Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

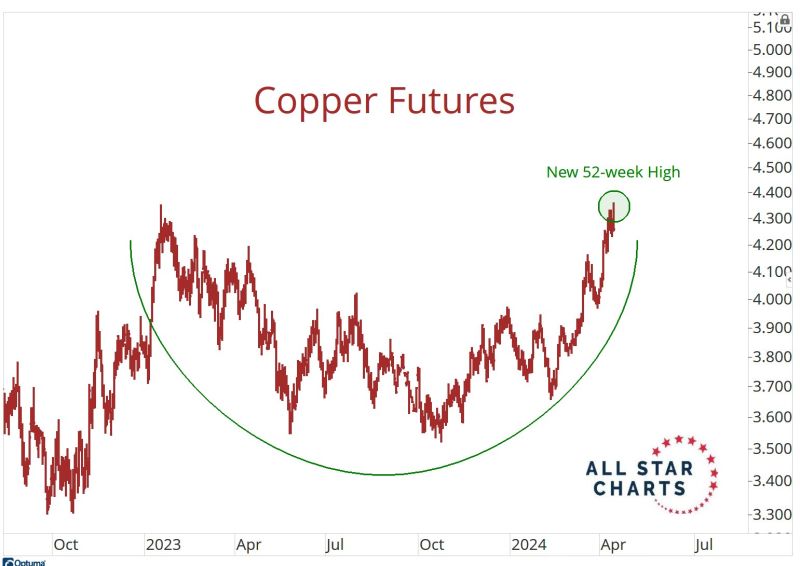

It's not just a Gold thing. It's a metals thing.

Copper hitting new 52-week highs. Source: J-C Parets

The Paxos Gold token traded as high as $3,000/oz Saturday night...

"Each Pax Gold $PAXG token is backed by one fine troy ounce of gold, stored in LBMA vaults in London."

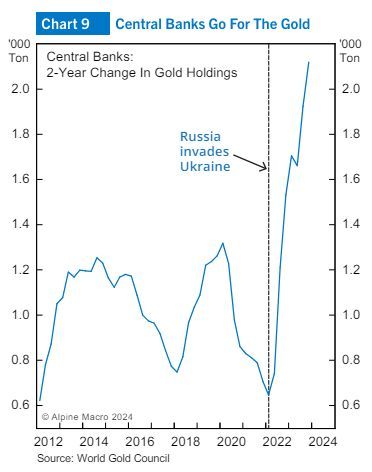

A number of Central Banks have begun to add gold to their reserves since Russia invaded Ukraine.

Chart from Alpine Macro. According to the IMF there is about $12 trillion of currency reserves held globally. That is nearly the market value of the gold stock, but according to Alpine Macro only about $3 trillion of gold is potentially available for central banks to purchase. While other factors need to be taken into account, Central banks buying is likely creating a supply/demand imbalance. Source: Crit Thomas, Alpine Macro

The Dow-to-Gold ratio has now backtested for the second time, after breaking down below its 25-year triangle.

And the chart is now very close to making an expected lower low, which will confirm the historical trend change. Is gold now set to outperform the general stock market? Source: Graddhy - Commodities TA+Cycles

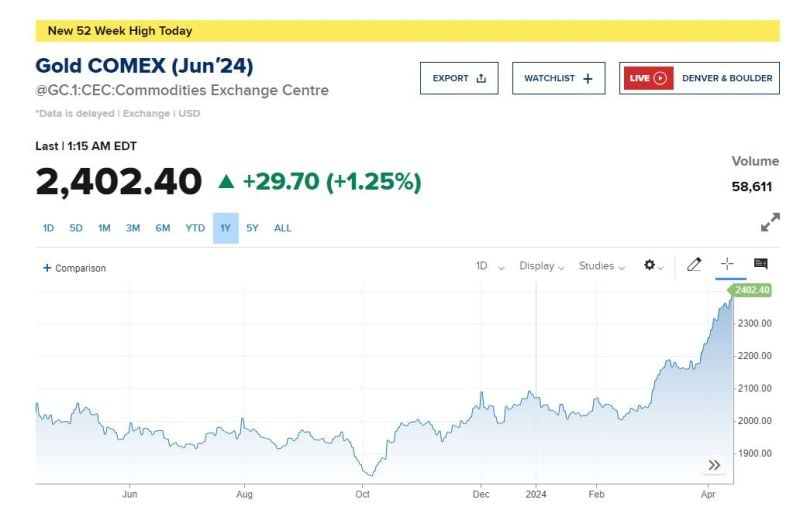

Have a look at the yearly Gold Forecast based on Bloomberg:

Highest forecast for 2024: 2,260, Median: 2,050 Highest forecast for 2025: 2,220, Median: 2,050 Highest forecast for 2026: 2,280, Median: 1,887 Highest forecast for 2027: 2,350, Median: 1,807 Consensus doesn't look optimistic at all on gold. We are far from bubble territory. Is the bull market just starting? Source: Ronnie Stoeferle

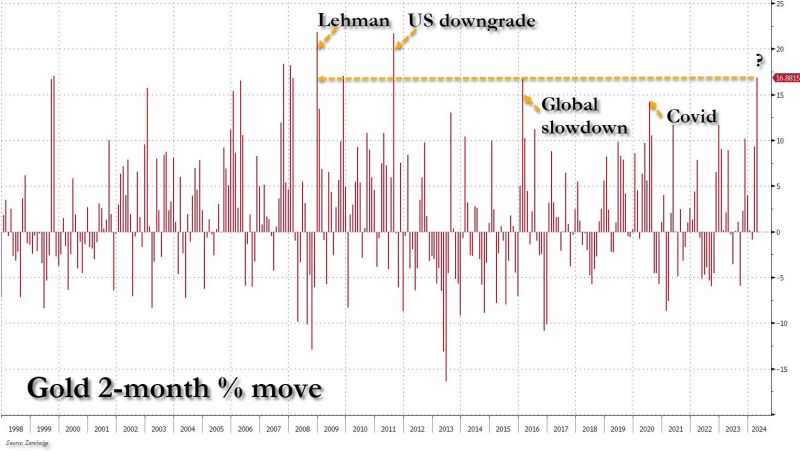

Just In: Gold rising to new all-time highs above $2,400 per ounce

for the first time in history.

Investing with intelligence

Our latest research, commentary and market outlooks