Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Congrats to Saudi Arabia who wins bid for 2030 world fair, beating Italy, S. Korea.

The Saudi Arabian capital of Riyadh won the right to host the Expo 2030 world fair, vote results showed on Tuesday, in another diplomatic victory for a Gulf country after last year's soccer World Cup in Qatar. South Korea's port city of Busan and Rome in Italy were also in the running to host the five-yearly event that attracts millions of visitors and billions of dollars in investment. “Our goal in the Kingdom is to organize the first environmentally friendly exhibition that achieves a zero level of carbon emissions,” Expo blueprint team member Eng. Nouf Bint Majid al-Muneef said. “The Riyadh Expo 2030 site will be powered by clean resources that rely on solar energy, and we are developing high standards for resource efficiencies and detailed strategies to enhance biodiversity, eliminate food waste, and ensure green waste management and recycling.” Source: Reuters, Al Arabiyah

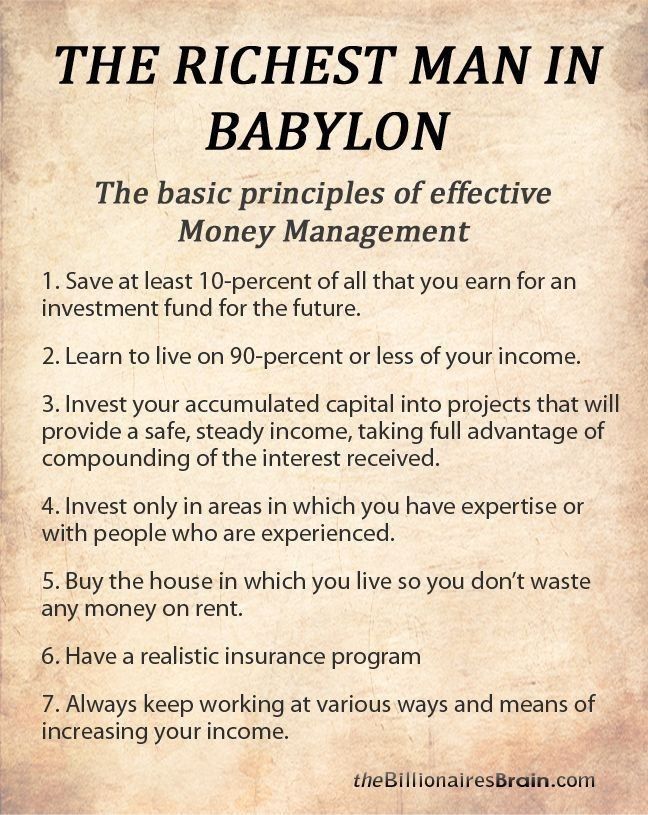

7 Timeless Principles of Effective Money Management

Source: Investment Books (Dhaval)

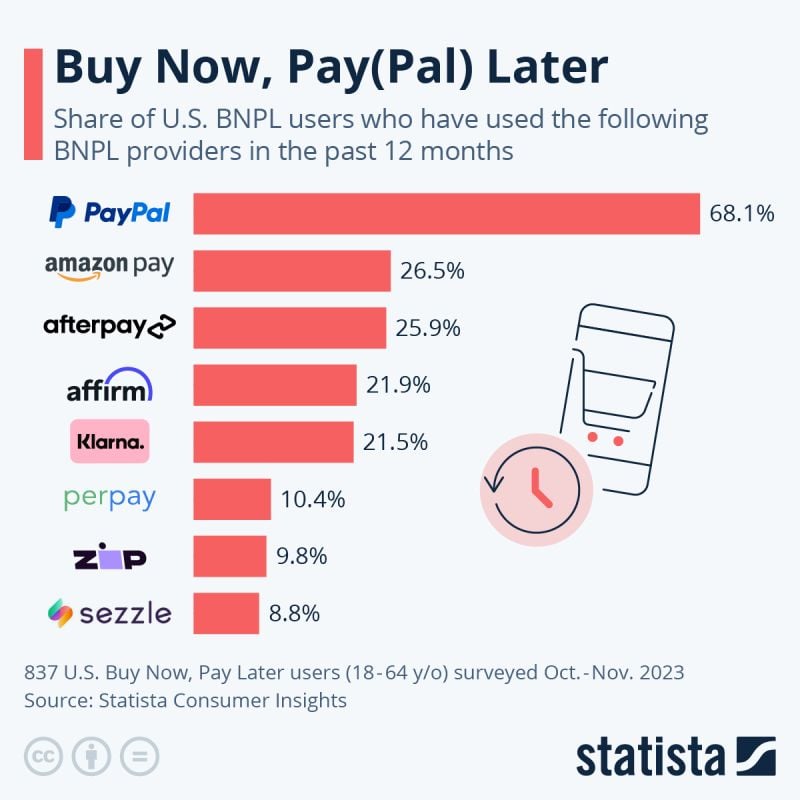

Record holiday spending: good news, just one problem: consumers used buy-now-pay-later schemes to spend $7.3BN from Nov. 1 to Nov. 26, up 14% from a year ago, per Adobe

These are basically vendor/3rd party financing programs which don't show up on already maxed out credit cards... Source: Statista, www.zerohedge.com

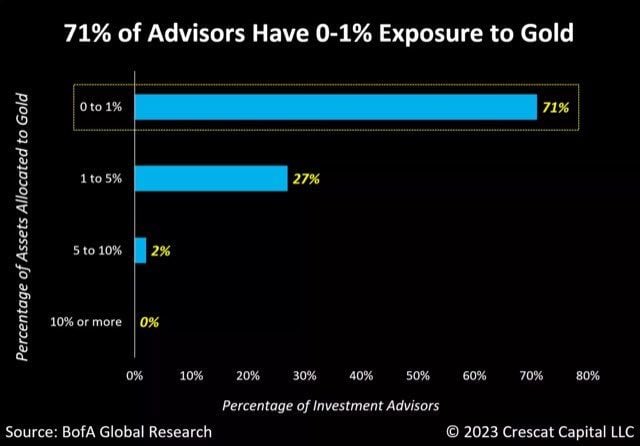

As highlighted by Tavi Costa, one of the positives for gold today is the consistent neglect of the metal as a defensive alternative over the past few decades

This is evident in the significant underrepresentation of precious metals among traditional investment strategists. Source: Crescat Capital

Fun Fact: Bill Gates Could Be A Trillionaire Today If He Had ‘Diamond-Handed’ His Original $MSFT Shares

If he maintained his 45% stake, it would equate to $1.23 Trillion today... Source: Cheddar Flow

Investing with intelligence

Our latest research, commentary and market outlooks