Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

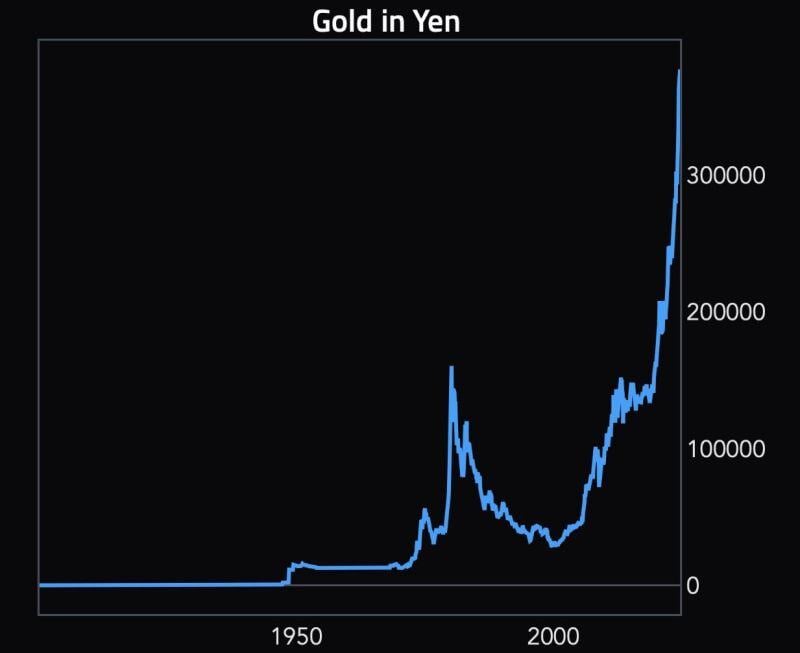

Remarkable chart: gold in yen.

No further comments necessary. Source: Michel A.Arouet, Ht @AugurInfinity

The dichotomy between gold (orange line( and the US 10-year real rate (the red line) is becoming massive...

Source: www.zerohedge.com, Bloomberg

Gold >2400 as markets believe lower than expected CPI report is opening the door to rate cuts by the FED starting in September.

Source: www.zerohedge.com

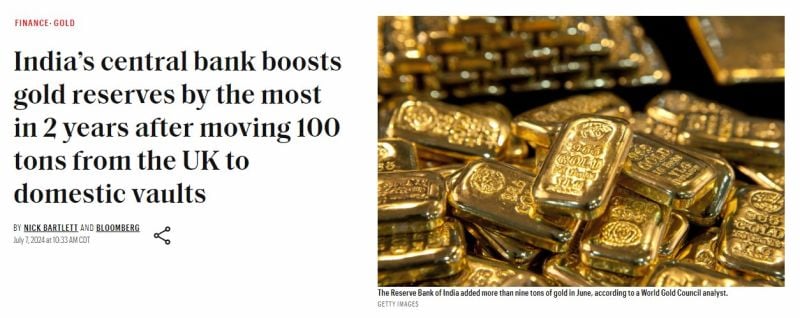

What do Serbia, Czech Republic and India have in common?

central banks are ALL accumulating gold... Source: Bloomberg, Krishan Gopaul

India increases gold reserves by the most in 2 years

Source: Barchart

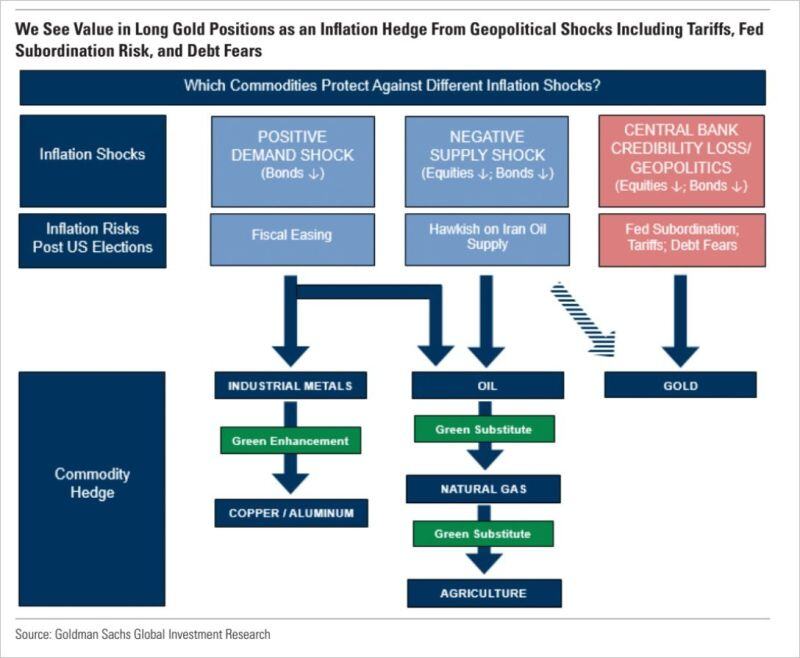

Which commodities protect against different inflation shocks? Goldman regards GOLD as a decent hedge

Source: Goldman Sachs, Ronnie Stoeferle

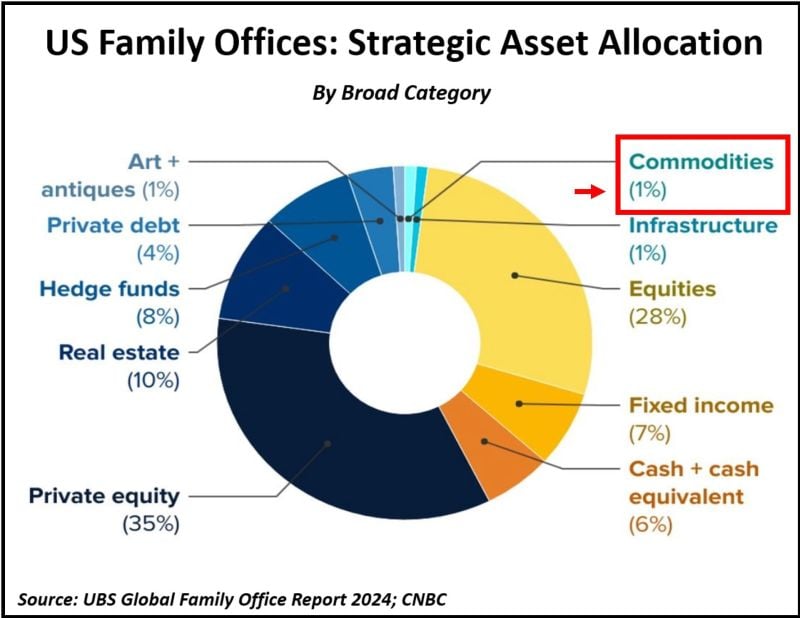

US family offices currently allocate just 1% of their assets to commodities, including gold.

Source: UBS, Tavi Costa

Investing with intelligence

Our latest research, commentary and market outlooks