Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Satoshi Nakamoto

HBO documentary film maker Cullen Hoback has named Peter Todd, a bitcoin core developer who has been involved with bitcoin since 2010, as who he believes to be the real-world identity of Satoshi Nakamoto. If it is true, it means that this man holds about 1.1m BTC tokens (around $70 billion...) in about 22,000 different addresses. Source: Bitcoin Magazine

Exactly what someone who's Satoshi would say ???

Source: Wall Street Silver

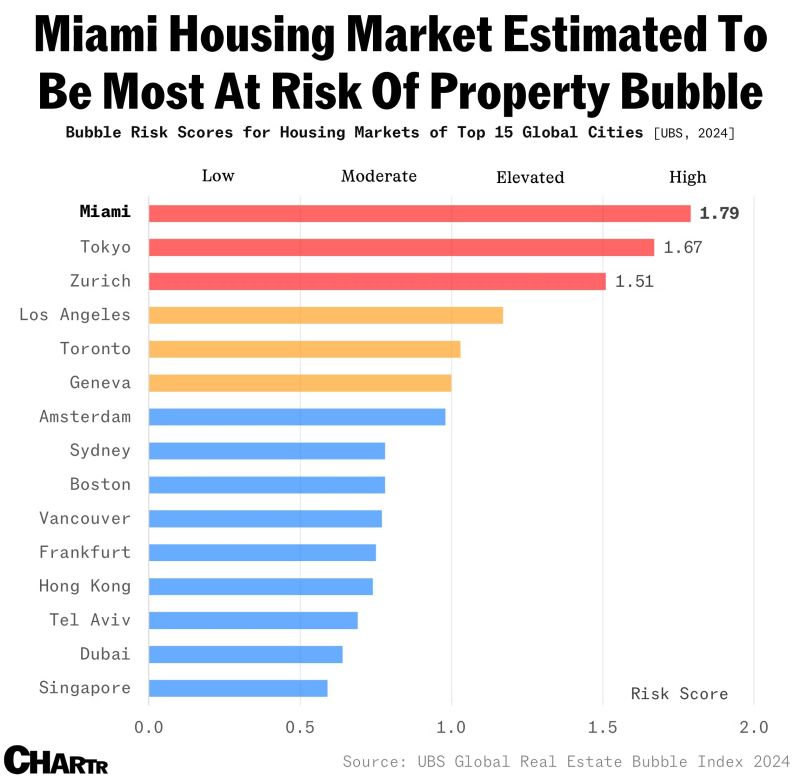

Miami tops a global list of cities most at risk of a housing bubble.

The annual UBS Global Real Estate Bubble Index for 2024, which analyzes residential property prices in 25 major cities worldwide, revealed that Miami’s soaring housing market had the highest bubble risk with an index score of 1.79 — beating Tokyo and Zurich for the top spot. Source: Chartr, UBS

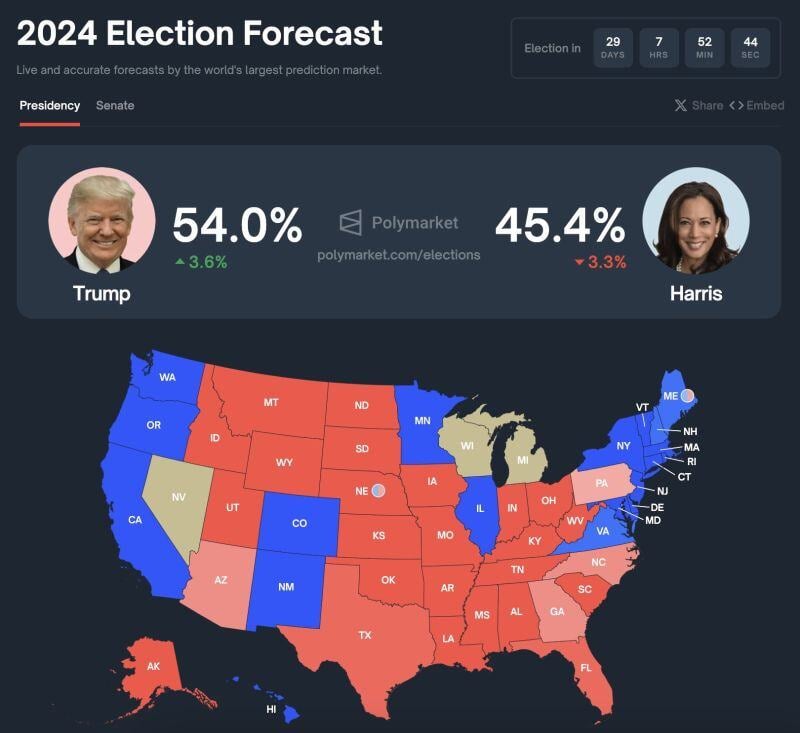

BREAKING: Polymarket’s prediction markets now show Donald Trump nearly 9 percentage points ahead of Kamala Harris.

This is nearly his largest lead since Kamala Harris entered the election. Source: The Kobeissi Letter on X

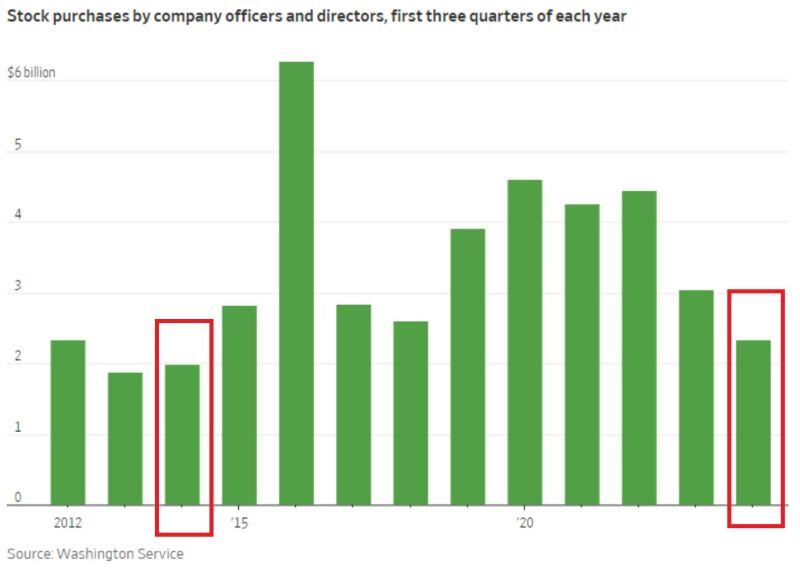

🚨 US INSIDERS ARE STOPPING BUYING THEIR COMPANIES' STOCKS🚨

US firms' executives purchased $2.3 billion worth of stock year-to-date, THE LEAST since 2010. To put this into perspective, during the COVID CRASH in 2020 they bought $1.3 billion in one month Source: Global Market Investors

$GOOGL's share of the U.S. search ad market is expected to drop below 50% next year for the first time in over a decade, according to eMarketer.

TikTok is already targeting ads based on search queries, and AI startup Perplexity, backed by Jeff Bezos, is planning to roll out ads soon. Meanwhile, Amazon, with a 22.3% share, continues to grow fast. The competition is heating up... Source: WSJ thru Wall Street Engine

Investing with intelligence

Our latest research, commentary and market outlooks