Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

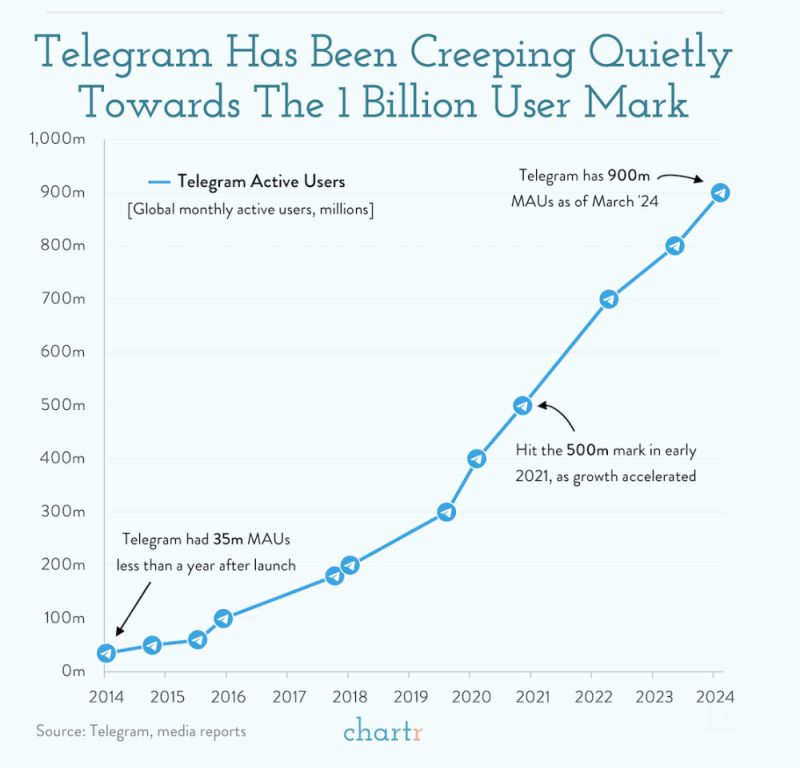

Telegram, a global social media and messaging giant that only ~1 in 4 Americans are actually familiar with, has just reached 900 million monthly active users globally.

Despite its relatively low profile in the US, the platform has been making waves in other countries since its launch in 2013 — largely thanks to its apparent emphasis on privacy and security, which has helped it notch hundreds of millions of downloads in India, parts of South America, and Russia, where the app was originally founded. Telegram is many things to many people. It’s a place to joke with friends; a means for freedom fighters to arrange protests; a valuable outlet to get news to readers where media is censored… but, it’s also a place where people go to buy guns, drugs, fake bank cards, and was (or maybe still is) a major platform for terror groups to organize and spread information on. Source: Chartr

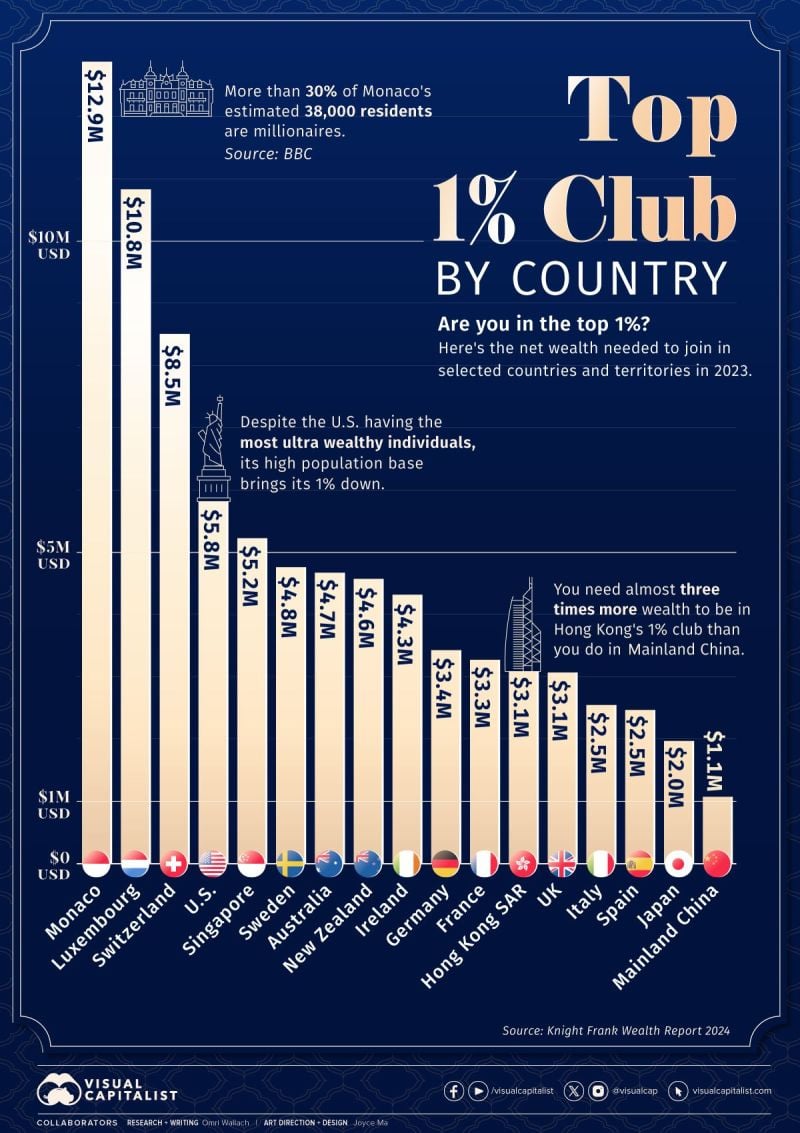

Wealth Needed to Join the Top 1%, by Country

https://lnkd.in/ggijSHbK Source: Visual Capitalist

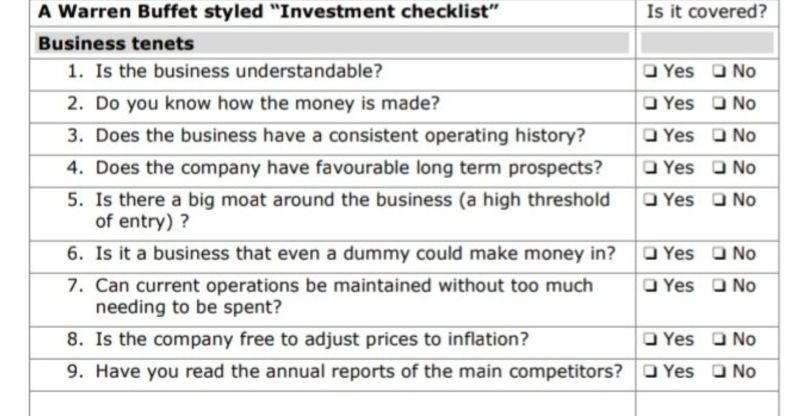

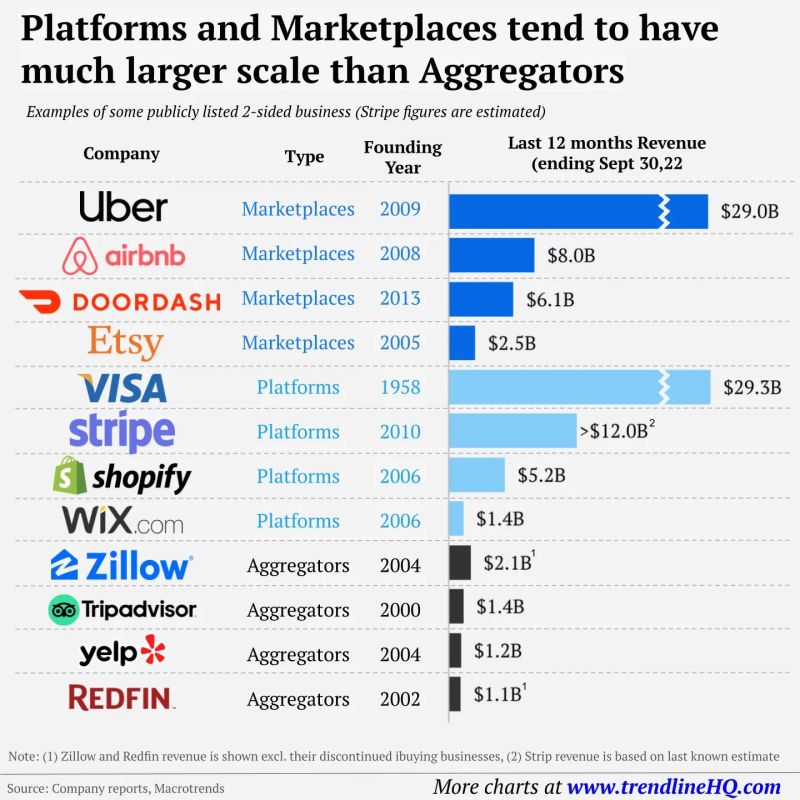

What's the difference between a marketplace, an aggregator, and a platform? A lot...

Source: CJ Gustafson

Don't fall in love with success, fall in love with the habits that bring success

Source: Succeeded Mind

This chart by Quartr illustrates the brands within 12 of the largest consumer brand conglomerates in the world.

$NESN $PEP $PG $ULVR $KO $MDLZ $BN.PA $KHC $ABF.L $GIS $CL

Investing with intelligence

Our latest research, commentary and market outlooks