Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

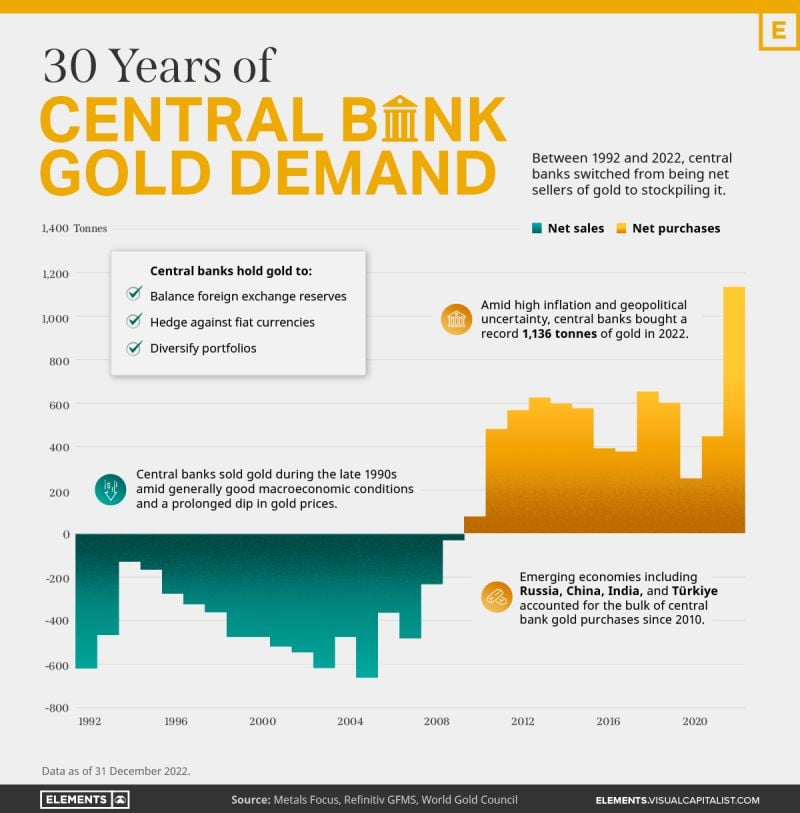

Charted: 30 Years of Central Bank Gold Demand

by Elements / Visual Capitalist

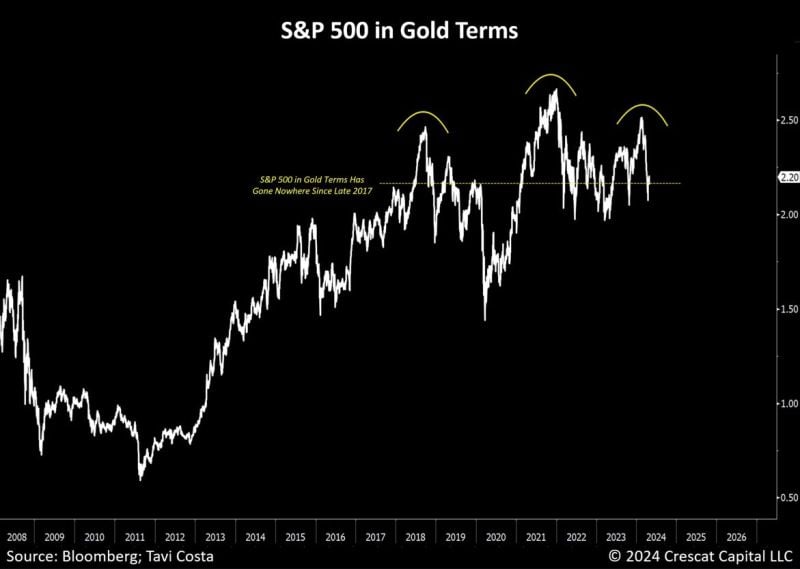

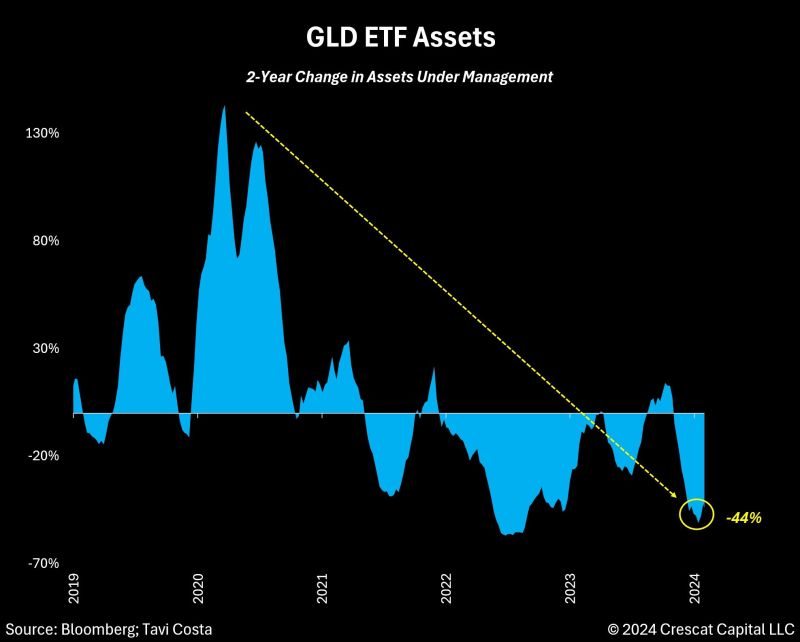

The SP500 in gold terms has gone nowhere since 2017 + it’s hard to ignore this massive head and shoulders taking shape.

Source: Tavi Costa, Bloomberg

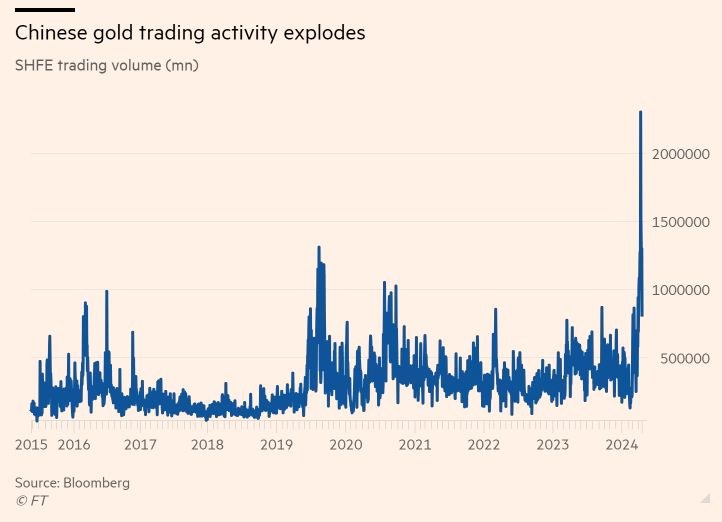

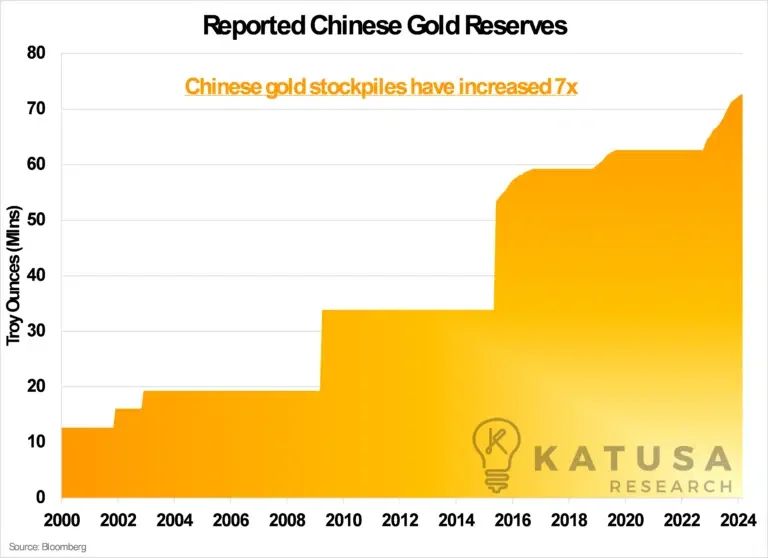

China has quietly accumulated large quantities of gold for 17 straight months – to the tune of 72.7 MILLION ounces (about 2,250 tonnes).

Despite its rise as an economic power, China’s vast reserves are predominantly in USD, an exposure it aims to minimize. To reduce this reliance, the People’s Bank of China is diversifying by increasing its gold holdings. Since 2011, China has decreased its dollar reserves by a third, down to approximately $800 billion. Meanwhile, China’s gold reserves have skyrocketed. China’s economic strategy involves diversifying away from the US dollar, which dominates global trade and commodity pricing. Source: Katusa Research

Investing with intelligence

Our latest research, commentary and market outlooks