Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

“I don’t mind at all under current conditions building the cash position."

"When I look at what’s available in equity markets and the composition of what’s going on in the world, we find it quite attractive." - Warren Buffett

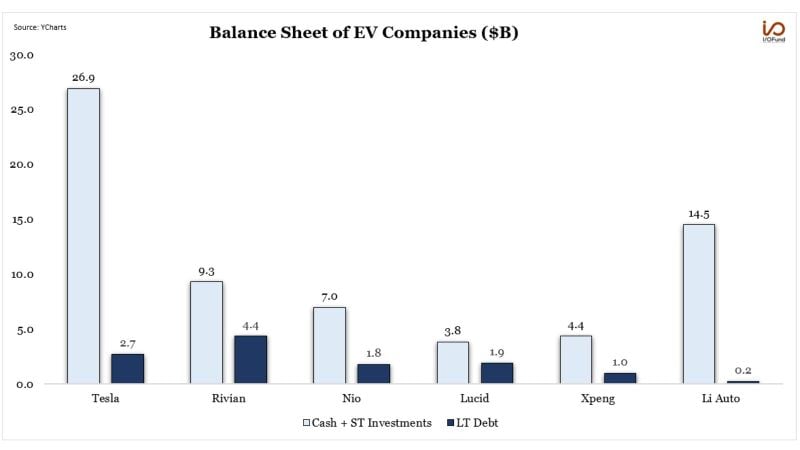

Electric vehicles companies are cash-rich...

Here’s a look at the cash vs. long-term debt for EV companies: $TSLA $RIVN $NIO $XPEV $LI Source: YCharts, Beth Kindig

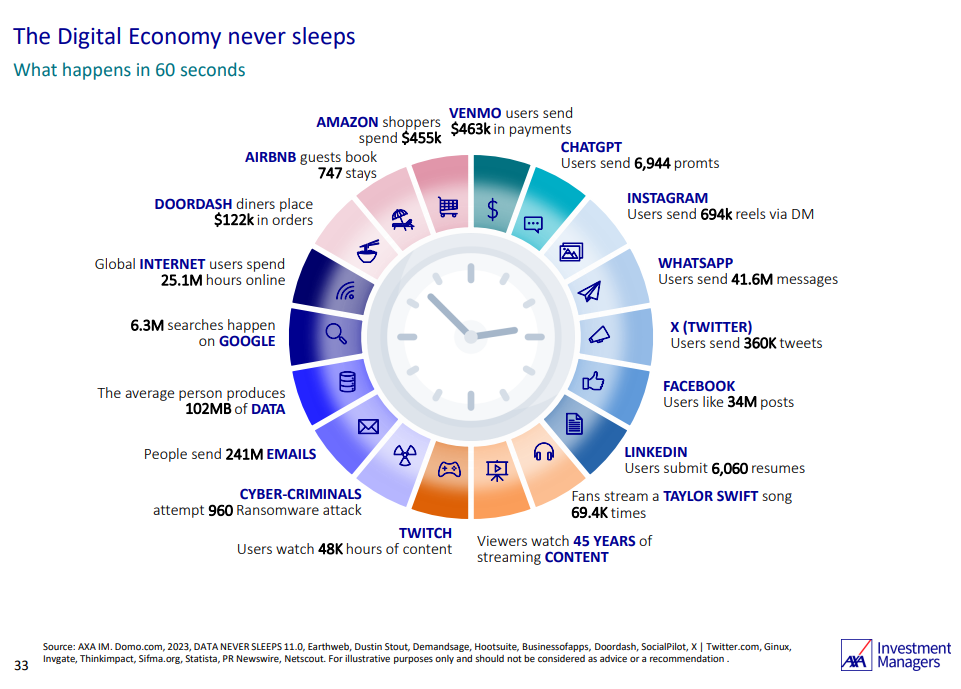

The digital Economy never sleeps

Source: AXA Investment Managers (2023 numbers)

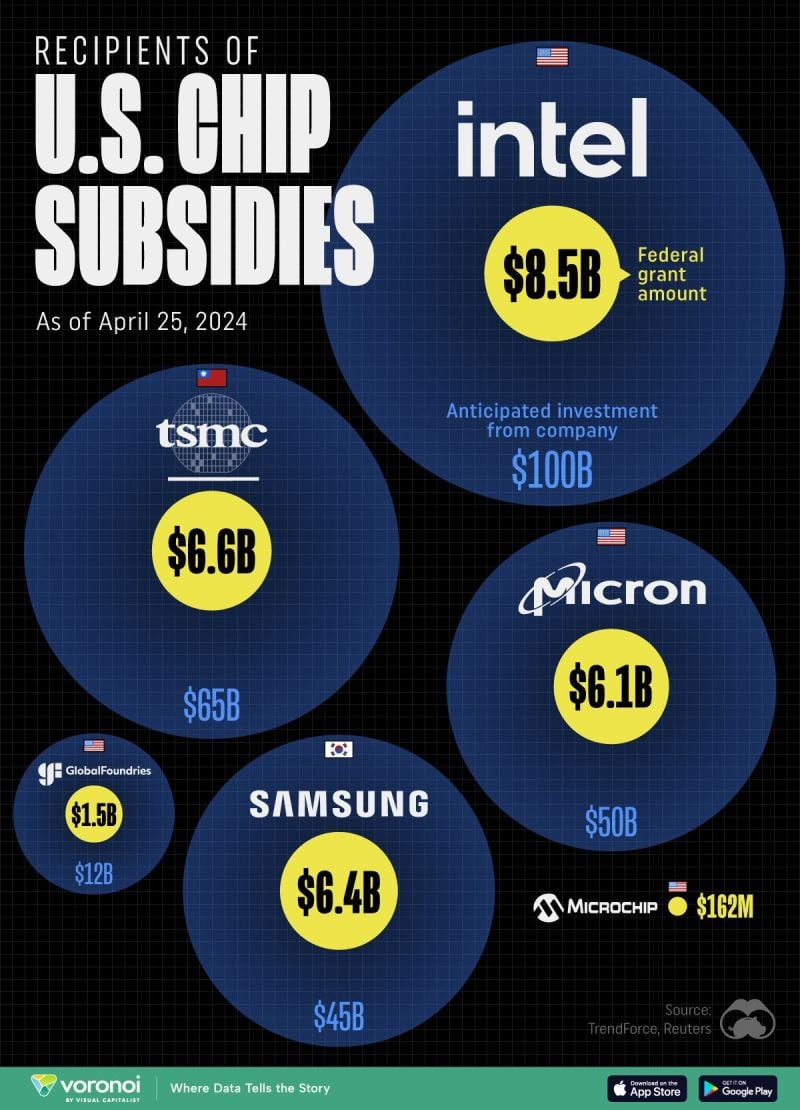

All of the Grants Given by the U.S. CHIPS Act 💻️

Source: Visual Capitalist

Investing with intelligence

Our latest research, commentary and market outlooks