Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

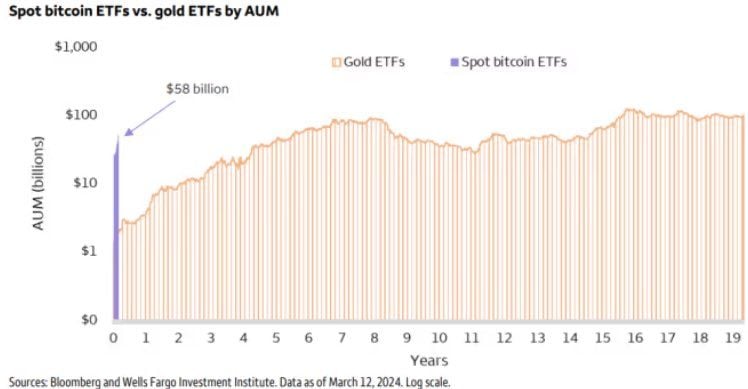

Why are gold and digital gold (aka bitcoin) rallying?

Sometimes one chart is worth a thousand words... As explained by Tavi Costa, If easing monetary conditions with inflation re-accelerating is the next move, then this is probably the most compelling setup to own hard assets (and storer of values) that we've ever seen. Source: Tavi Costa, Crescat Capital, Bloomberg

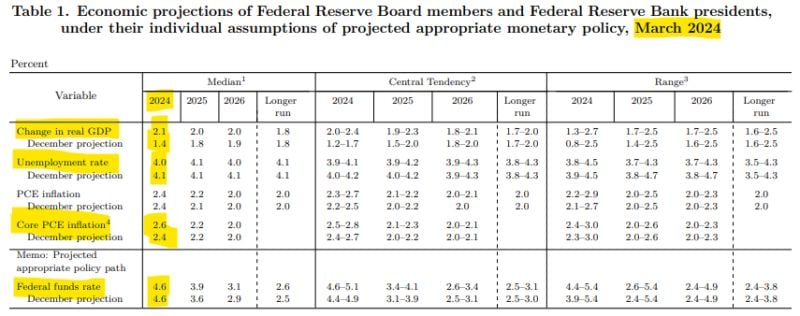

This table explains why markets were soooo... happy yesterday.

As shown by Charlie Bilello: as compared to their December forecasts, the Fed is expecting higher Real GDP growth (2.1% vs. 1.4%), lower Unemployment (4.0% vs. 4.1%), & higher Core PCE Inflation (2.6% vs. 2.4%) but is still anticipating 3 rate CUTS this year. This uber-dovish and bullish for risk assets and gold...

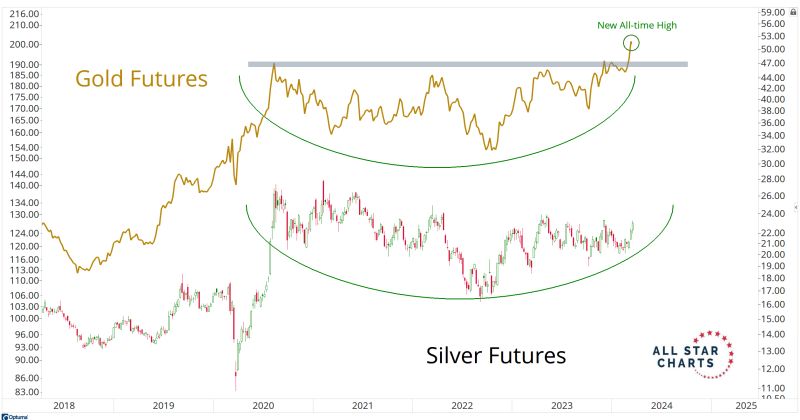

Look at this base on silver... could it follow the steps of gold ?

Source chart: J-C Parets

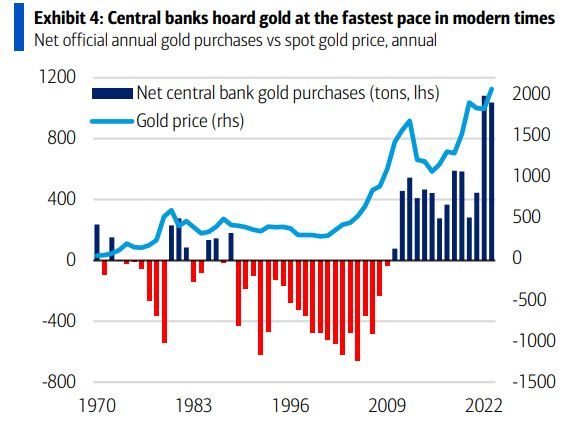

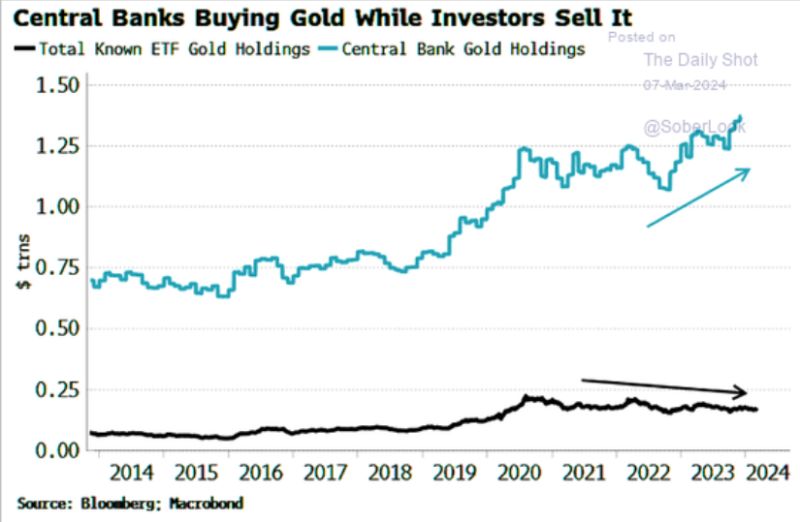

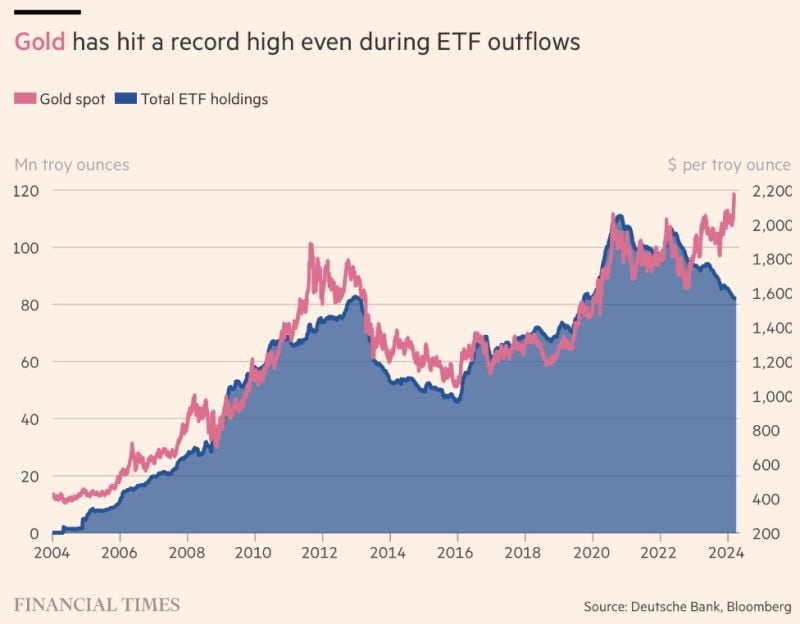

Central banks demand matters a lot more than ETF flows for gold

Source: Bob Elliott, Bloomberg, Macrobond, The Daily Shot

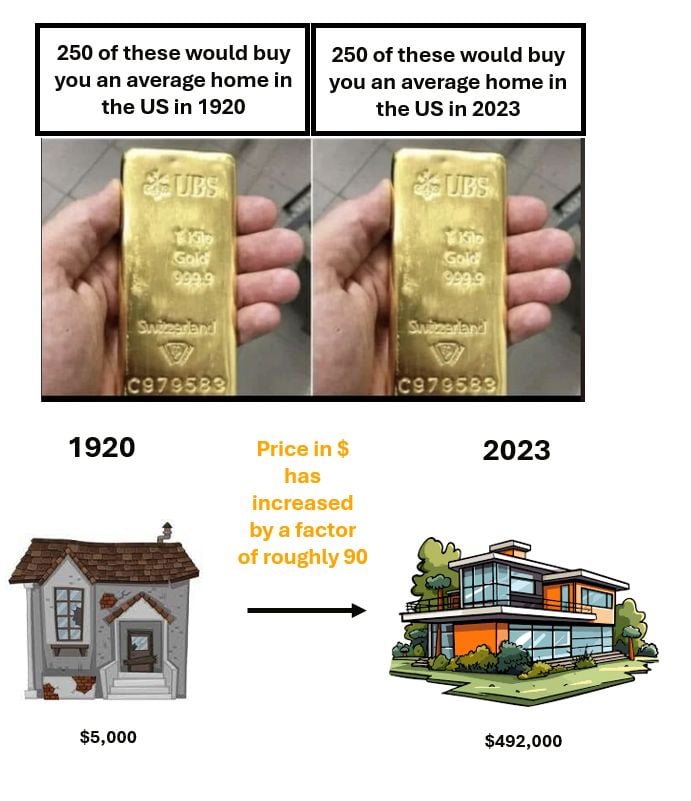

What is a store of value?

A good store of value preserve the amount of goods / services money can buy over time. Example (simplified): - The average gold price in 1920 was $20.68 per ounce. Today it is worth $2,100 per ounce. A 100 fold increase. - The average house price in the US in 1920 was between $5,000 and $6,000. The average sales price of a new home in 2023 was $492,000. A 90 to 100 fold increase.

Investing with intelligence

Our latest research, commentary and market outlooks