Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

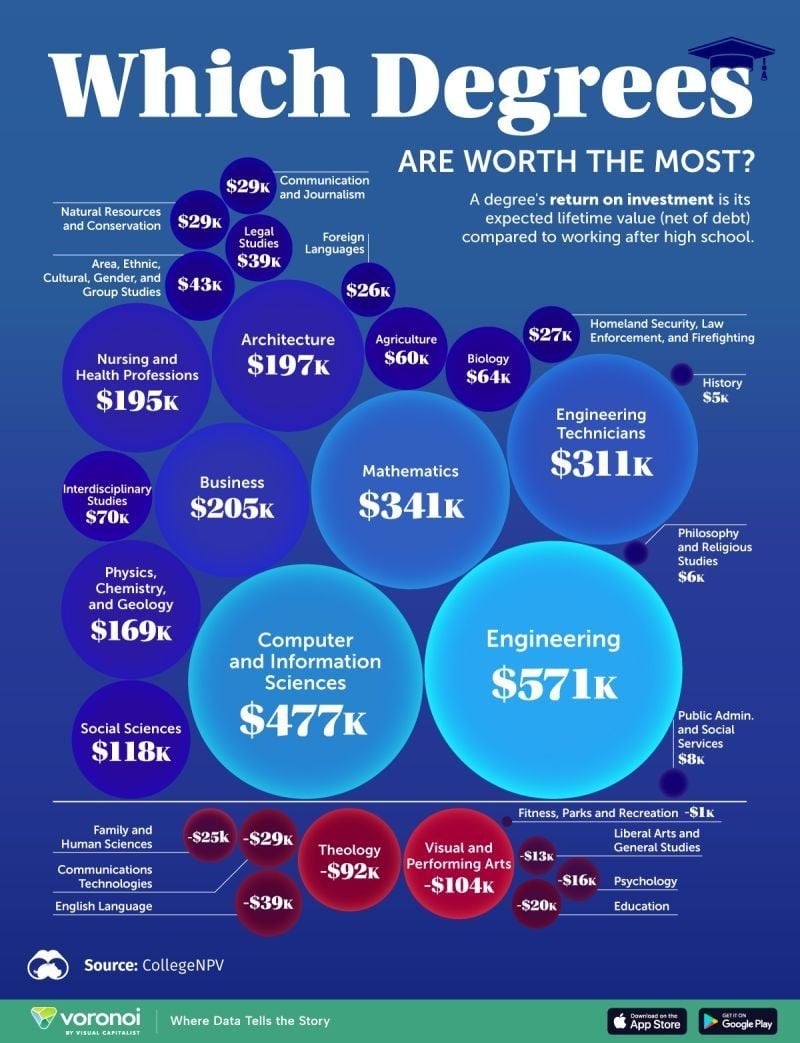

🎓 Which degrees are worth the most?

The visual below by Voronoi / Visual Capitalist shows the average return on investment of a degree in the U.S., based on data from CollegeNPV. 👉 The return on investment of a degree is the expected lifetime value of the degree (net of debt) compared to entering the workforce after high school. 🥇 Engineering, computer and information sciences, mathematics, and engineering technician degrees are the most valuable degrees in the U.S. when looking at expected lifetime income minus debt compared to working right after high school. 📌 💲As for specific programs, Harvard University's computer science degree ranks first for ROI, according to CollegeNPV. Graduates of this program can expect an ROI of over $4 million in their lifetime, with $256,539 in median income and $14,000 in median debt. On the other end, humanities degrees like visual and performing arts, theology, and English are among the least valuable degrees when looking at lifetime earnings. Link to full article >>> https://lnkd.in/gahbyZzn Source: Voronoi, The Visual Capitalist

The co-founder of the world’s largest asset manager has said the outcome of the looming US election between Kamala Harris and Donald Trump 'really doesn’t matter' for financial markets.

https://lnkd.in/eZCKpyDZ Source: FT

Is "America's exceptionalism" too much of a crowded trade?

Watch out The Economist cover below 👇

The mainstream lost its monopoly over media.

Now it's losing its monopoly over polls, prediction markets and shaping public opinion as trust shifts to independent new entities Source: www.zerohedge.com

BREAKING 🚨: Illegal SHORT SELLERS in South Korea now face the possibility of LIFE IN PRISON

#freemarkets Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks