Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

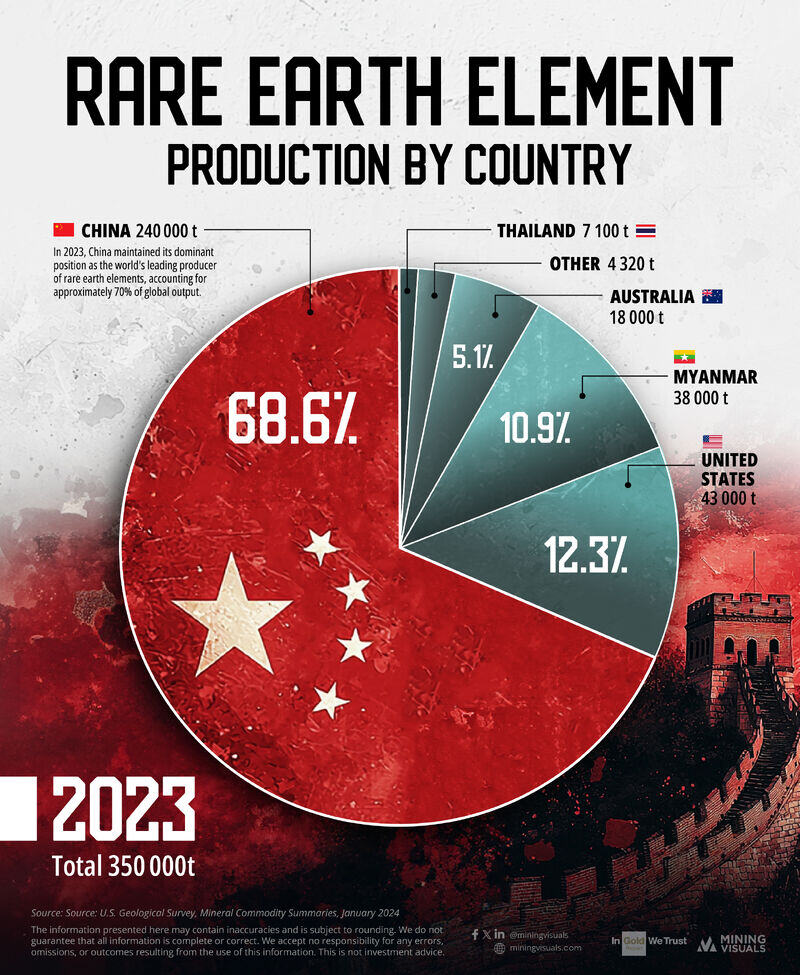

Rare earth element production by country

Source: Visual Capitalist

BREAKING: Alex Mashinsky of Celsius Network pleads guilty to:

1. Inducing investor to sell their Bitcoin to Celsius with false statements about its EARN program. 2. Manipulating the price of CEL Sentencing is Tuesday, April 8, 2025 at 11:30 with a max sentence of 30 years. Source: Aaron Bennett @AaronDBennett on X

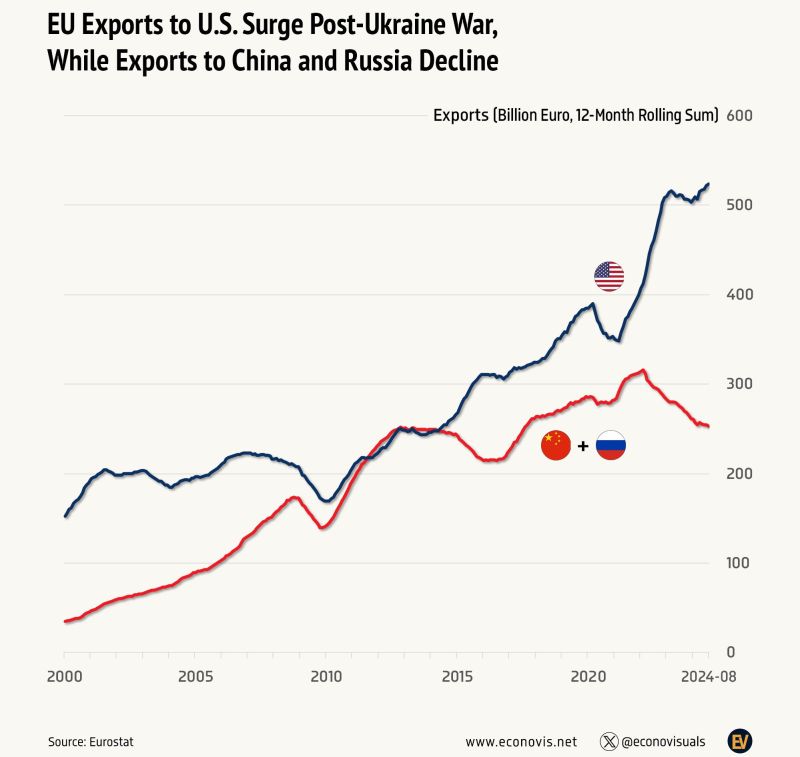

Europeans, especially the German carmakers,simply cannot afford losing the US market due to tariffs after taking a hit in other major markets.

They need to be really polite to Trump‘s administration... Source: Econovisuals, Eurostat

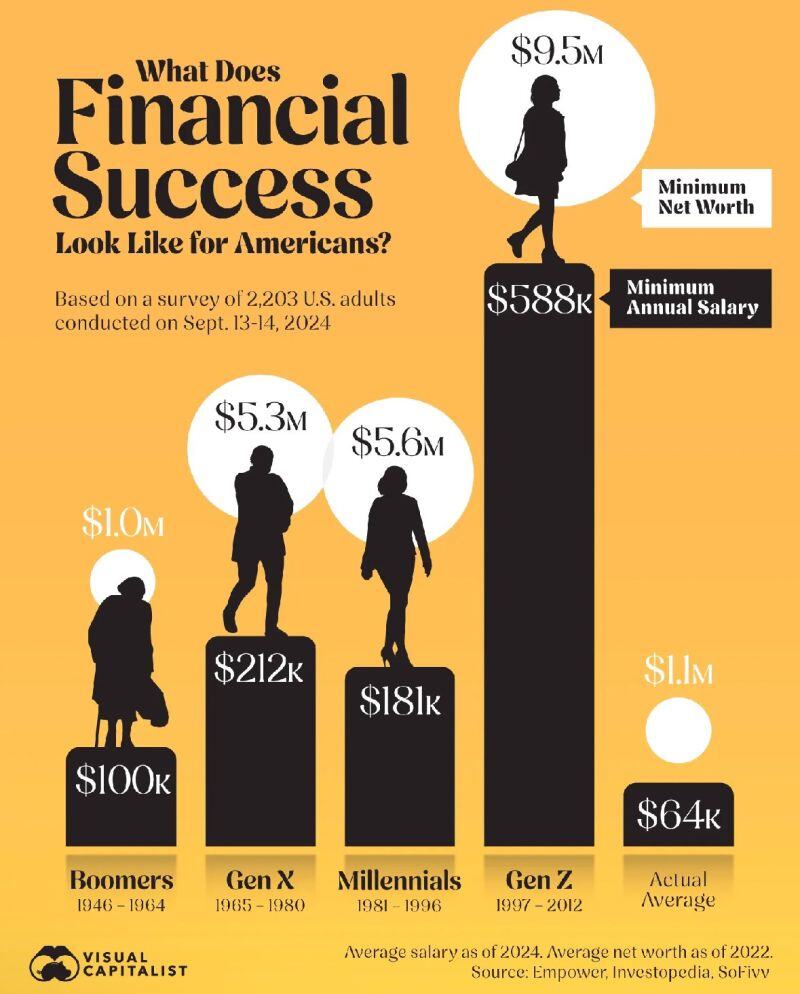

Here’s what different 🇺🇸 generations think financial success looks like

Source: Visual Capitalist

ALL DAY TRADING IS COMING??

This start-up stock exchange just won approval from the US SEC to allow nonstop trading 23 hours a day, 5 days a week. Trading technology pioneer Dmitri Galinov's 24 Exchange has secured regulatory approval to launch what could become America's first near round-the-clock equities trading venue, marking a potential watershed moment for US market structure. The extended hour trading is subject to Equity Data Plans making changes that would facilitate overnight trading hours and 24X National Exchange making an additional rule filing with the SEC confirming the changes and the Exchange’s ability to comply with the Securities Exchange Act. The Securities and Exchange Commission (SEC) has greenlit 24X National Exchange, the latest venture from Galinov, who previously founded FastMatch - now Euronext FX - and held senior roles at Direct Edge. The approval represents a significant milestone for the firm, which has been steadily expanding its trading offerings since its 2019 launch. The exchange will roll out in two phases, with initial trading hours from 4:00 AM ET to 7:00 PM ET on weekdays, starting in the second half of 2025. The second phase would extend trading from 8:00 PM ET Sunday through 7:00 PM ET Friday, subject to approval from Equity Data Plans and additional SEC requirements. A one-hour operational pause will occur during each trading day to accommodate routine software upgrades and functionality testing. (Source: www.liquidityfinder.com)

Semiconductor Stocks $SMH testing the 200D moving average for only the 4th time since January 2023 🚨

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks