Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

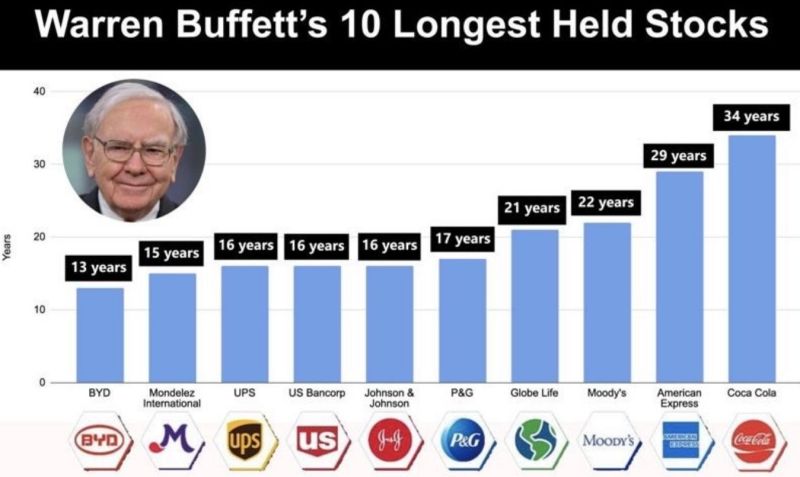

The way to build wealth, is over the long-term:

Source: Invest In Assets | Stock Market Investing 📈

10 Accounting KPIs everyone should know

By Compounding Quality / Chris Quinn

Something to keep in mind for 2024?

Source: Michel A.Arouet

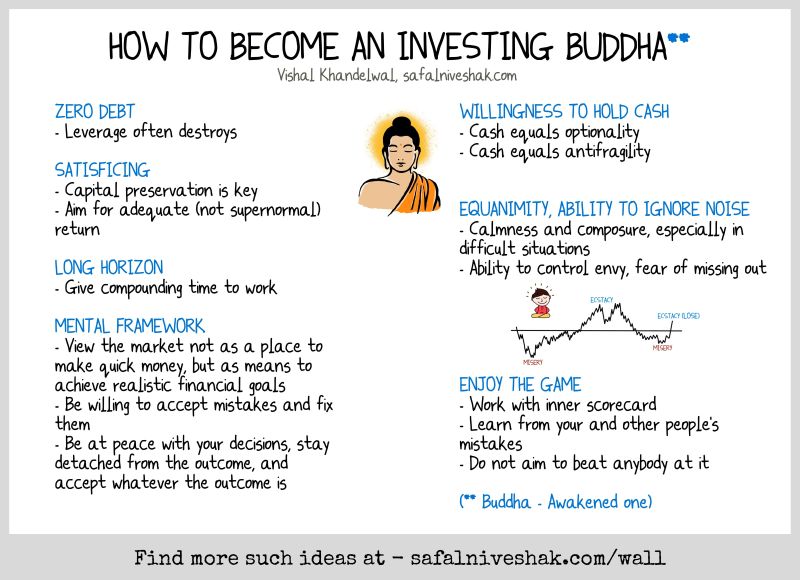

How to become an investing Budha

Source: Vishal Khandelwal, Safal Niveshak

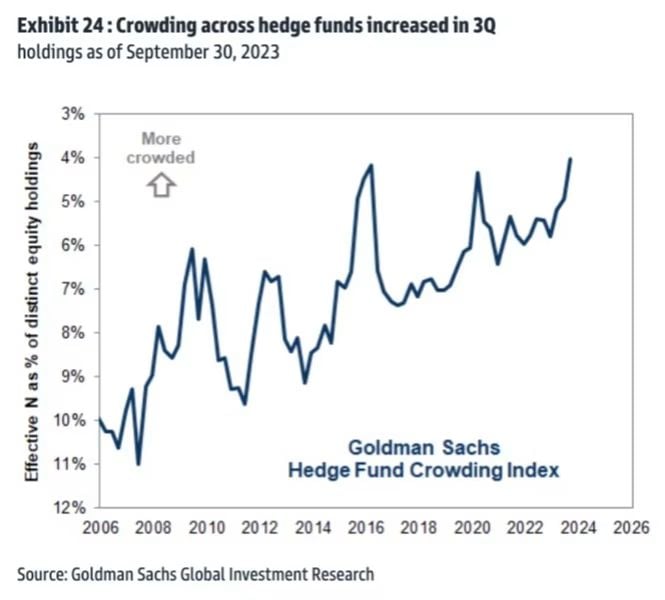

Hedge Fund Position Concentration hits all-time high 🚨 i.e. everyone chasing the same trades - Mag 7

Source: Barchart, Goldman Sachs

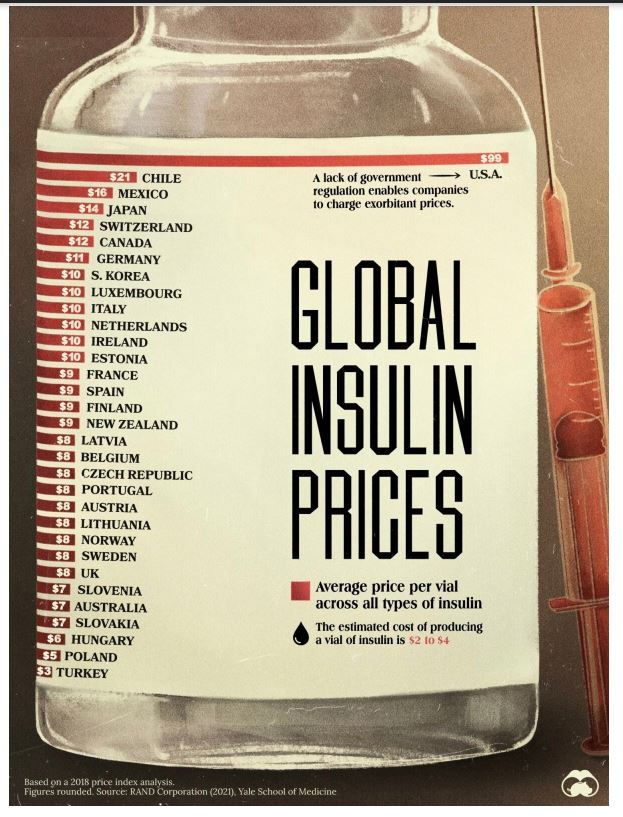

Charted: The Average Cost of Insulin By Country by Visual Capitalist

Drug prices in the U.S. are notoriously high for many important medications, including insulin. When comparing the cost of insulin by country, we see that the difference is not even close. This chart shows the average cost of insulin across OECD countries, based on a 2021 publication by RAND Corporation.

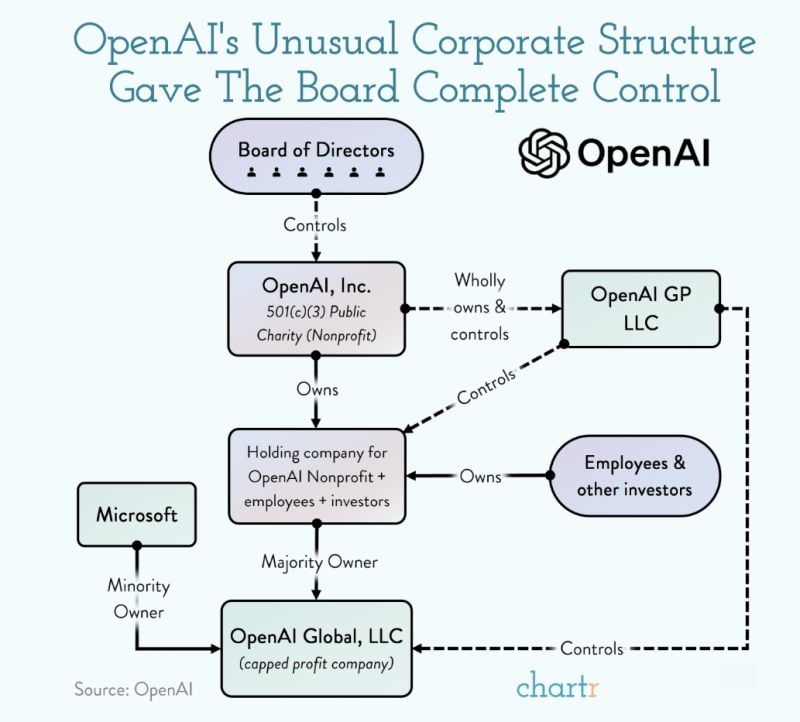

The corporate structure of OpenAI by Chartr or how a generationally-important company like OpenAI could be plunged into such chaos is partly down to its unique corporate model

Following the company's structure from top to bottom — even with a few subsidiaries thrown in — reveals that the board of directors had ultimate control to make decisions over both the nonprofit and for-profit OpenAI entities... leaving anchor investor Microsoft blindsided by Altman’s ousting just moments before the public announcement. The company that launched ChatGPT less than a year ago claims that its structure is designed to develop artificial general intelligence that’s “safe and benefits all of humanity”, with the capped profit arm of OpenAI, first introduced in 2019, able to issue equity and raise capital to further the work of the original nonprofit that was established in 2015. Source: Chartr

Investing with intelligence

Our latest research, commentary and market outlooks