Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

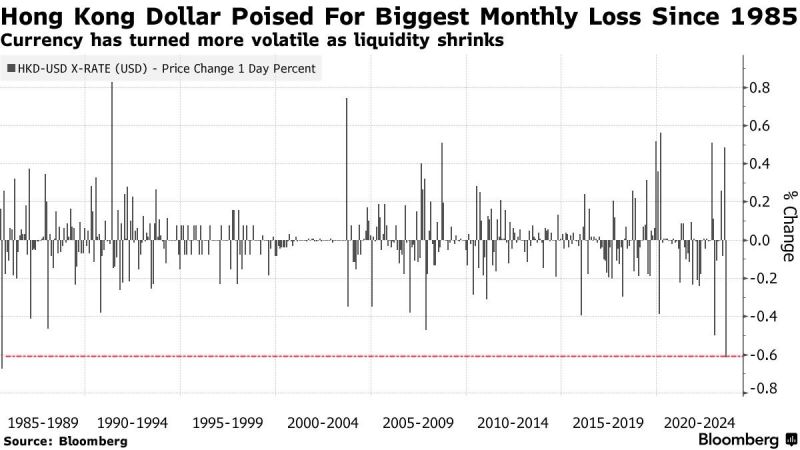

Hong Kong Dollar is on track for its biggest monthly loss against the US Dollar in 38 years

source: Bloomberg, Barchart

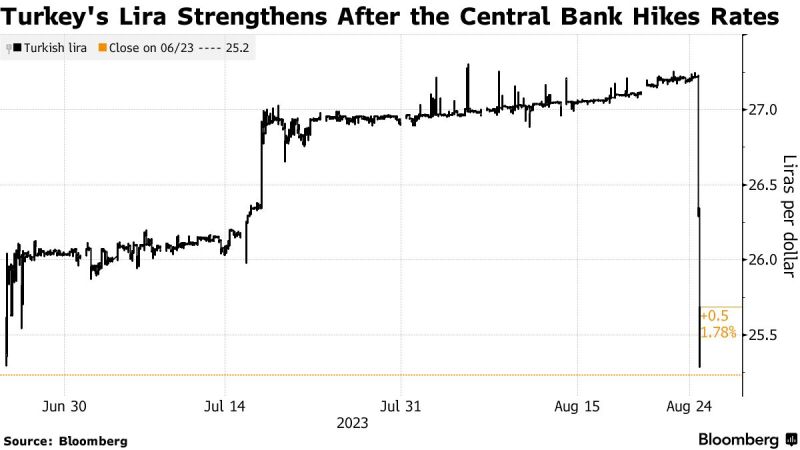

Lira Rallies as Turkey stuns with biggest rate hike in years

The central bank raises benchmark rate by 750 basis points. Turkish currency surges more than 5% against the dollar. The Monetary Policy Committee, under Governor Hafize Gaye Erkan, raised the benchmark one-week repo rate to 25% from 17.5%, the sharpest increase since 2018. Most economists polled by Bloomberg predicted a hike to 20%. It’s the latest indication that Turkey’s new administration is prepared to move away from the unorthodox policies — including ultra-loose borrowing costs — that were championed by President Recep Tayyip Erdogan but caused foreign traders to flee the country’s bond and stock markets en masse. Source: Bloomberg

The PBoC is putting more measures in place to slow the depreciation trend in the yuan

Overnight, the Chinese central bank set its yuan fixing at 7.2006 per dollar compared to the average estimate of 7.3047. The gap - an unprecedented 1,041 pips - was the largest gap to estimates since the poll was initiated in 2018. Source: Bloomberg, zerohedge

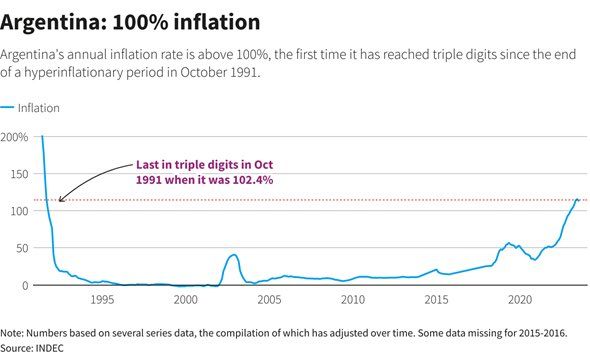

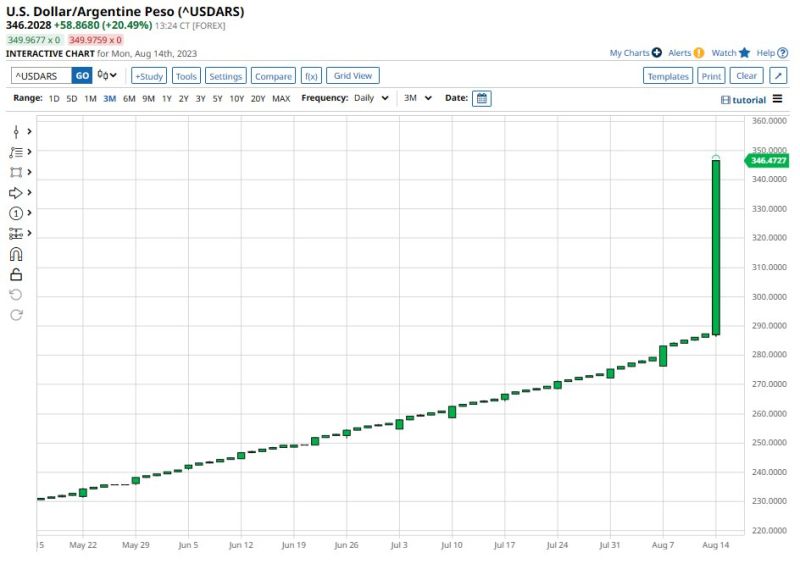

Unprecedented times in Argentina

- On Monday, Argentina’s central bank raised interest rates to 118%. - Forex: you now get a record 350 Argentine Pesos for each US Dollar. - Argentina 30-year mortgage is now at a record 82.2%. - For the first time since 1991, their inflation rate is above 100%. Source: The Kobeissi Letter

Argentine Peso having a rough day. An 18% devaluation to 350 pesos per dollar (chart) accompanied by a 21 percentage point hike in interest rates to 118% …

Source: Barchart

The Euro is now overvalued against the Dollar for the 1st time in 2 years, says the Big Mac index.

Source: The Economist

Investing with intelligence

Our latest research, commentary and market outlooks