Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Google and Anthropic are reportedly in talks on cloud deal worth tens of billions

Anthropic is in discussions with Google $GOOGL about a deal that would provide the with additional computing power valued in the high tens of billions of dollars The plan, which has not been finalized, involves Google providing cloud computing services to Anthropic - Bloomberg Google stock is up 3% in after hours on the news Source: Evan

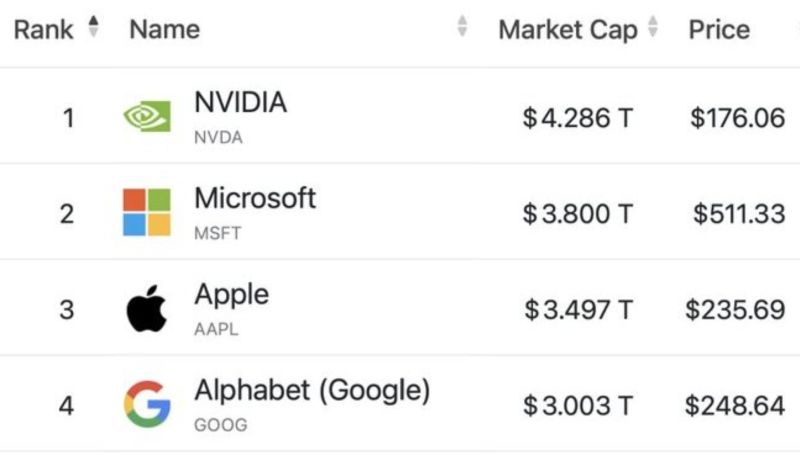

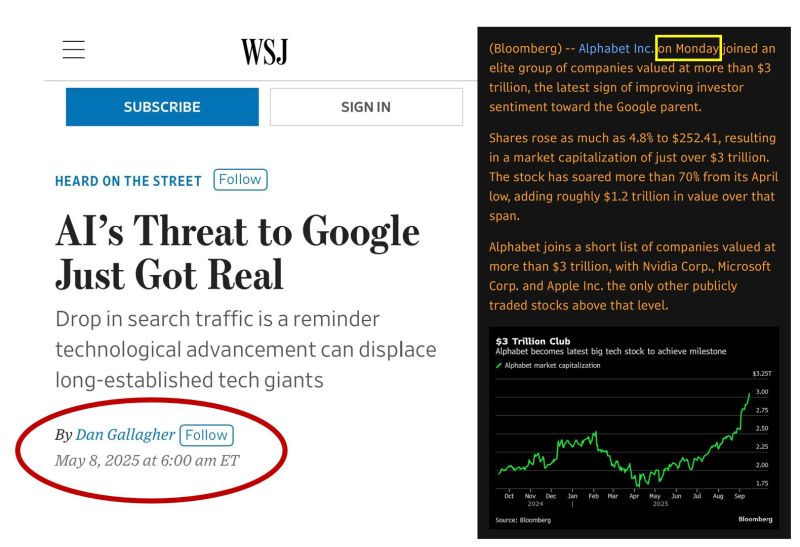

$GOOGL JUST JOINED THE $3T CLUB ALONGSIDE $MSFT, $AAPL & $NVDA

Source: Shay Boloor

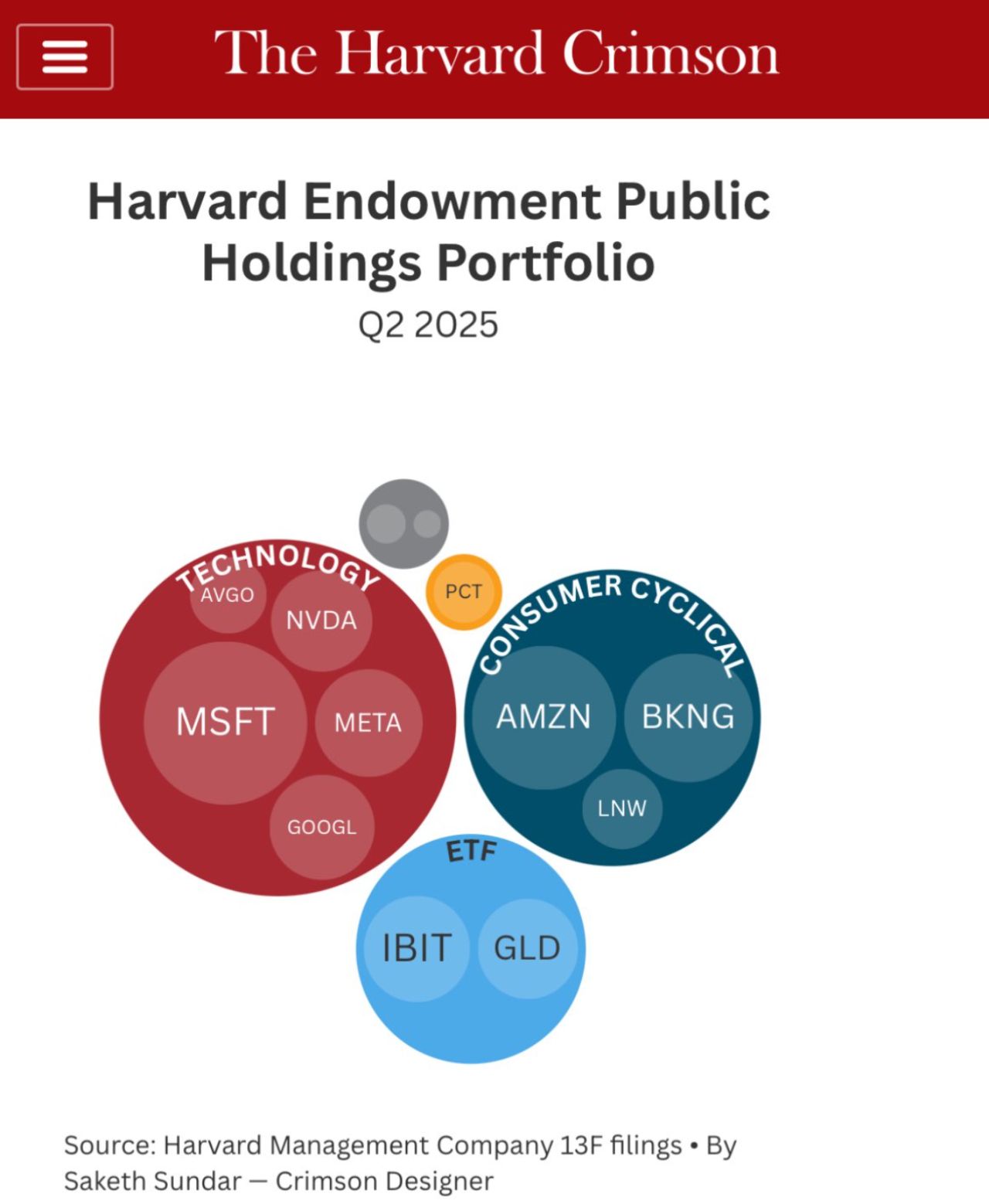

Nicely put by Matthew Yglesias on X as another example that just owning index funds is often the wiser investment decision.

Source: Matthew Yglesias on X

Google can keep its popular Chrome browser, a federal judge has ruled

Alphabet $GOOGLE shares are up 8% AFTER-MARKET. Source: Brew markets, CNBC

On this day in 2004: Google went public at a valuation of $23 billion.

Today, it’s worth $2.5 trillion. Source: Jon Erlichman @JonErlichman on X

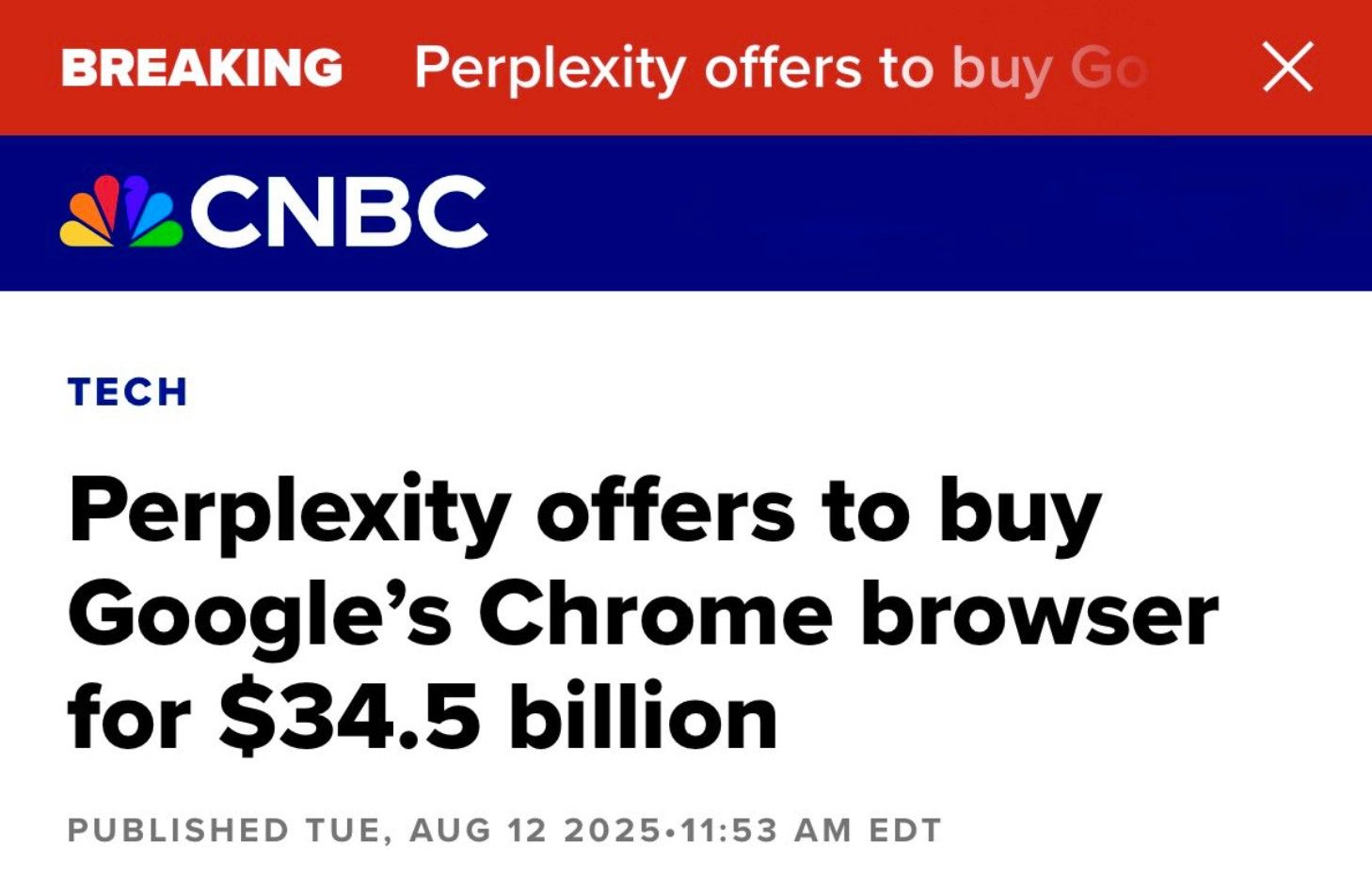

Perplexity, valued at $18 billion, is offering $34.5 billion to buy Google Chrome.

Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks