Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

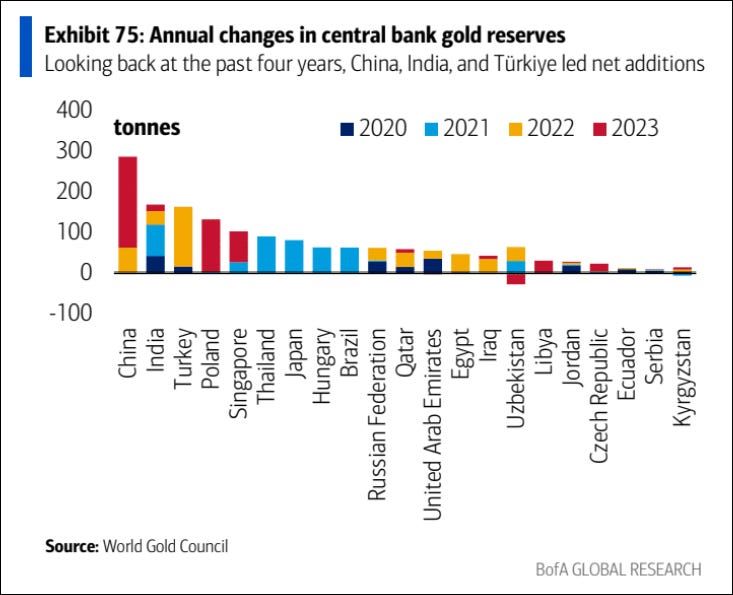

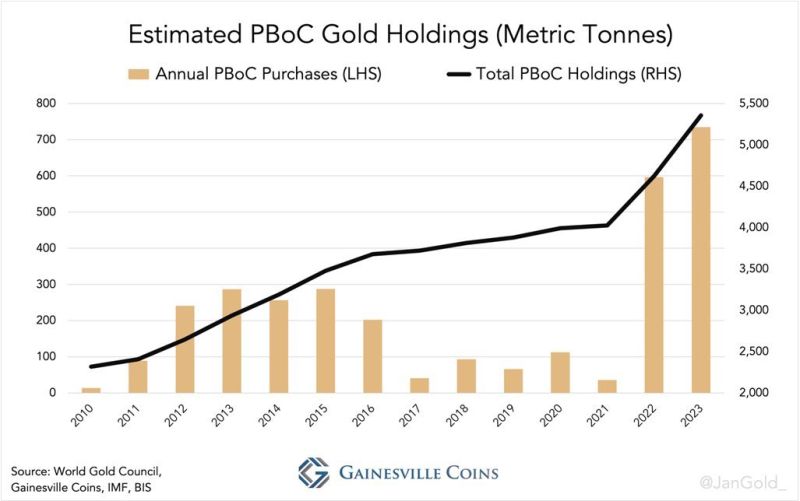

Nice chart by BofA showing central bank gold purchases from 2020-2023

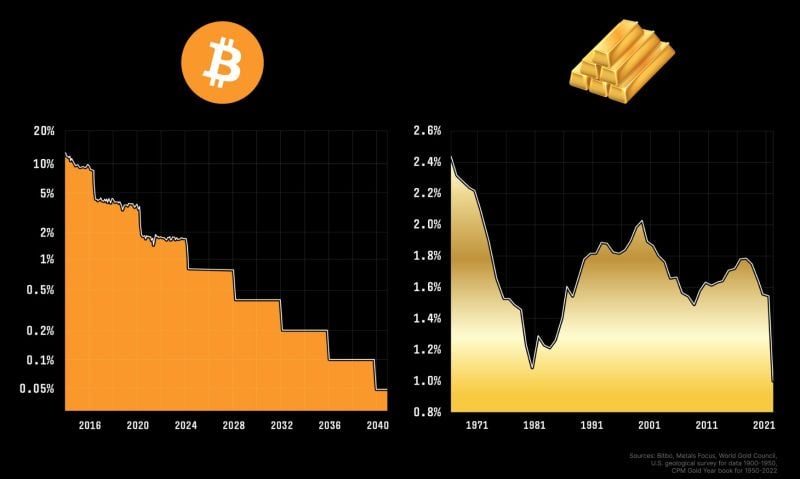

Thru Ronnie Stoeferle

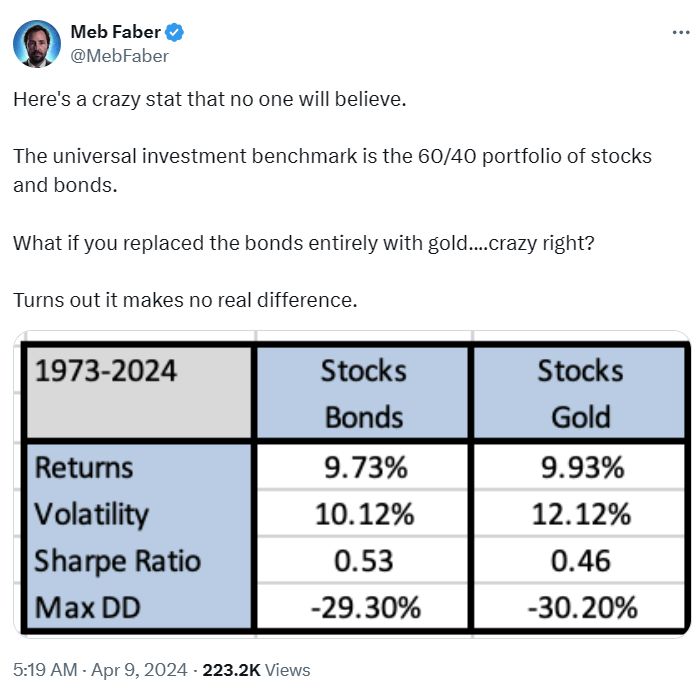

As shown by Meb Faber, holding 40% gold instead of US treasuries within your 60-40 portfolio would have delivered similar results as the 'traditional' 60-40 portfolio...

Going forward, with US Treasuries expected to be a poor diversifier due to supply overhang and sticky inflation, gold might prove to be even more useful within multi-assets portfolios.

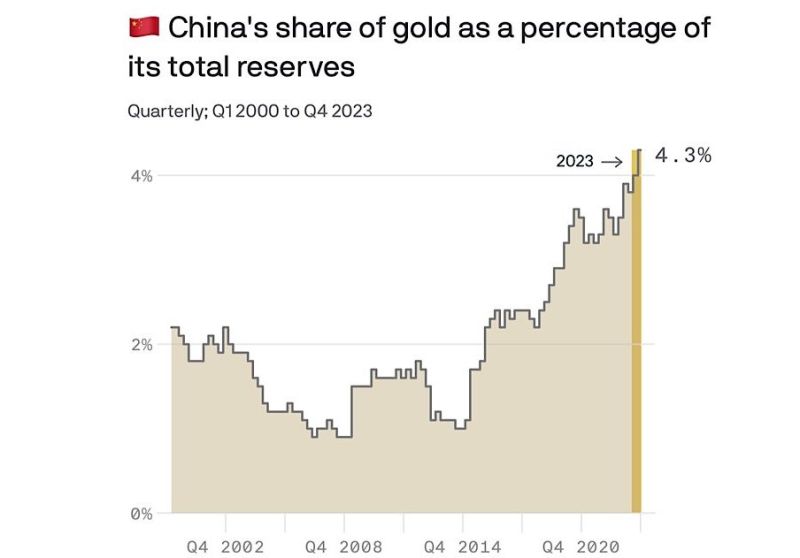

Gold is rallying despite retail and institutional investors dumping.

This is bullish. But who is buying by the way? Central banks... Do they know something investors don't know? Source: BofA

Investing with intelligence

Our latest research, commentary and market outlooks