Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

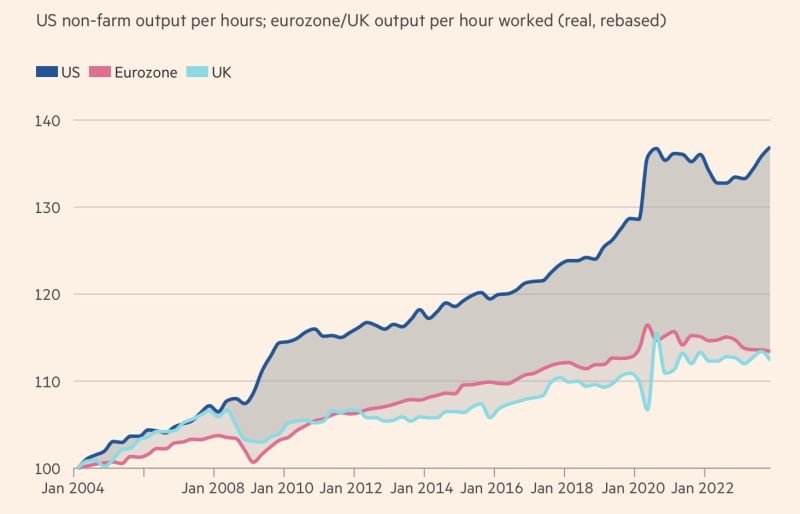

The US has not only much stronger demographics than Europe, but also better productivity growth.

Would you prefer to put your long-term investments into Euro or US Dollar? Source: FT, Michel A.Arouet

How do you make your money work while you're sleeping?

Source: Markets & Mayhem

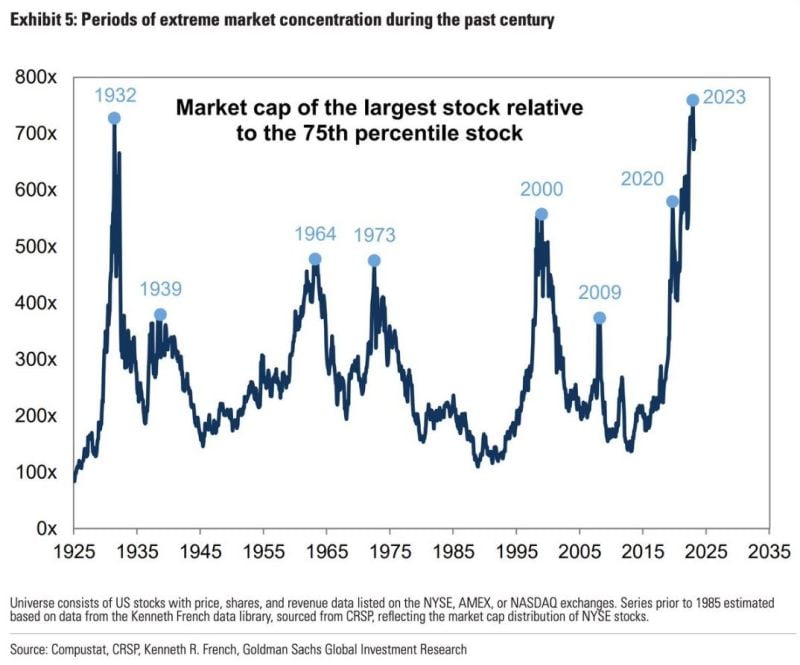

It's starting to feel a bit more crowded

Source: mayhem4markets

Happy international womens day 2024

"In the future, there will be no female leaders. There will just be leaders." Sheryl Sandberg This quote by Sheryl Sandberg, the former COO of Facebook, is about advocating for gender equality in leadership positions. She is proposing a future where gender is not a factor in determining leadership potential, and where people are simply judged on their merits and qualifications. Source: UK Artificial Intelligence

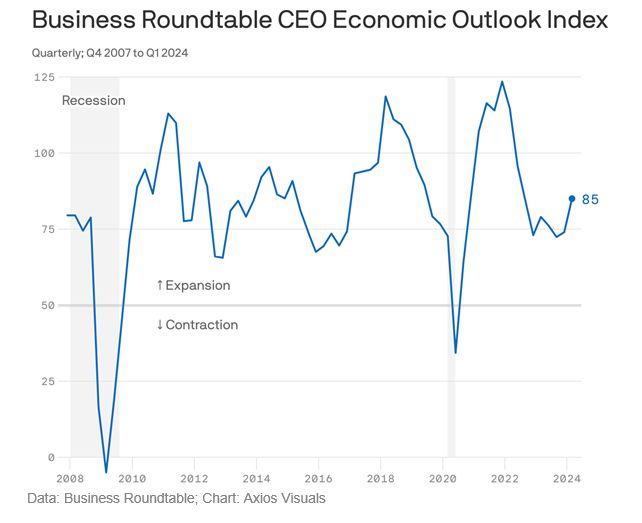

CEOs' economic outlook is surging

America's top executives are strikingly more confident about the economy, with expectations of stronger sales and capital investments. For the first time in two years, the Business Roundtable's quarterly gauge of CEO sentiment is above its historical average. By the numbers: The lobbying group's index jumped by 11 points in the first quarter to 85 — topping the long-running average by 2 points. source : axios

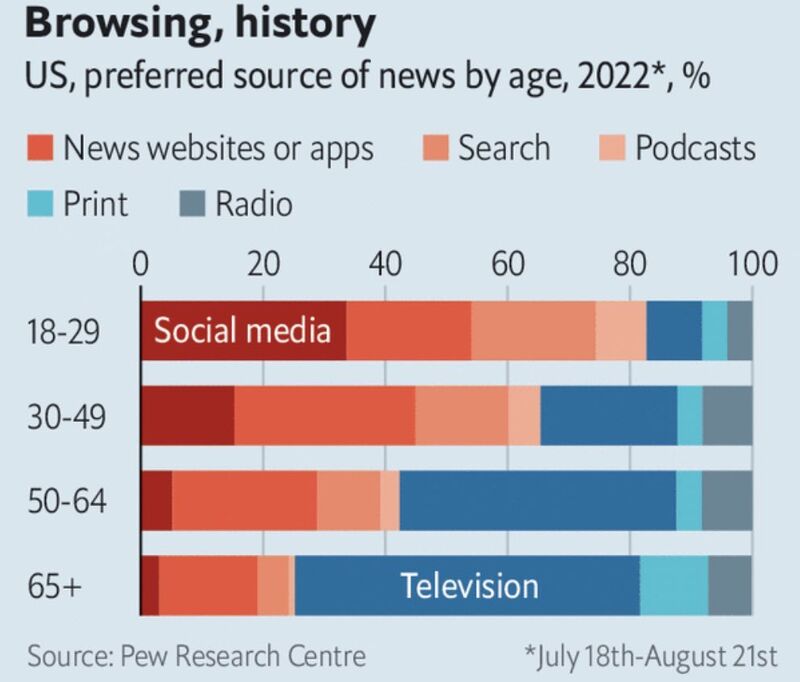

Television will eventually follow the path of print newspapers and slowly disappear.

My daughter and most of her friends don’t even have a TV-set anymore. Those who control social media will accumulate enormous political power as we go forward. Source: Michel A.Arouet

Investing with intelligence

Our latest research, commentary and market outlooks