Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

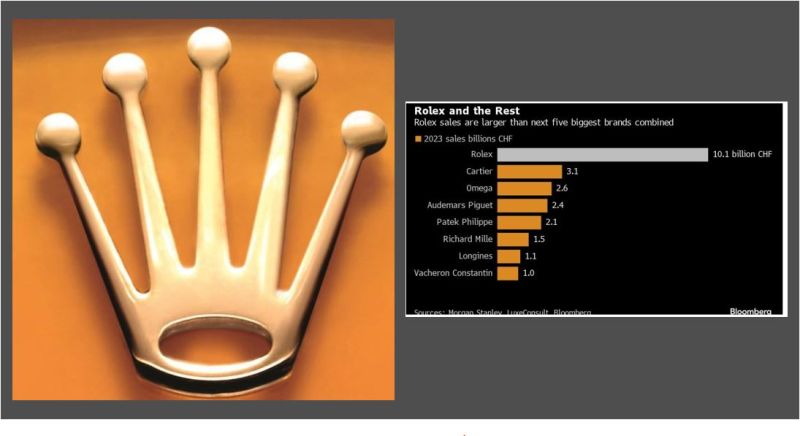

Rolex Sales Reach $10 Billion for the First Time: Report

Rolex sales crested $10 billion for the first time as the top Swiss watch brand gained market share, according to a report by Morgan Stanley. The dominant Swiss luxury watch brand produced 1.24 million watches in 2023 with sales of 10.1 billion Swiss francs ($11.5 billion). That’s a gain of 11% from 2022, analysts at Morgan Stanley and Swiss firm LuxeConsult said in a report Wednesday, adding Rolex’s current level of market share is “unprecedented.” The maker of the Daytona, Submariner and Datejust models grew its retail market share to just over 30% as well-heeled buyers clamored for watches made by the Geneva-based entity, which is controlled by a charitable trust named for Hans Wilsdorf, who co-founded the brand in 1908. The lower priced Tudor watch brand, which is owned by the same foundation as Rolex, had sales of about 545 million francs in 2023, according to Morgan Stanley estimates. source : bloomberg, morgan stanley

The World’s Biggest Fashion Companies by Market Cap 👔

Source: Visual Capitalist

Buffett's longest held stocks:

$KO - 34 years $AXP - 29 years $MCO - 22 years $GLBE - 22 years $PG - 18 years He has returned 20% CAGR since 1965. Source: The Investing for Beginners Podcast

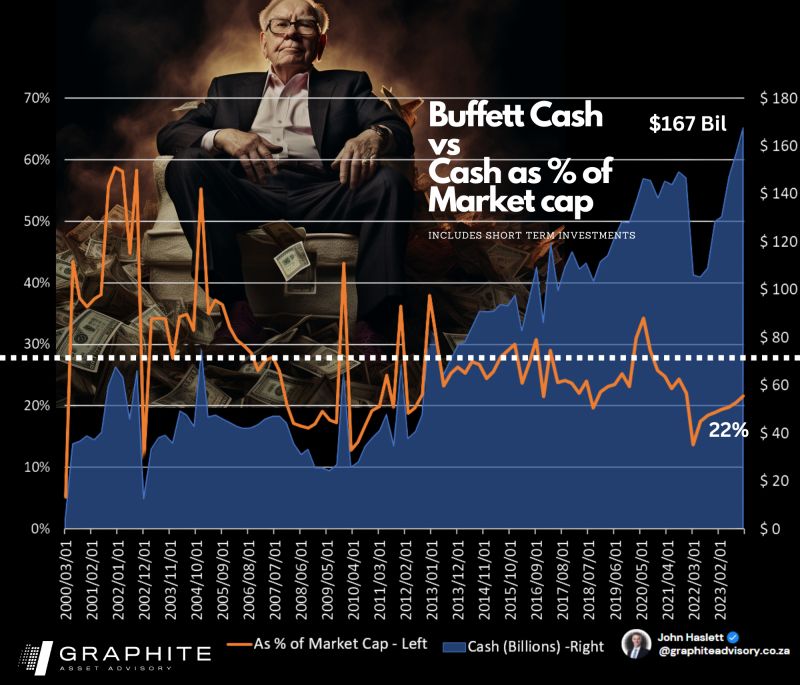

𝗕𝘂𝗳𝗳𝗲𝘁𝘁'𝘀 𝗖𝗮𝘀𝗵 𝗕𝗼𝗻𝗮𝗻𝘇𝗮 𝗡𝗼𝘁 𝗮𝘀 𝗕𝗶𝗴 𝗮𝘀 𝗬𝗼𝘂 𝗧𝗵𝗶𝗻𝗸 💰

While Berkshire Hathaway is hoarding a record-breaking $167 billion cash pile, it accounts for just 22% of the market cap, trailing the 𝗵𝗶𝘀𝘁𝗼𝗿𝗶𝗰𝗮𝗹 𝟮𝟳% 𝗮𝘃𝗲𝗿𝗮𝗴𝗲 the last 23 years. Source: John Haslett, CA(SA), FRM

BREAKING: A strong intraday reversal by apple stock $AAPL

After they announced they have CANCELLED their work on designing an electricvehicule to focus on artificialinteéligence.

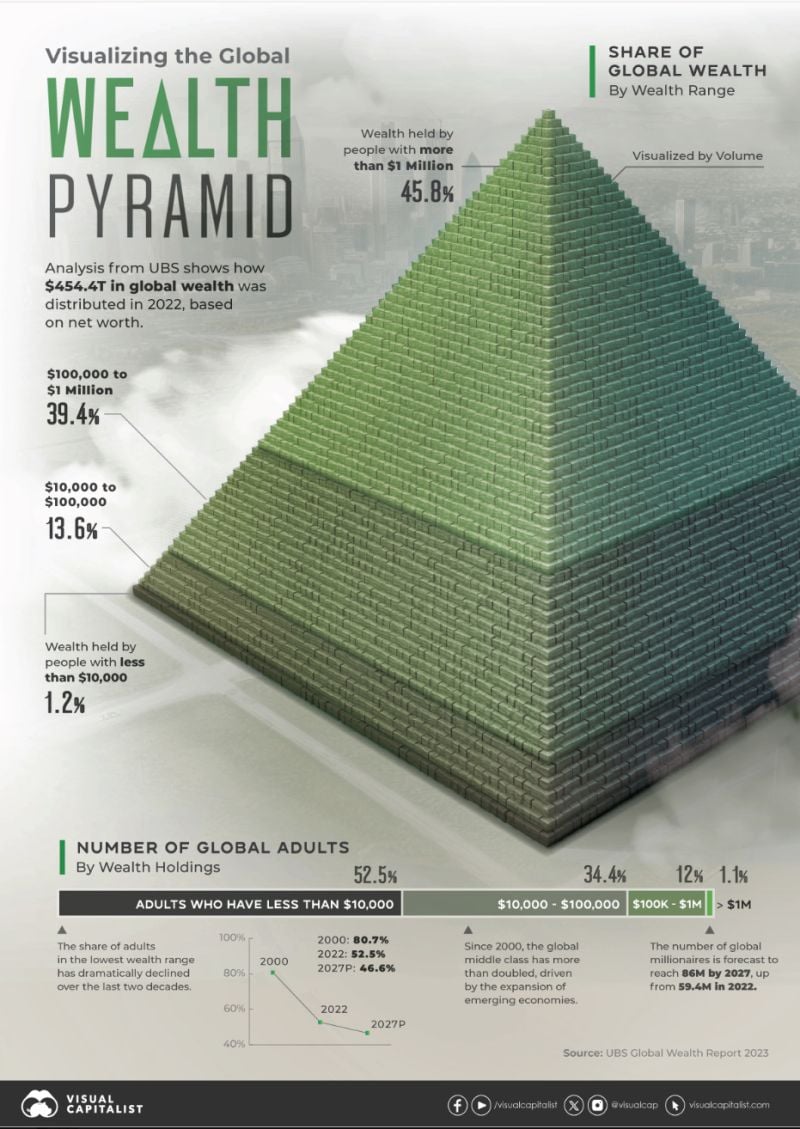

A nice visual by Visual Capitalist.

There's $450 Trillion in Global Wealth. There are 60 million millionaires. Forecast to be 86 million millionaires by 2027. The number of people in the lowest wealth range has fallen dramatically. The middle class doubled since 2000. https://lnkd.in/eVpj_Uk8

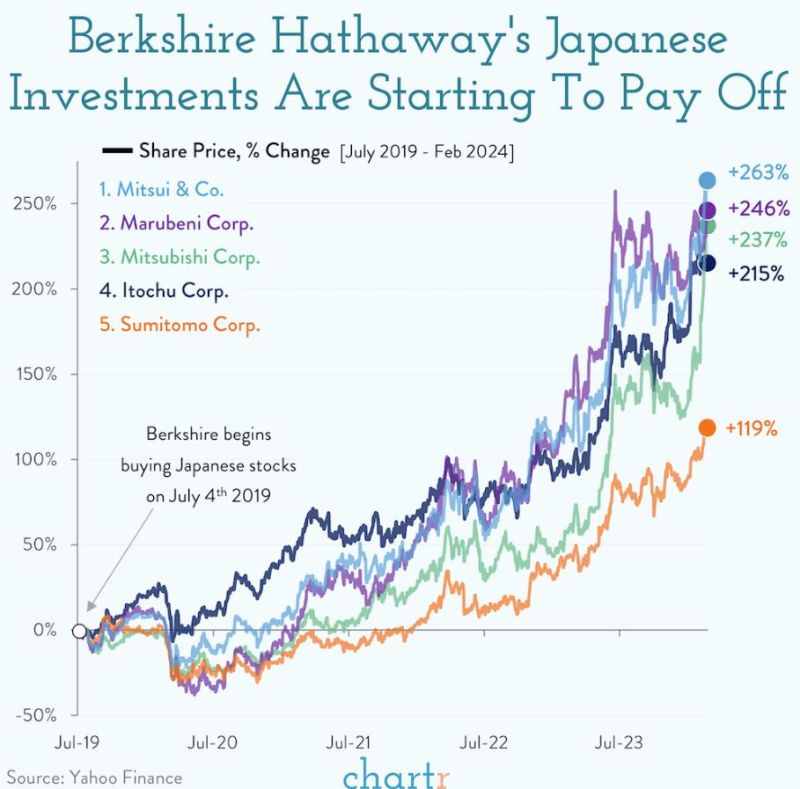

Berkshire Hathaway's Japanese Investment Are Starting To Pay Off

Source : chartr, yahoofinance

Investing with intelligence

Our latest research, commentary and market outlooks