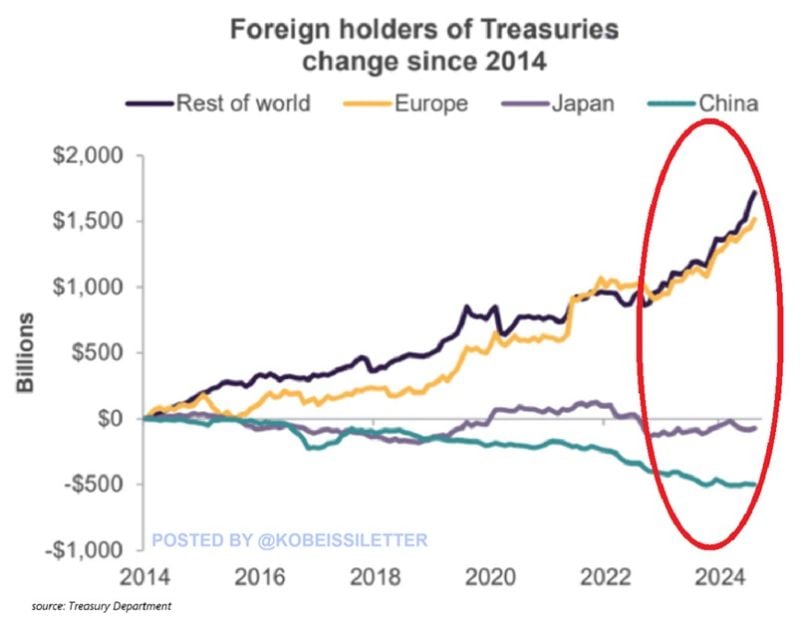

Foreign holdings of US Treasuries have jumped by $2.6 TRILLION over the last decade.

Europe’s Treasury holdings have risen by $1.5 trillion with the rest of the world acquiring $1.7 trillion of bonds. On the other hand, China and Japan's holdings have shrunk by ~$500 and ~$100 billion, respectively. Overall, total foreign holdings as a share of outstanding federal debt have dropped from 35% to 24%, near the lowest level in 18 years. This is the consequence of rapidly rising public debt with the supply of Treasuries rising ~$15 trillion over the last decade. Foreign demand for Treasuries cannot keep up with skyrocketing US debt. Source: The Kobeissi Letter

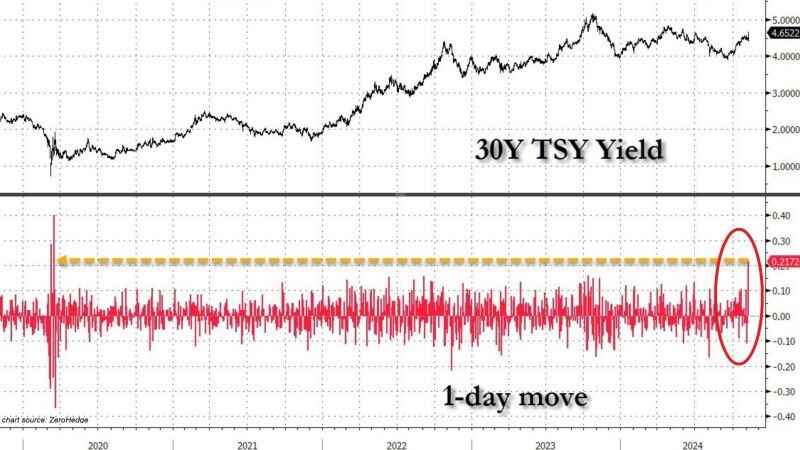

THIS IS AN ABSOLUTELY WILD MOVE >>>

The 30-year US Treasury jumped by a massive 22 basis points, the biggest spike since the COVID CRISIS. At the same time, the 10-year yield jumped by 16 basis points, to the highest since July. Meanwhile, the Fed is going to cut today.... Source: Global Markets Investor

Some Trump trades really going for the extreme...

Russell futures vs the 10 year trading with a gap not seen in ages. Source: The Market Ear

UK borrowing costs hit highest level this year as gilt sell-off intensifies.

This should not come as a surprise, Eurizon SLJ Research's Stephen Jen says: When the debt stock is 99% of GDP, and the govt imposes the largest tax hike post-WWII and the largest increase in spending in multi-decades, why should one be surprised that the bond market shows signs of indigestion? Source: HolgerZ, FT

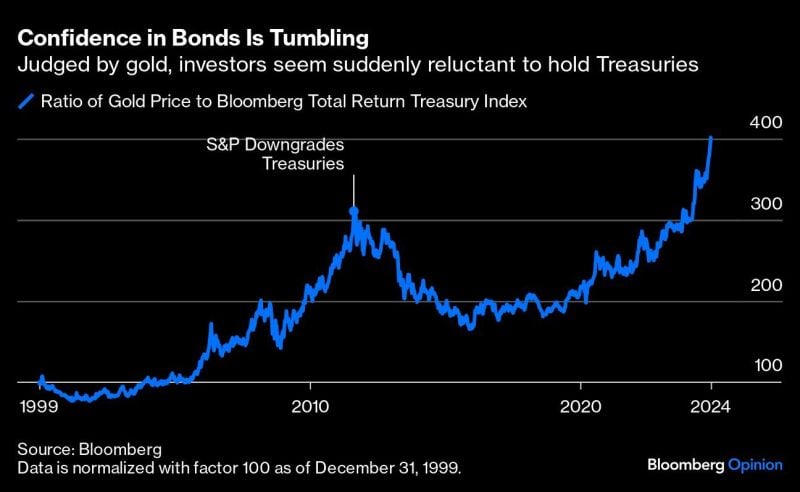

Why is it happening?

With Interest Expense soaring and US debt/GDP at 125% & rising, the only way the US can keep USTs nominally money good are via negative real rates. hence the gold outperformance. Source: Bloomberg, Luke Gromen

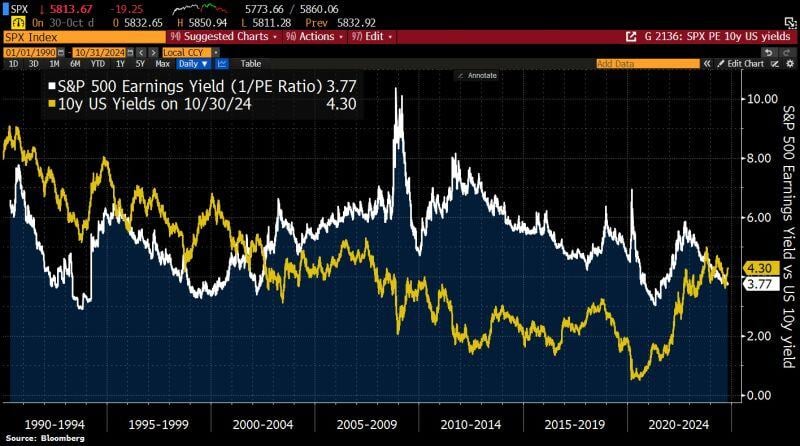

It seems the stock markets haven’t yet recognized that equity risk premiums have turned negative.

The yield on the 10y US bond is now higher than the earnings yield of the S&P 500... Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks