Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

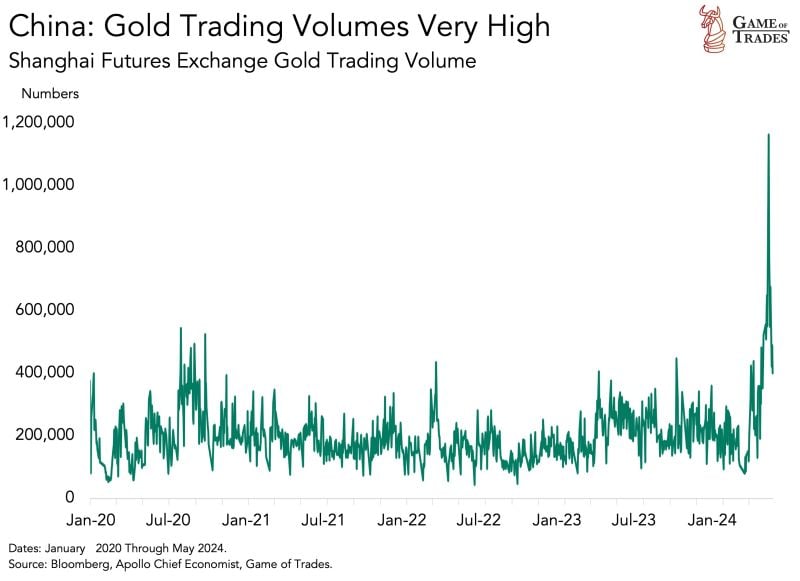

BREAKING: SPOT GOLD PRICE TUMBLED BY $20 PER OUNCE AS CHINA'S PBOC STOPPED GOLD RESERVES BUILDING.

China's end-May forex reserves are $3.2320 trillion, higher than the previous $3.2008tln. Gold reserves were unchanged at 72.80 million ounces, and the value of gold reserves was $170.9bln vs the previous $167.9 bln as gold price increased in May. Source: CN Wire

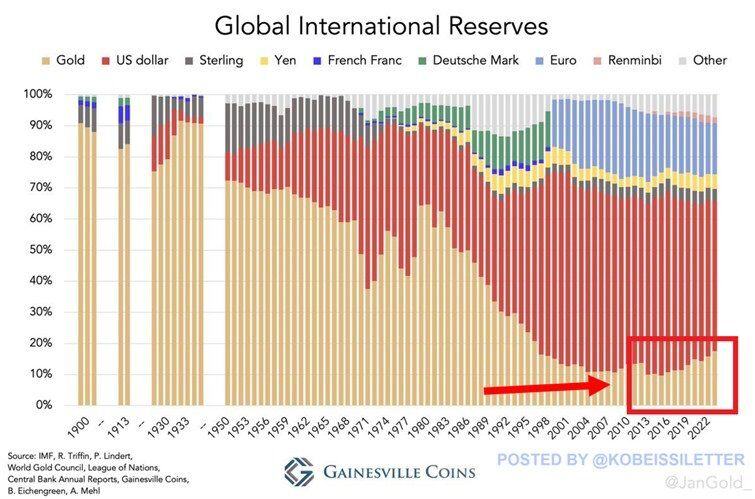

BREAKING: Gold's share of global international reserves jumps to 17.6% in 2023, the most in 27 years.

Source: WinSmart, Gainesville Coins, The Kobeissi Letter

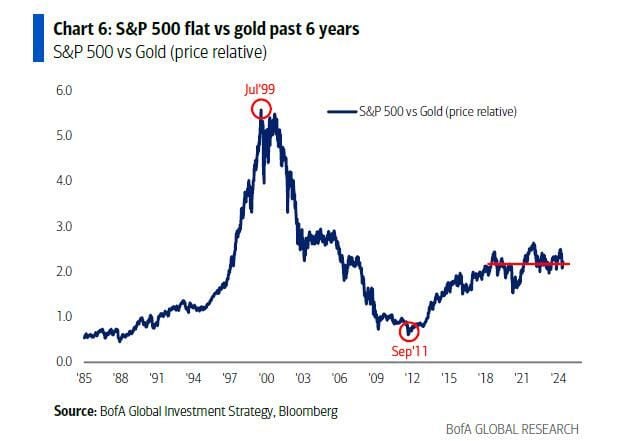

Did you know that the S&P 500 has been basically flat vs gold over the last six years? 🤔

Source: Markets & Mayhem, BofA

Hedge funds build largest long Gold position in more than 4 years

Source: Barchart

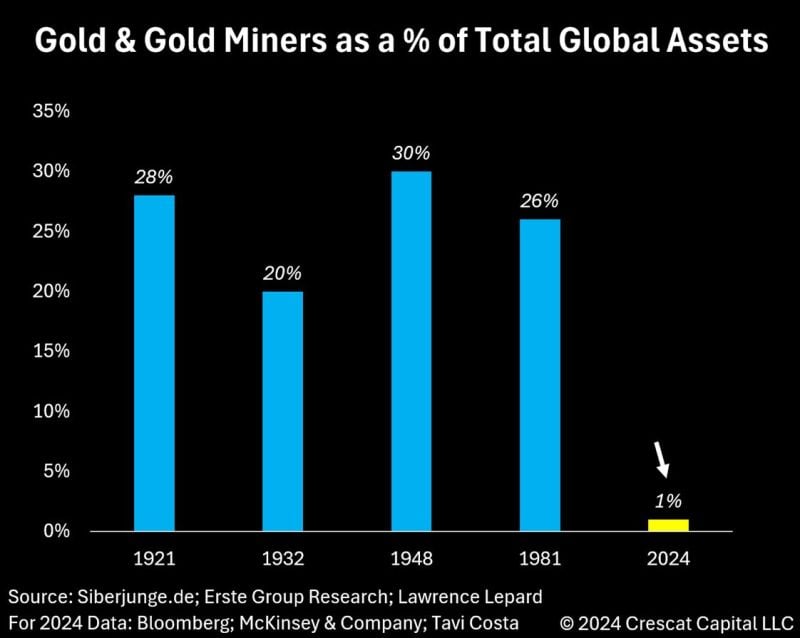

Multiple times in history, the precious metals industry was considered the largest market among global assets.

Today, however, it has shrunk so much that it's almost a rounding error. Will capital start to flow back into this industry? If yes, the impact on prices could be substantial... Source: Crescat Capital, Bloomberg

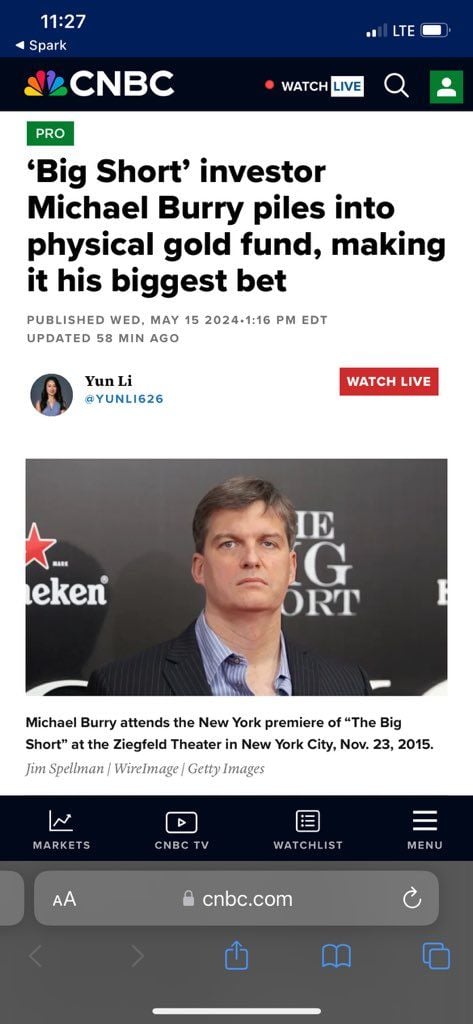

Michael Burry is back! This time he’s loading up on $10 million worth of physical gold $PHYS

Source: Barchart, CNBC

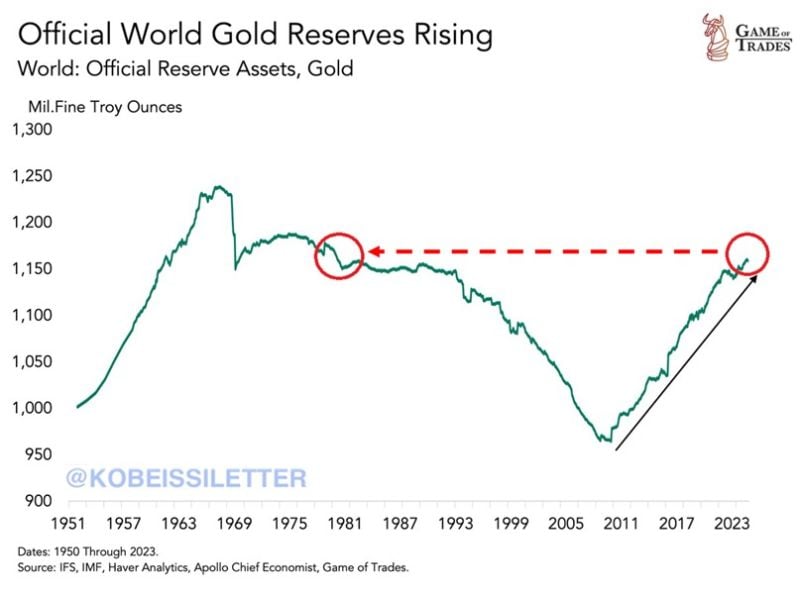

Official world gold reserves have reached 1,170 million fine troy ounces, the most since the 1970s.

Over the last 13 years, world central banks' gold holdings are up roughly 21%. Global gold reserves are now even higher than just before President Nixon broke the US Dollar's link to gold in 1971. In 2022 and 2023 alone, world central banks bought 1081 and 1037 tons of gold, respectively. Meanwhile, gold is up 15% year to date and 85% over the last 5 years. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks