Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Economic Growth Forecasts for G7 and BRICS Countries in 2024 🗺️

Source: knownquotes

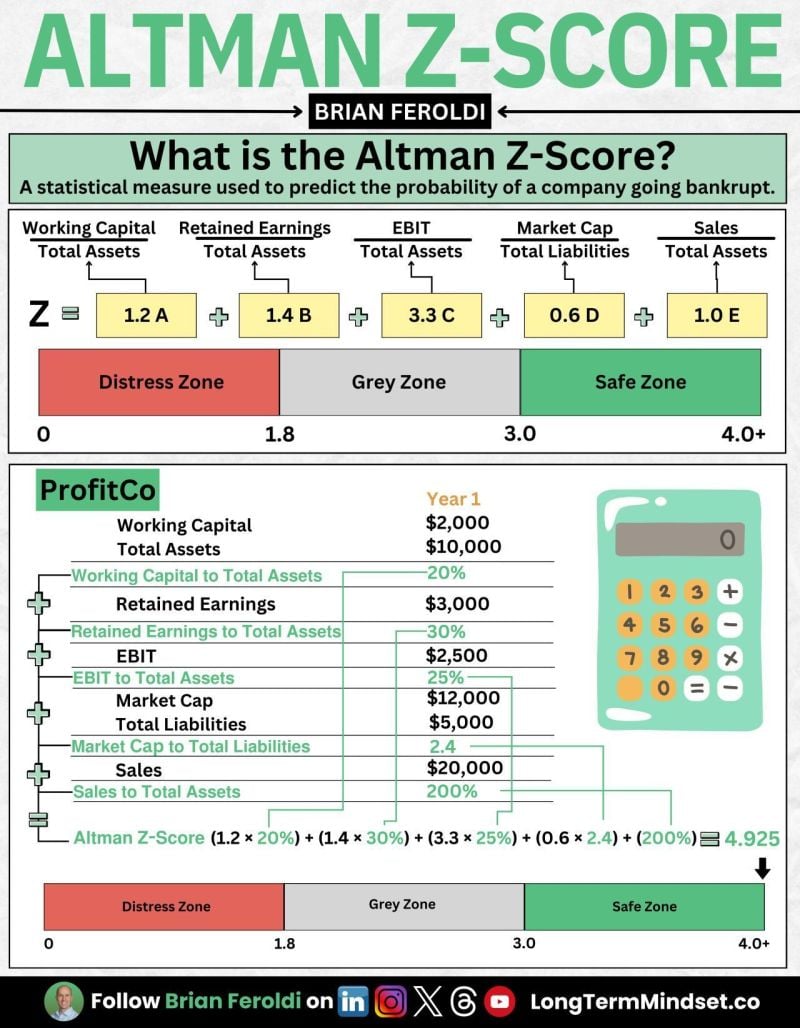

The Altman Z-score as explained by Brian Feroldi

The Altman Z-Score is a formula developed by Edward Altman in the 1960s. It is used to predict the likelihood of a company going bankrupt within two years. The Z-Score uses five different financial ratios to come up with a single number that measures the company's financial health. Altman Z-Score breaks down into five major components: • 𝗪𝗼𝗿𝗸𝗶𝗻𝗴 𝗖𝗮𝗽𝗶𝘁𝗮𝗹 𝘁𝗼 𝗧𝗼𝘁𝗮𝗹 𝗔𝘀𝘀𝗲𝘁𝘀 - A measure of 𝗹𝗶𝗾𝘂𝗶𝗱𝗶𝘁𝘆 • 𝗥𝗲𝘁𝗮𝗶𝗻𝗲𝗱 𝗘𝗮𝗿𝗻𝗶𝗻𝗴𝘀 𝘁𝗼 𝗧𝗼𝘁𝗮𝗹 𝗔𝘀𝘀𝗲𝘁𝘀 - A measure of 𝗽𝗿𝗼𝗳𝗶𝘁𝗮𝗯𝗶𝗹𝗶𝘁𝘆 • 𝗘𝗮𝗿𝗻𝗶𝗻𝗴𝘀 𝗕𝗲𝗳𝗼𝗿𝗲 𝗜𝗻𝘁𝗲𝗿𝗲𝘀𝘁 𝗮𝗻𝗱 𝗧𝗮𝘅𝗲𝘀 𝘁𝗼 𝗧𝗼𝘁𝗮𝗹 𝗔𝘀𝘀𝗲𝘁𝘀 - A measure of 𝗼𝗽𝗲𝗿𝗮𝘁𝗶𝗻𝗴 𝗲𝗳𝗳𝗶𝗰𝗶𝗲𝗻𝗰𝘆 • 𝗠𝗮𝗿𝗸𝗲𝘁 𝗩𝗮𝗹𝘂𝗲 𝗼𝗳 𝗘𝗾𝘂𝗶𝘁𝘆 𝘁𝗼 𝗧𝗼𝘁𝗮𝗹 𝗟𝗶𝗮𝗯𝗶𝗹𝗶𝘁𝗶𝗲𝘀 - A measure of 𝘀𝗼𝗹𝘃𝗲𝗻𝗰𝘆 • 𝗦𝗮𝗹𝗲𝘀 𝘁𝗼 𝗧𝗼𝘁𝗮𝗹 𝗔𝘀𝘀𝗲𝘁𝘀 - A measure of 𝗮𝘀𝘀𝗲𝘁 𝘁𝘂𝗿𝗻𝗼𝘃𝗲𝗿 𝗛𝗲𝗿𝗲'𝘀 𝗮 𝗯𝗿𝗲𝗮𝗸𝗱𝗼𝘄𝗻 𝗼𝗳 𝘁𝗵𝗲 𝗳𝗼𝗿𝗺𝘂𝗹𝗮: (1.2 × Working Capital/Total Assets) + (1.4 × Retained Earnings/Total Assets) - (3.3 × EBIT/Total Assets) + (0.6 × Market Value Equity/Total Liabilities) - (1.0 x Sales/Total Assets) = Altman Z-Score Altman Z-Score RESULTS: 0.0 - 1.8 = Distress Zone 1.8 - 3.0 = Grey Zone 3.0 - 4.0+ = Safe Zone

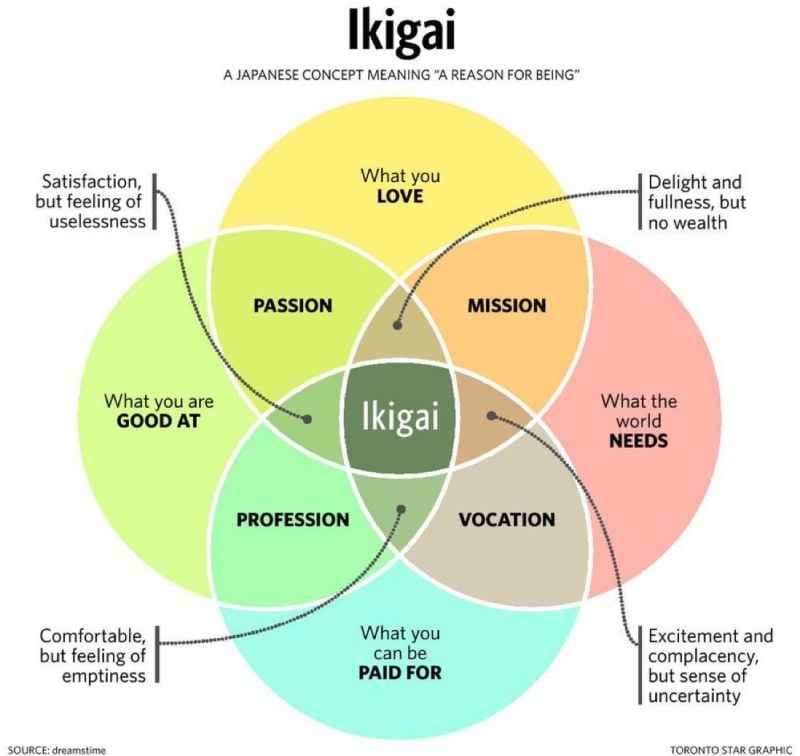

The Japanese secret to a long, happy and meaningful life: Ikigai

Ikigai: passion | mission | vocation | profession • What you love • What you are good at • What the world needs • What you can get paid for Source: Vala Afshar, Dreamstime

"The solid sales growth in the first quarter reflects the loyalty of our clients worldwide"

- Axel Dumas, Executive Chairman of Hermès $RMS Q1 2024 revenue growth by business line: Source: Quartr

Europeans ‘less hard-working’ than Americans, says Norway oil fund boss Tangen finds US investments more attractive due to weaker regulations and more risk-taking >>>

Europe is less hard-working, less ambitious, more regulated and more risk-averse than the US, according to the boss of Norway’s giant oil fund, with the gap between the two continents only getting wider. Nicolai Tangen, chief executive of the $1.6tn fund, told the Financial Times it was “worrisome” that American companies were outpacing their European rivals on innovation and technology, leading to vast outperformance of US shares in the past decade. His views are significant as the oil fund is one of the largest single investors in the world, owning on average 1.5 per cent of every listed company globally and 2.5 per cent of every European equity. Its US holdings have increased in the past decade while its European ones have declined. US shares account for almost half of all its equities compared with 32 per cent in 2013. The leading European country — the UK — represented 15 per cent of its equity portfolio a decade ago but just 6 per cent last year. Source: FT

Life is too short to spend a third of it doing something that makes you unhappy.

Find joy in what you do, and work won’t feel like work anymore. Source: Corporate Rebels

Investing with intelligence

Our latest research, commentary and market outlooks