Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Amazing, isn’t it? No wonder Ferrari stock has been going parabolic since IPO

Source: Michel A.Arouet

"I’d be a bum on the street with a tin cup if the markets were always efficient.” - Warren Buffett

Source: MastersInvest.com

THIS IS VERY FASCINATING:

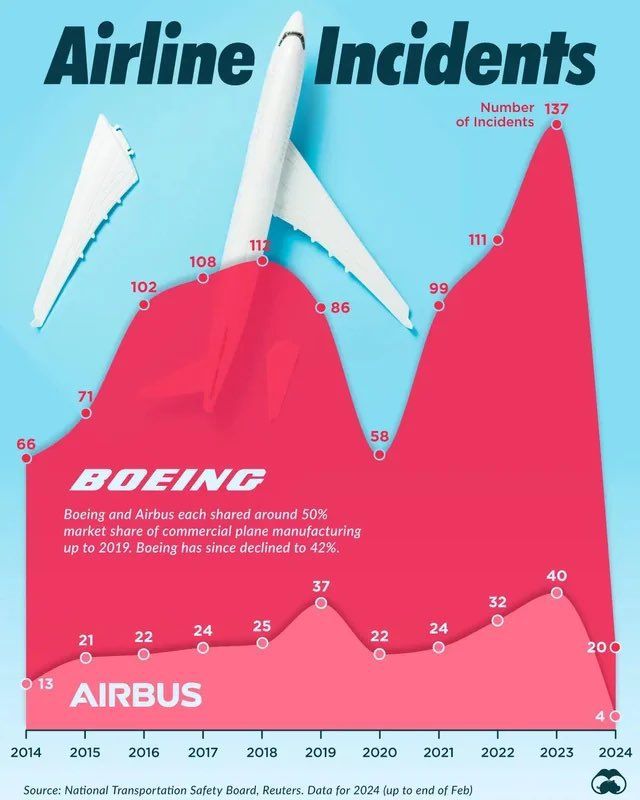

BOEING AND AIRBUS EACH HAVE AROUND A 50% MARKET SHARE BUT BOEING PLANES HAVE ALMOST 4 TIMES MORE “INCIDENT’S” THAN AIRBUS PLANES Source: Gurgavin, Visual Capitalist

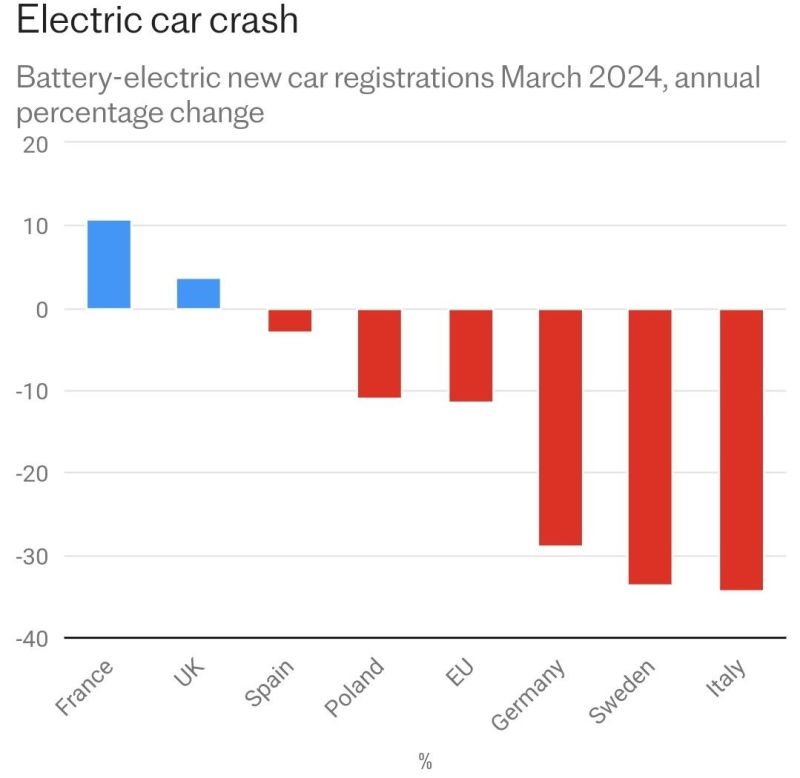

An electric vehicle car crash?

As shown below, Battery-electric new car registrations (March 2024, yoy) are crashing in most European countries. Source: Michael A.Arouet

The problem with the world is that fools and fanatics are alwyas so certain of themselves, and wiser people so full of doubts

Source: Charlie Munger Fans

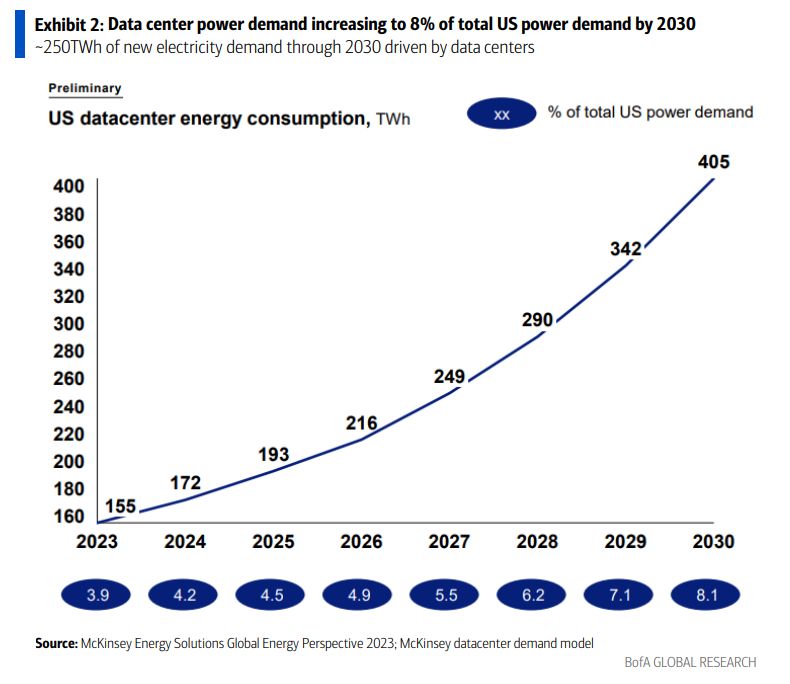

Data center power demand will 2x to 8% of total US power demand by 2030

Source: Mike Zaccardi, McKinsey

MUST READ: Mario Draghi, who is writing a report on how to revive the European economy at the request of Brussels, shares “the design and the philosophy” of his forthcoming report.

https://lnkd.in/emkyzQCN Source: Javier Blas

Investing with intelligence

Our latest research, commentary and market outlooks