Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

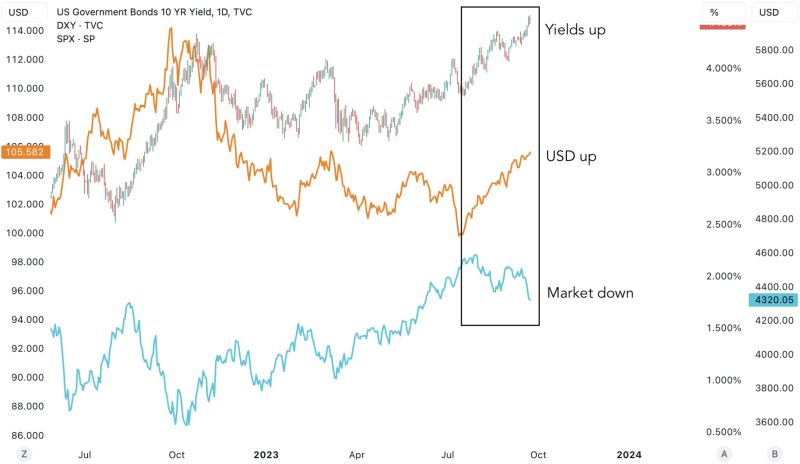

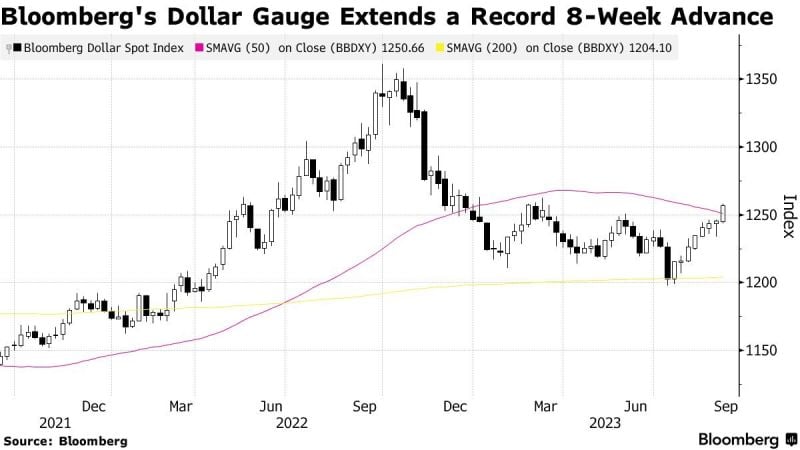

Markets summarized in one chart: Yields up, USD up and Equities down

Source: Game of Trades

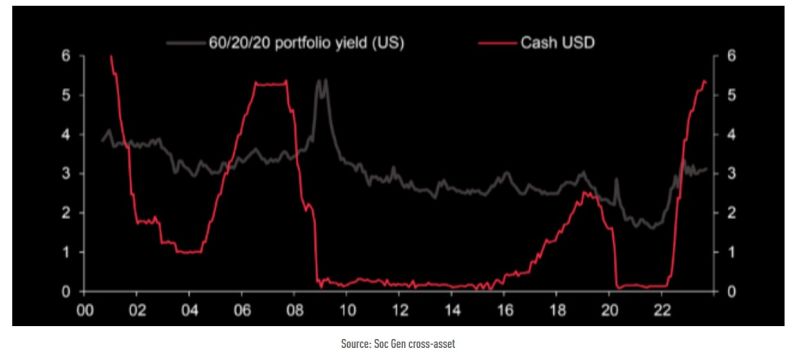

The attractiveness of cash in a multi-asset portfolio (%)

Source: SG, TME

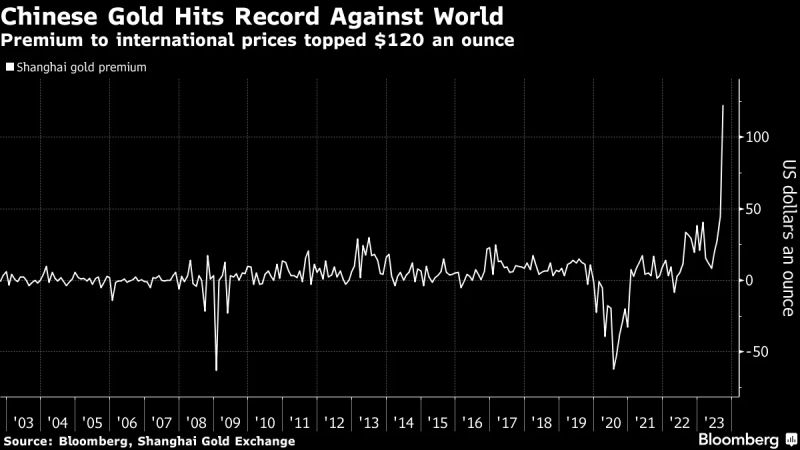

China Gold Premium to the rest of the world hit a new record of $120 an ounce as Beijing defends yuan

Gold in China is trading at a record premium to international prices, a sign of Beijing’s escalating battle to defend its currency. Bullion on the Shanghai Gold Exchange traded at a premium of more than $120 an ounce on Thursday, according to calculations by Bloomberg. That’s the highest since the exchange was founded over two decades ago, as a weak yuan drove up prices in recent weeks. Source: Bloomberg

EURUSD pair continues a bearish trend after ECB hike

EURUSD stays on a rather bearish EUR bullish USD trend which wasn’t helped by today’s ECB decision to increase rates by another 25bps. Shortly after the ECB’s announcement, US PPI came out slightly higher than expected which led the pair to reach a low of 1.0656 before stabilizing around 1.0675.

Support: 1.0650, 1.0605, 1.0560

Resistance: 1.0720, 1.0770, 1.0810

Source: Bloomberg

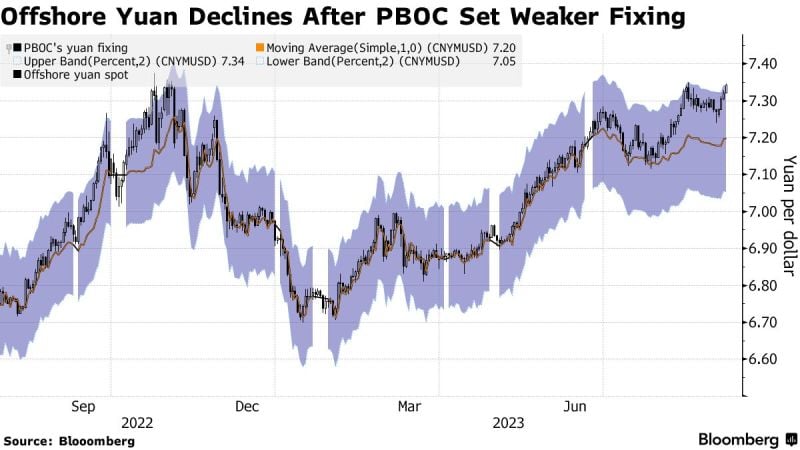

China Budges in Fight With Bears, Sending Yuan Toward Record Low – Bloomberg

The offshore yuan weakened toward its lowest on record against the dollar, as a cut to the daily reference rate for the managed currency stoked bets China is comfortable with a gradual depreciation. China’s currency declined to about 7.36 per dollar in overseas trading, beyond the psychologically important level of 7.35 and close to the weakest since the creation of the offshore yuan market in 2010. The move came after the People’s Bank of China set its so-called fixing at a two-month low on Friday.

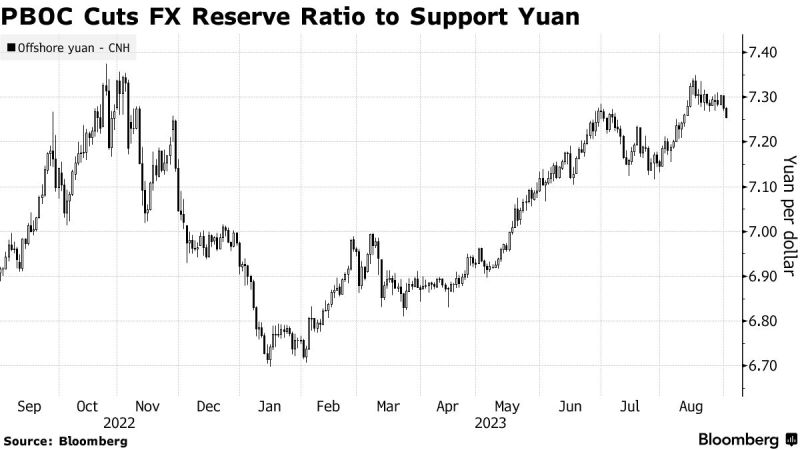

China Uses Another Tool to Aid Yuan in String of Market Support – Bloomberg

China moved to support the yuan by increasing the supply of foreign currency in its local market, part of a multi-pronged effort by Beijing to restore confidence amid sluggish growth. Financial institutions will need to hold just 4% of their foreign-exchange deposits in reserve starting Sept. 15, the People’s Bank of China said Friday, compared to the current level of 6%. The greater availability of overseas currency relative to the yuan effectively boosts the allure of the latter. The so-called FX RRR cut came on the heels of Thursday’s reduction in down payments for mortgages to help the country’s under-pressure residential property market and after policymakers lowered stamp duty for stock trading over the weekend. The combination of supportive measures is a sign that Beijing is growing uncomfortable with increasing pessimism in its financial markets.

Investing with intelligence

Our latest research, commentary and market outlooks