Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

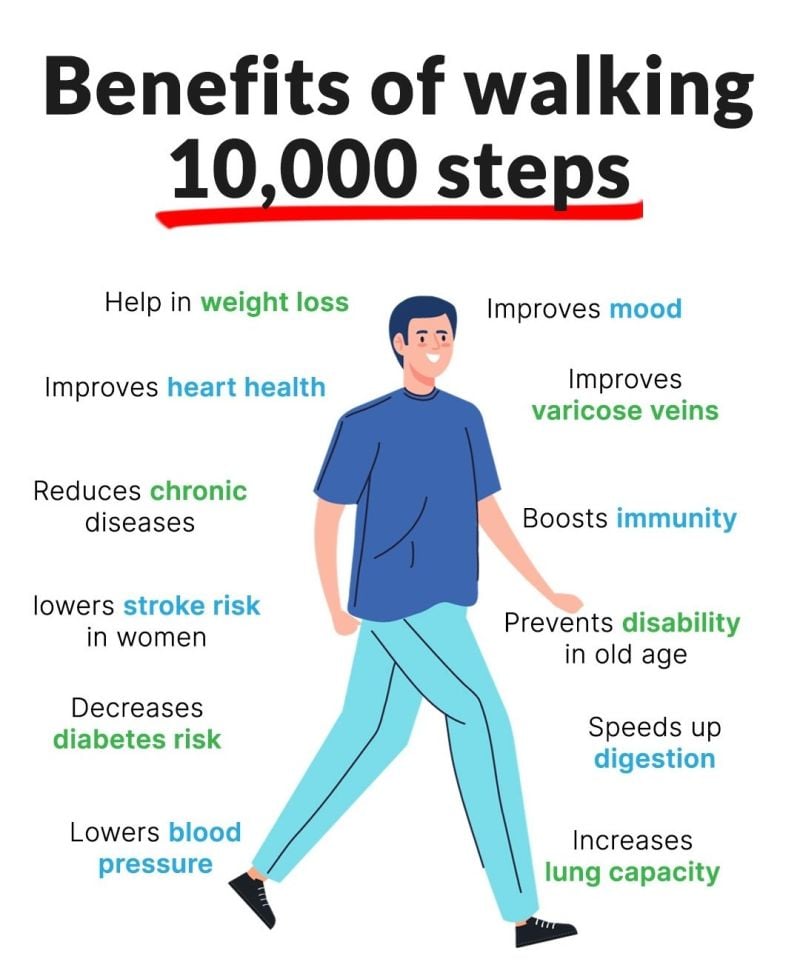

The importance of using the right media to reach your target audience

Source: Mom's Village Asia

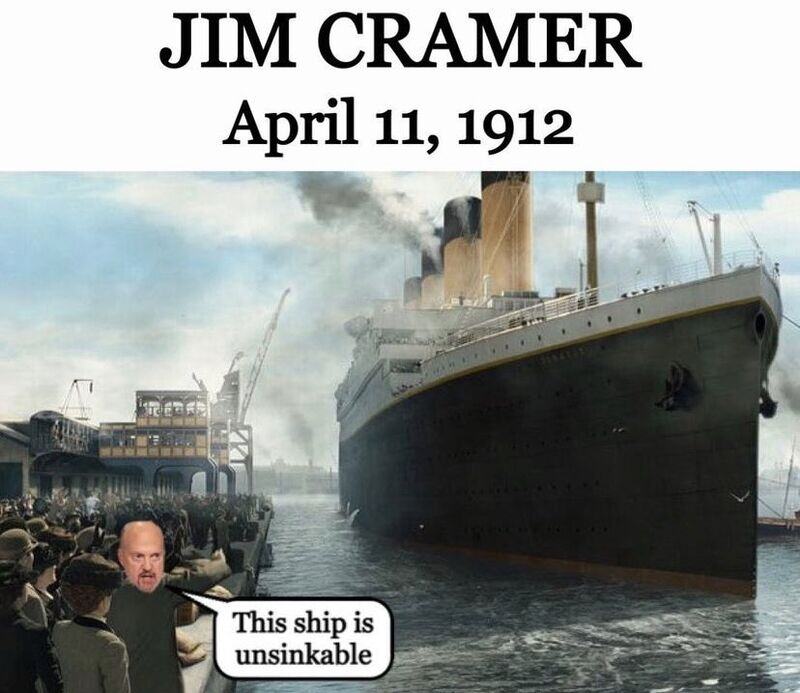

One of the most famous Jim Cramer meme

Source: Not Jerome Powell on X

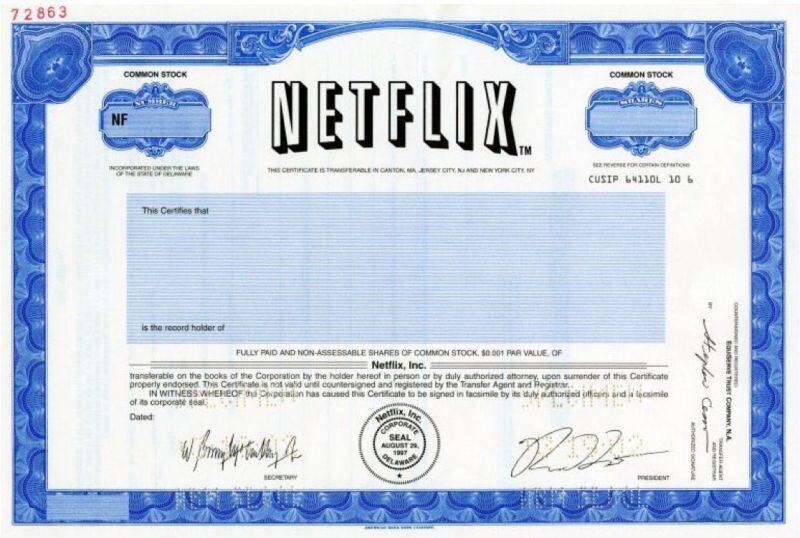

On this day in 2002: Netflix went public.

$2,000 invested in the IPO would be worth $1 million today. Source: Jon Erlichman

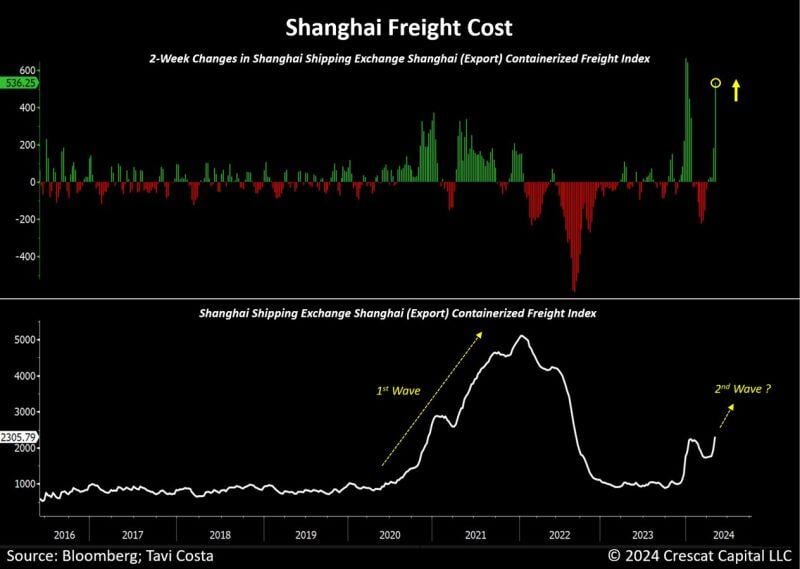

Shanghai and global freight costs are surging again.

We just experienced one of the steepest 2-week changes in history. Source: Tavi Costa, Bloomberg

Top Startup Cities in the World - San Francisco remains #1

Source: Barchart, Visual Capitalist, Pitchbook

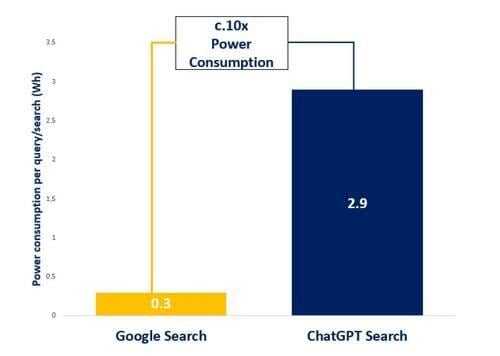

Emerson Electric CEO:

"AI data center racks consume significantly more power than traditional data centers with a search on ChatGPT consuming 6 to 10 times the power of a traditional search on Google" $EMR $GOOG $GOOGL $MSFT Source: The Transcript

Investing with intelligence

Our latest research, commentary and market outlooks