Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

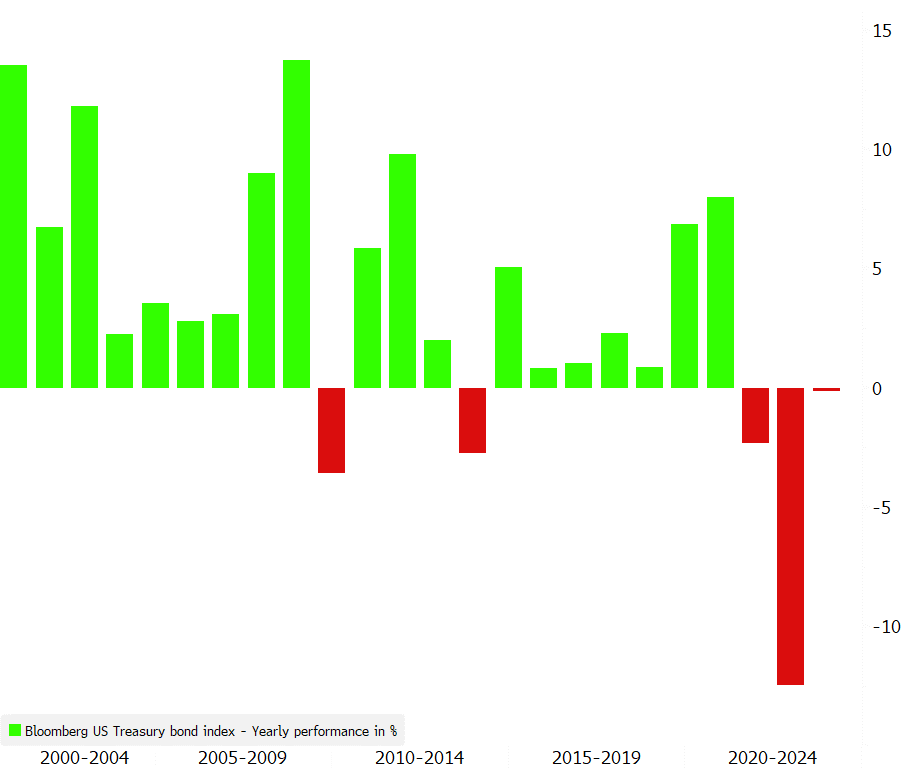

U.S. Treasury bond performance in 2023 turns negative!

For the first time in 2023, the year-to-date performance of U.S. Treasuries has turned negative (-0.14%). Yesterday, the U.S. Treasury yield curve shifted upward by about 15 basis points as the index has lost 2.6% in February so far. This sharp reversal is due to a stronger than expected resilience in the U.S. economy, which could trigger further tightening of U.S. monetary policy. Source: Bloomberg

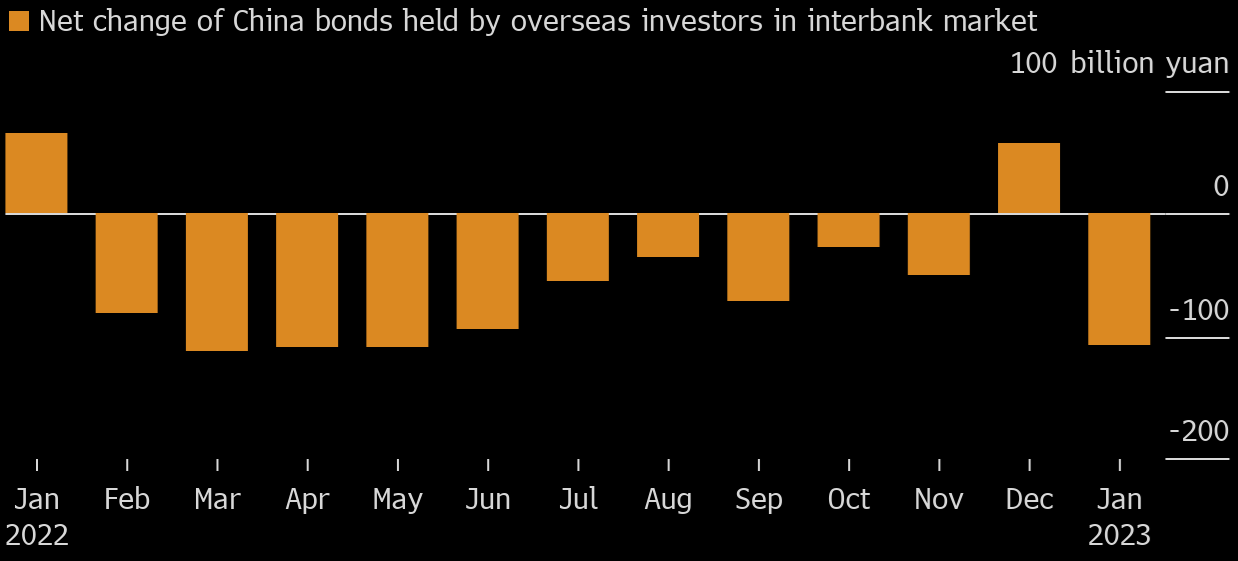

Chinese bond outflows are back!

While sentiment is positive on Chinese assets due to hopes of the economic impact of the reopening, the inflows of CNY bonds lasted only one month. In January, capital outflows resumed due to fears of accelerating inflation in Asia and particularly in China as its economy reopens. It should be noted that the PBOC (People Bank of China) is one of the few central banks to maintain an accommodating monetary policy since the beginning of the COVID. Source: Bloomberg.

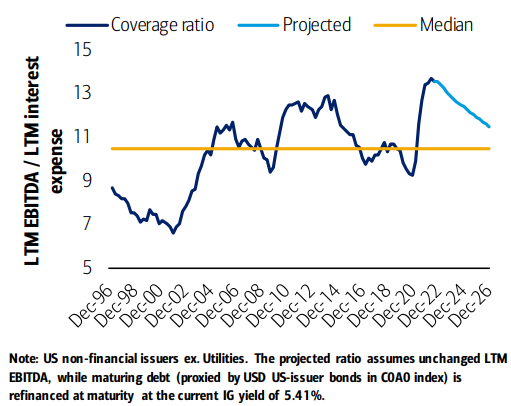

Higher yields: No material impact for Investment Grade companies?

The rising cost of financing could be a headwind for companies, but investment grade (IG) companies appear to be "immune" for the next few years. Indeed, according to Bank of America, refinancing maturing debt at the current IG yield of 5.4% would reduce the coverage ratio to about 11.5x by the year 2026, which is still above the median. Source: Bank of America.

US 10y yields jump to 3.84%, new 2023 high, following hotter-than-expected US PPI data

Source: Bloomberg, HolgerZ

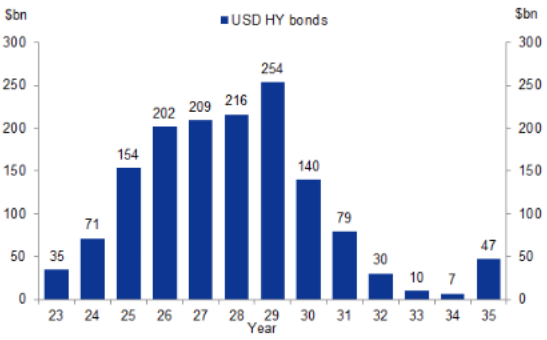

No refinancing pressure yet for US high yield companies!

One of the main factors supporting US high yield is technical. The U.S. high yield market is not facing an "avalanche" of new issuance because refinancing needs are very low for 2023. Therefore, the potential negative impact of rising interest rates should be limited for U.S. high yield companies for the time being. Source: Goldman Sachs

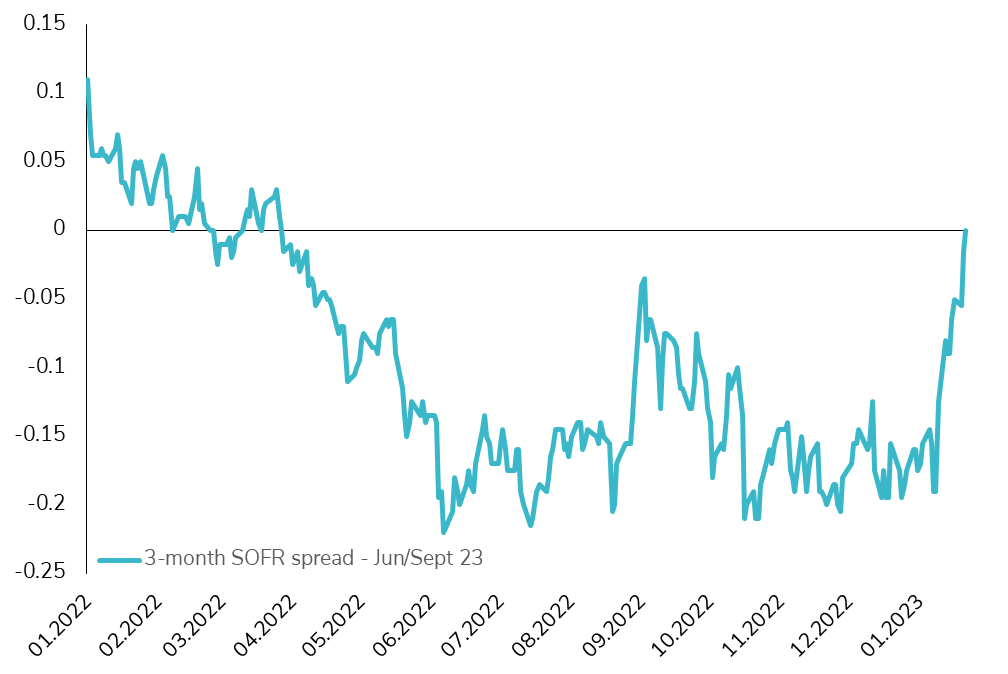

The market no longer expects a rate cut during the summer!

While the market has been anticipating the first Federal Reserve rate cut in the summer of 2023 for the past year, improving economic growth sentiment and a still strong job market have led the market to revise its expectations. Indeed, the spread between the SOFR 3-month June and September 2023 futures turned positive yesterday, reflecting the fact that no further rate cuts are expected by the market from June to September. Source: Bloomberg

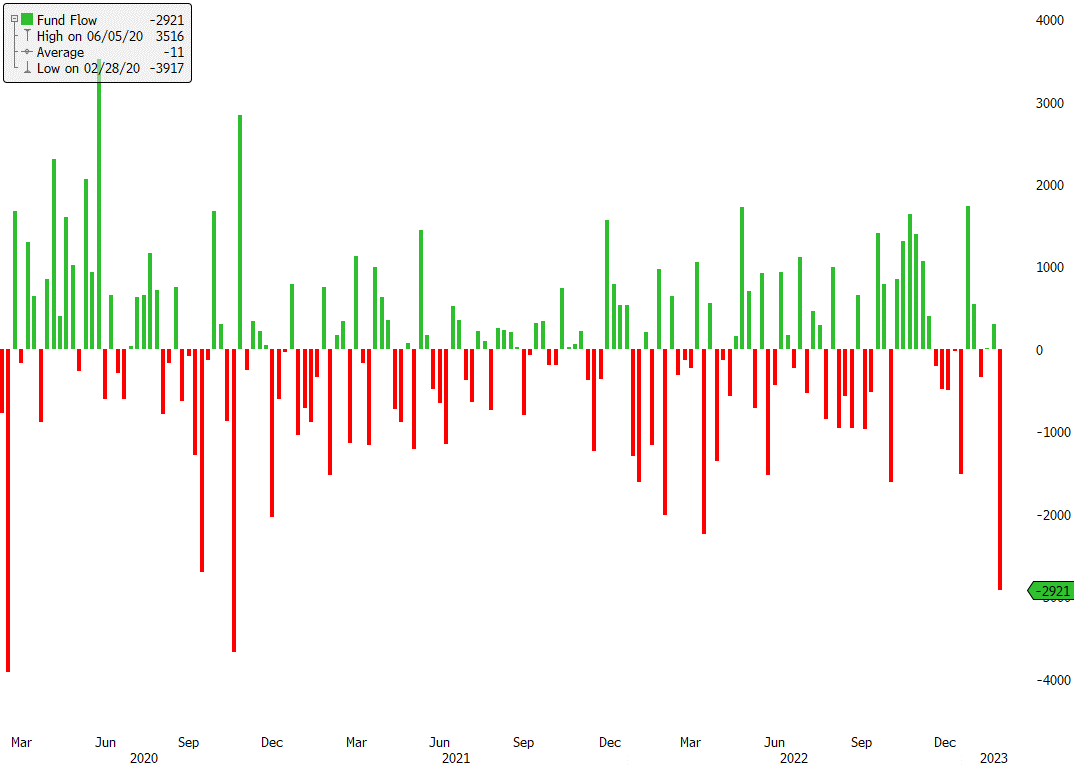

Largest weekly outflow since 2020 in U.S. High Yield bonds!

Last week, one of the largest ETFs tracking U.S. high yield bonds, the HYG or iShares iBoxx HY Corporate Bond ETF, had its largest outflow since 2020. Valuations are stretched in high yield despite solide fundamentals. Any spike in equity volatility could quickly negatively impact this segment. Source: Bloomberg

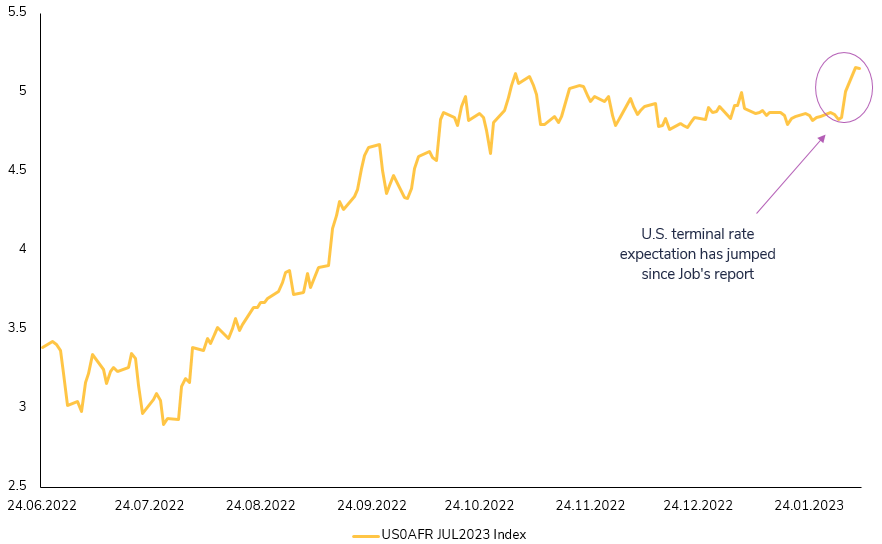

A new cycle high for U.S. terminal rate expectation

The market has pushed its expectations for the U.S. terminal rate higher (and longer). Indeed, it now appears that it will end slightly above 5% and in July 2023 (one month later than previously expected). The resilience of the U.S. economy (driven by a strong labor market) continues to drive terminal rate expectations higher and for a longer period of time. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks