Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Turkey CenBank raised main interest rate to 30% from 25%, but w/inflation at ~60%, real rates are still very heavily negative

The hike continues what many see as a return to more orthodox monetary policy under Governor Hafize Gaye Erkan, a former executive of First Republic Bank & Goldman Sachs, who was appointed in June after President Recep Tayyip Erdogan won a close-fought re-election. Erkan now hiked rates by a cumulative 2150bps. Source: Bloomberg, HolgerZ

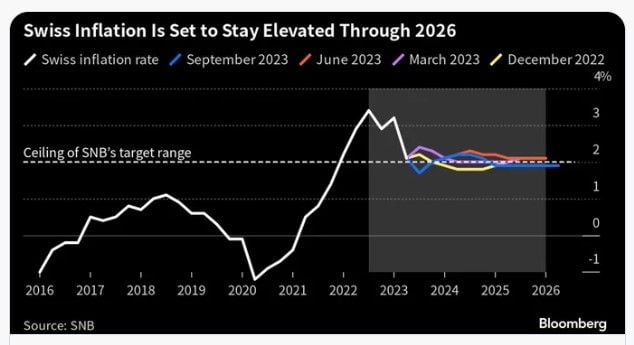

The Swiss National Bank pauses its monetary tightening, defying expectations of another interest-rate hike to avoid adding constriction on a stalled economy

- The SNB left today its key rate unchanged at 1.75%, debunking market expectations of an additional 25bp hike - The slowdown in inflation, the magnitude of the monetary policy tightening already implemented (CHF short term rates were still negative a year ago) and rising risks surrounding the global outlook underpin this decision. - Indeed, as inflation is within the SNB target (1.6%, in the 0%-to-2% target), economic activity is slowing down (0% GDP growth in Q2 2023) and the Swiss franc remains firm, the case for further tightening had turned much less compelling in the past few weeks. Unlike the ECB, forced to hike last week due to an inflation rate still much above its target, the SNB had very good reasons to pause today and adopt a cautious stance. - The SNB doesn’t rule out additional hikes in the future if warranted, but the combination of slowing growth in Europe (likely to dampen underlying price pressures) and of the strength of the currency are highly likely, in our view, to keep Swiss inflation dynamics in check in the months ahead.

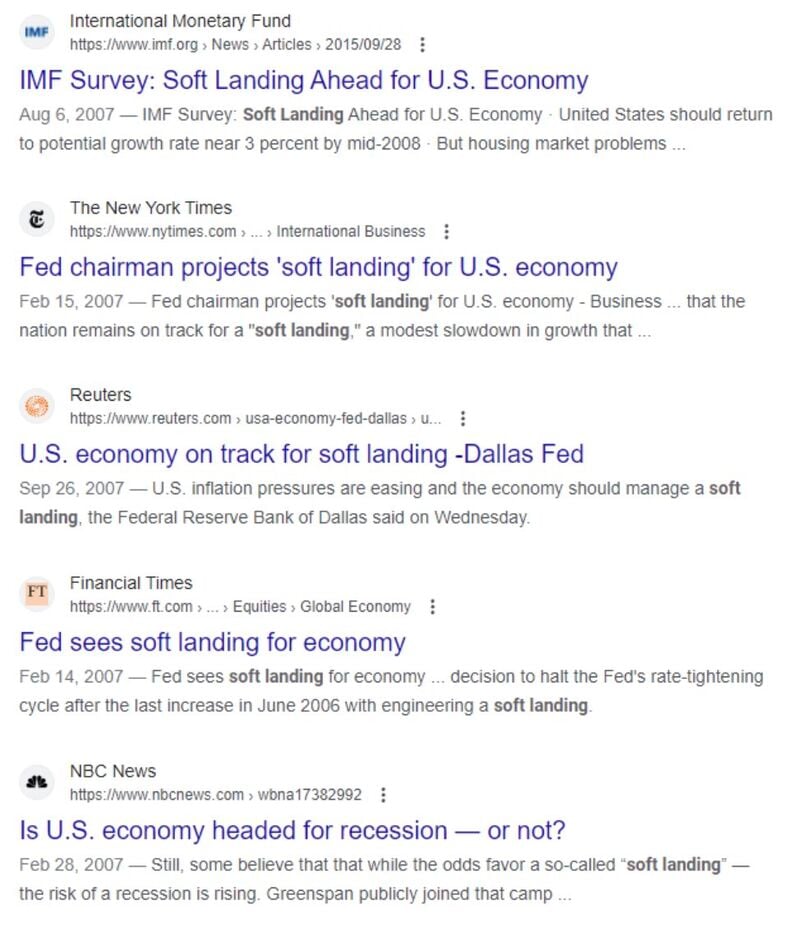

Soft landing narrative is not new. It’s quite common before each recession

Source: Michel A. Arouet

SNB unexpectedly leaves policy rate unchanged at 1.75%.

The Swiss national bank unexpectedly leaves its policy rate unchanged at 1.75%. Market was estimating the probability of a 25bps hike at more than 70% yesterday.

USDCHF broke the 200 daily moving average of 0.9036 and now trading higher over 0.9060.

EURCHF also trading higher at 0.9650.

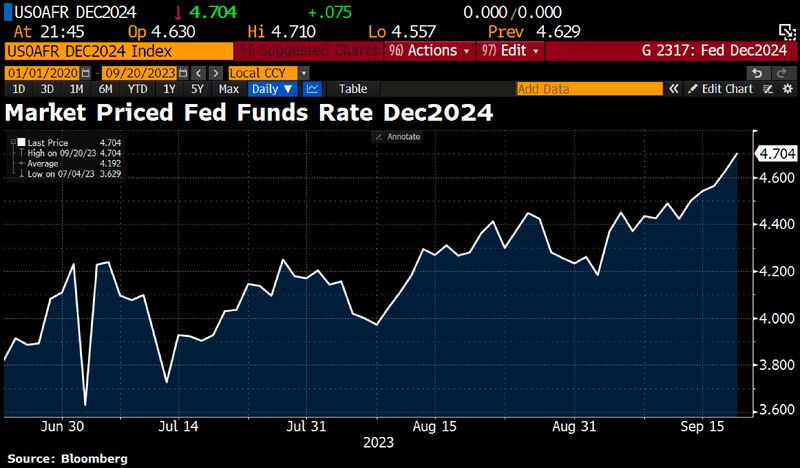

This chart tells the story:

The rate priced in for the Fed’s December 2024 meeting hit a new high for this cycle at 4.7%, meaning investors have sharply trimmed their hopes of interest rate cuts in 2024. Source: HolgerZ, Bloomberg

In case you missed it: German PPI deflation deepened w/PPI down 12,6%, most since the start of the statistic in 1949

Source: HolgerZ, Bloomberg

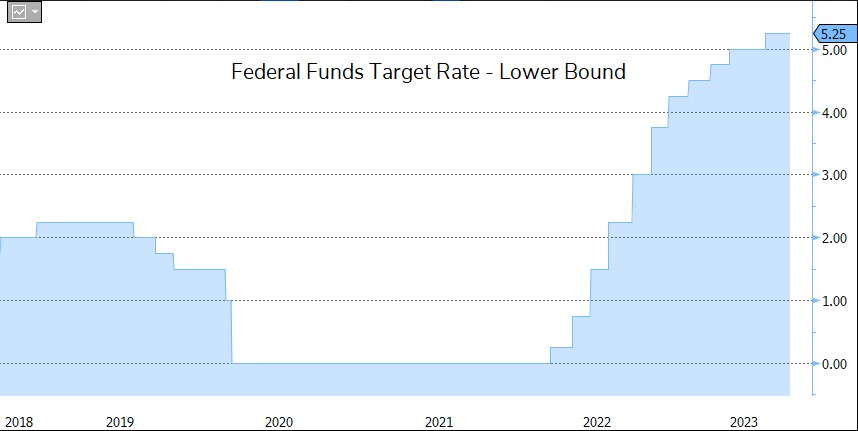

BREAKING: A HAWKISH PAUSE BY THE FED

FOMC KEEPS RATES UNCHANGED AS EXPECTED BUT MAKES CLEAR THAT HIGHER RATES ARE THE NEW NORMAL...US 2y yields hit highest since 2006 after somewhat hawkish Fed. Bottom-line: #Fed futures now no longer show rate CUTS beginning until September 2024. To put this in perspective, three months ago futures were expecting 4 rate CUTS in 2023. Now, interest rates are expected to PAUSE for at least 1 year... One remark: Fed estimates that r* (the real short-term interest rate expected to prevail when an economy is at full strength and inflation is stable) remains at 0.5%, and yet rates in 2026, when US debt may hit $50 trillion will be 3%. This means that blended interest on US debt will be ~$2 trillion, double where it is now. Source: Bloomberg, The Kobeissi Letter, HolgerZ, www.zerohedge.com

FED leaves rates unchanged, signals one more hike this year

The Federal Reserve left its benchmark interest rate unchanged while signaling one more hike this year. FOMC repeated language saying officials will determine the “extent of additional policy firming that may be appropriate.” The FOMC held its target range for the federal funds rate at 5.25% to 5.5%, while projections showed 12 of 19 officials favored another rate hike in 2023.

Investing with intelligence

Our latest research, commentary and market outlooks