Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Oil prices jump back above $75 after the US and UK conduct strikes in Yemen.

We are also seeing gold prices up on the news as fears of a larger war resurface. The primary motive for these strikes was the recent Red Sea attacks by the Houthi group in Yemen. Source: The Kobeissi Letter

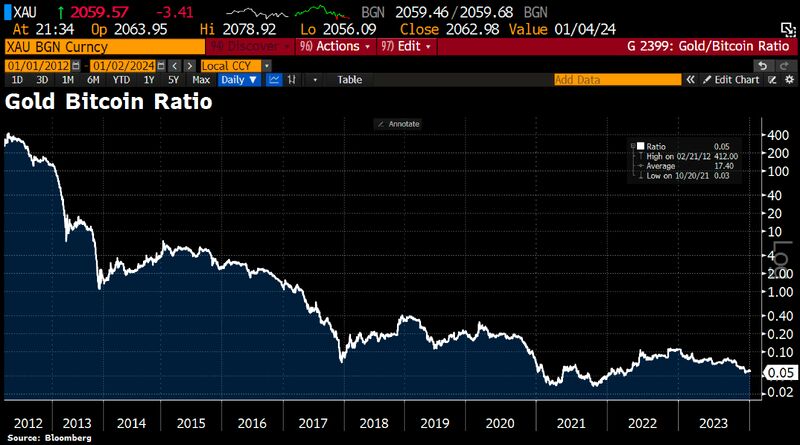

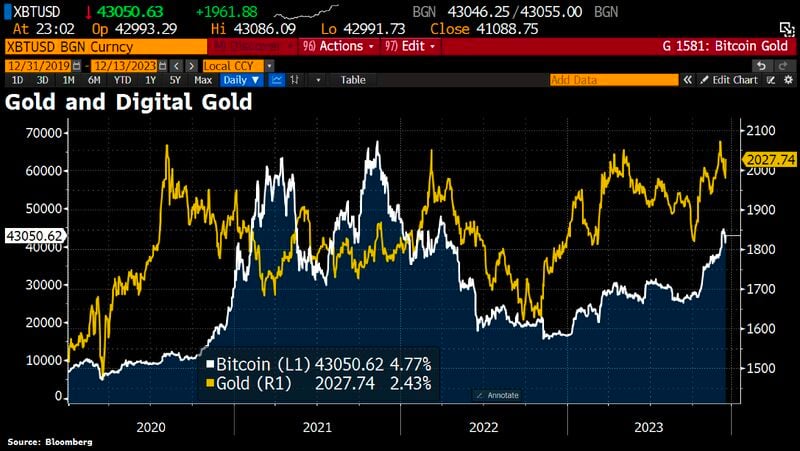

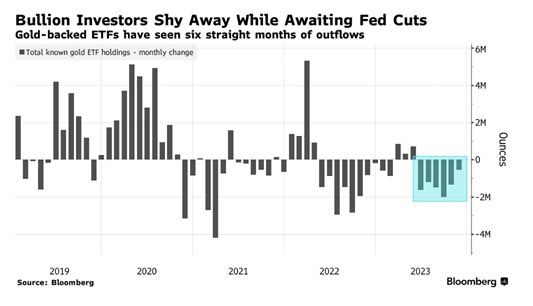

Gold rallying to 2k$ despite investors selling gold is remarkable. Is it all driven by central banks demand?

Source: Michel A.Arouet, Bloomberg

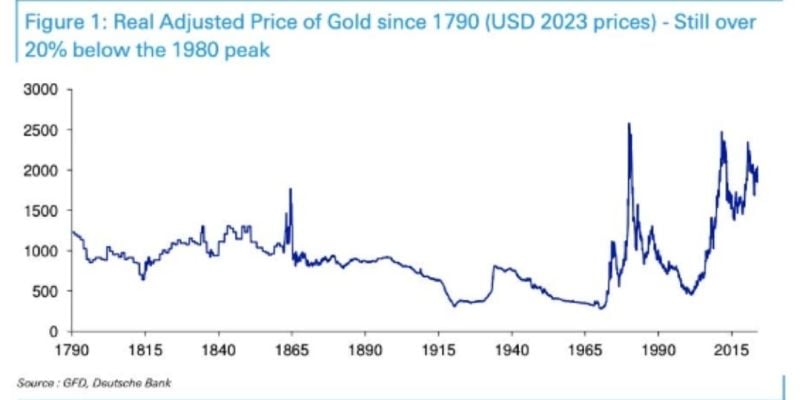

GOLD remains 20% below the 1980 peak inflation adjusted

Source: DB, Win Smart

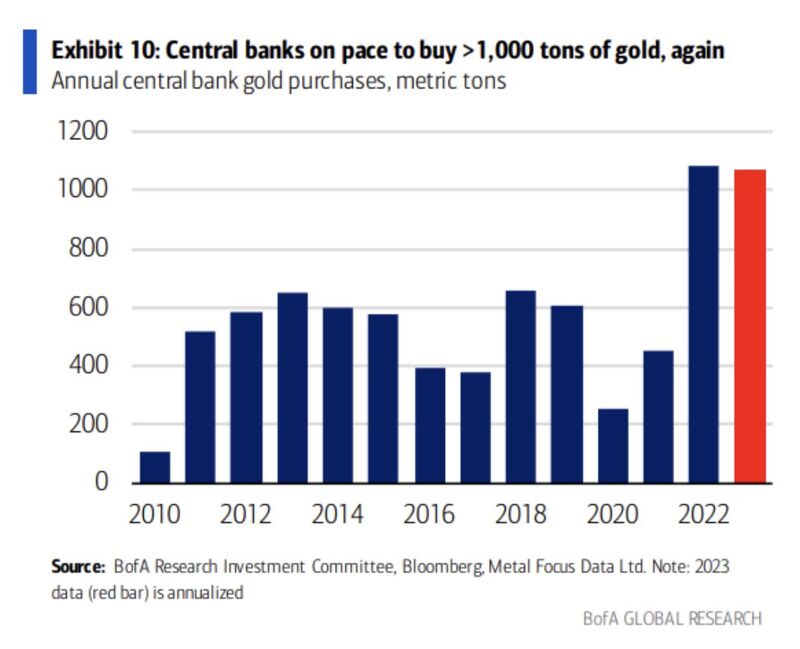

Central banks are on pace to buy over 1,000 tons of gold again

Despite the near-record annual purchases, it's worth noting that these institutions once held 80% of their balance sheet in gold Today, it's barely 20%. A return to the historical average of central banks holding 40% of their balance in gold could propel gold prices north of $3,000 based solely on that capital dynamic... Source: Tavi Costa, BofA

A golden cross on gold (50d MA is trading above 200d MA and both are trending higher)

Source. Bloomberg, Tavi Costa

Investing with intelligence

Our latest research, commentary and market outlooks