Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

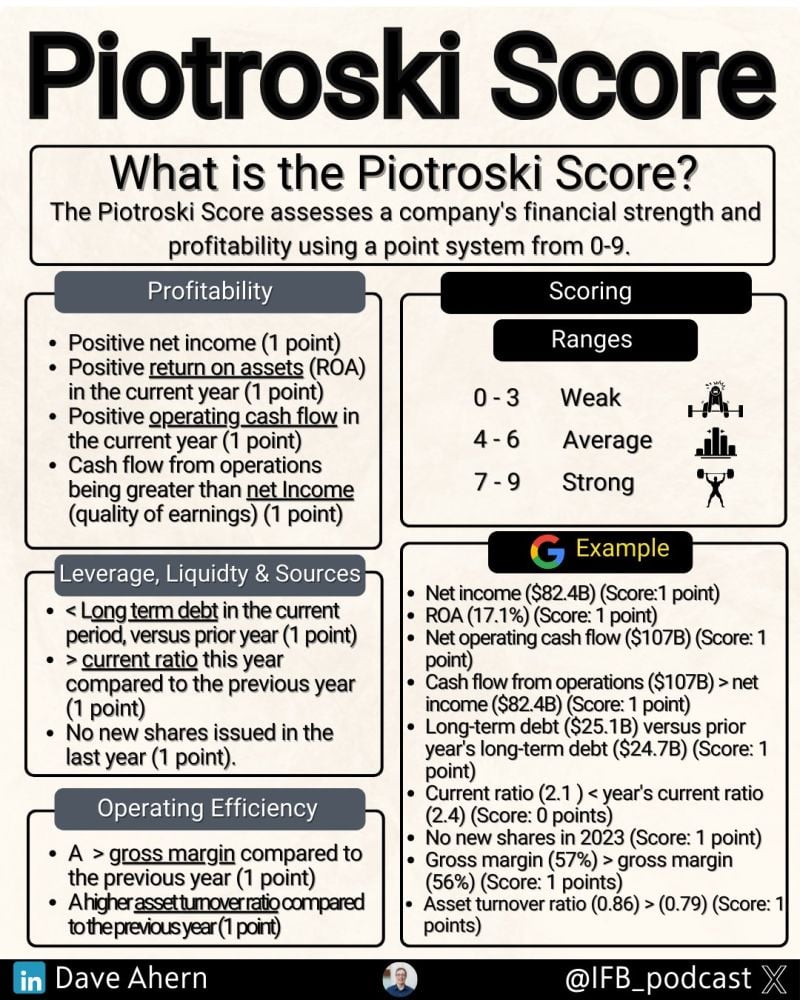

What is the Piotroski Score? It is a method of ranking the financial strength of a company

Using 9 questions, you can quickly determine the financial strength of Google or many others. Source: The Investing for Beginners Podcast

“Often times, the ones that are successful loved what they did so they could persevere when it got really tough”

- Steve Jobs

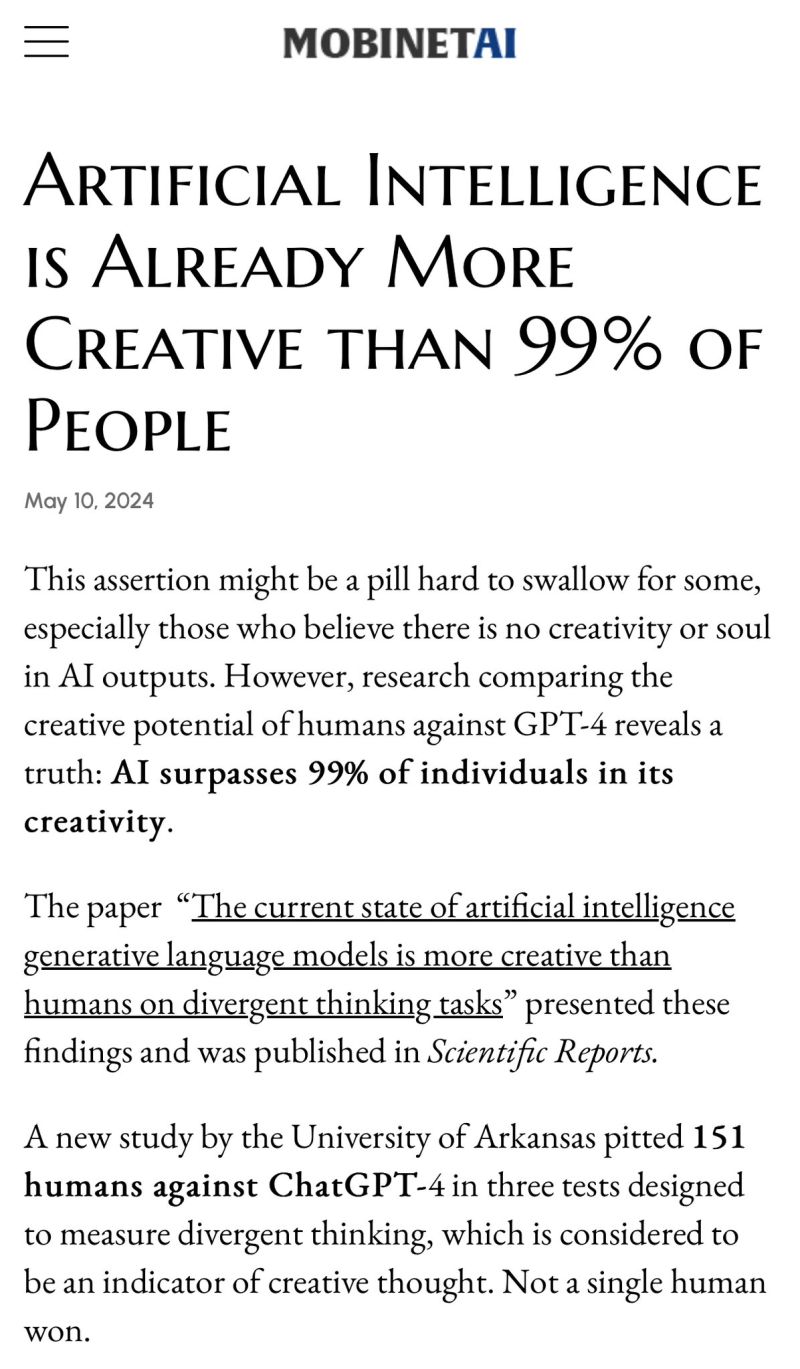

A new study by the University of Arkansas pitted 151 humans against ChatGPT-4 in three tests designed to measure divergent thinking, which is considered to be an indicator of creative thought

Not a single human won. Source: Jeremiah Owyang

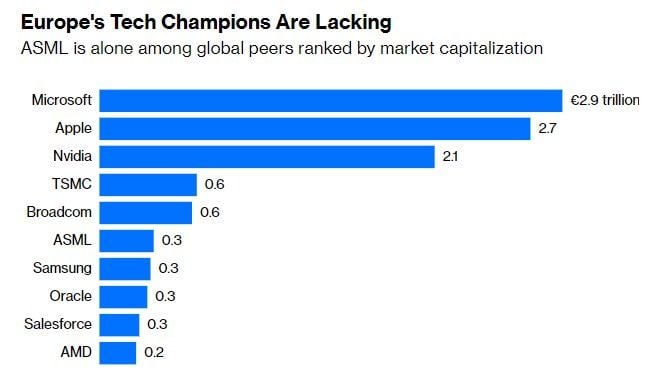

The issue with europe:

1) Over-regulation; 2) Too much bureaucracy: 3) Lack of hashtag#innovation. As shown below, Tech champions are lacking. Source: Bloomberg

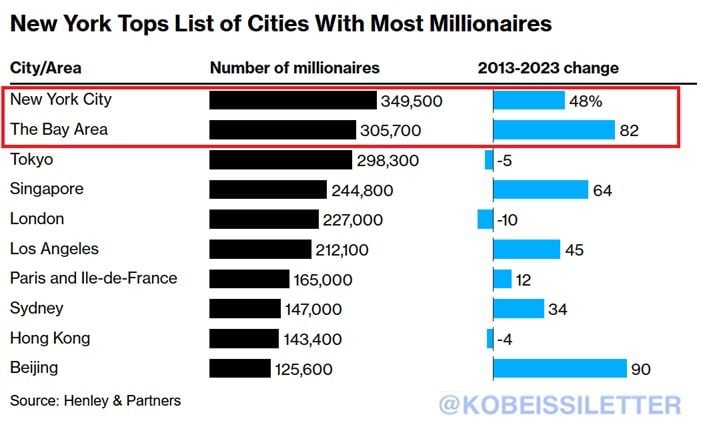

New York City now has 349,500 millionaires, more than any city in the world

Over the last decade, the number of millionaires in NYC has risen by a massive 48%. At the same time, in The Bay Area, the number of people with a seven-figure net worth has risen 82% to 305,700, the second-highest worldwide. This surge has been driven by a massive rally in financial markets and real estate prices. Meanwhile, 78% of Americans live paycheck to paycheck, according to the latest Payroll-org survey. The rich are getting richer at the fastest pace ever. Source: The Kobeissi Letter, Bloomberg

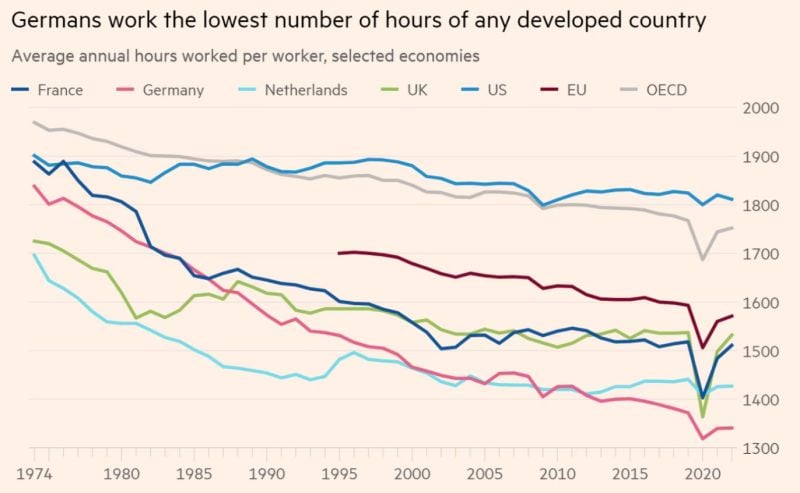

Germans already work much less than others, but German unions and some left politicians are seriously requesting move to four days workweek without pay cut

Source: FT, Michel A.Arouet

JUST IN: Vanguard appoints Salim Ramji as a new CEO, a former Blackrock’s Bitcoin ETF lead. Earlier, Vanguard refused to offer BTC ETF 👀

Trump now holds a 6.3 point lead on Biden and Republicans are now on top in the generic head to head. From @maximlott at https://lnkd.in/dT6EHQvp thru bespoke

Investing with intelligence

Our latest research, commentary and market outlooks