Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US national debt 23 years later...

Source: Mayhem4Markets

Private equity firms are redirecting their focus from mega buyouts to businesses such as private credit as higher interest rates disrupt their strategies

Over the past year, buyouts have been halted due to the impact of higher rates, resulting in private equity firms being burdened with portfolio companies acquired at high prices. In response to this challenging environment, some of the industry’s largest firms are venturing into new areas, including lending to companies, which has become more lucrative as central banks raise interest rates to combat inflation. Top executives from Apollo and Blackstone recently highlighted the potential of private credit and infrastructure investing at the annual IPEM industry conference in Paris. https://lnkd.in/exw5bqWp. Source: https://lnkd.in/eSMS2Q-k

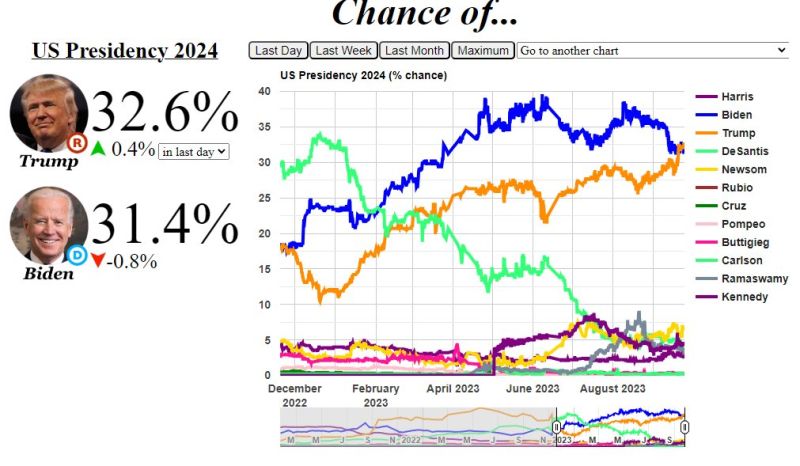

Do you remember what Larry Summers said last year about soft landing?

This story of second marriage and the triumph of hope vs. experience seems to find an echo at the FED level...

The business outlook in Germany has improved slightly amid a shrinking economy

Source: Bespoke

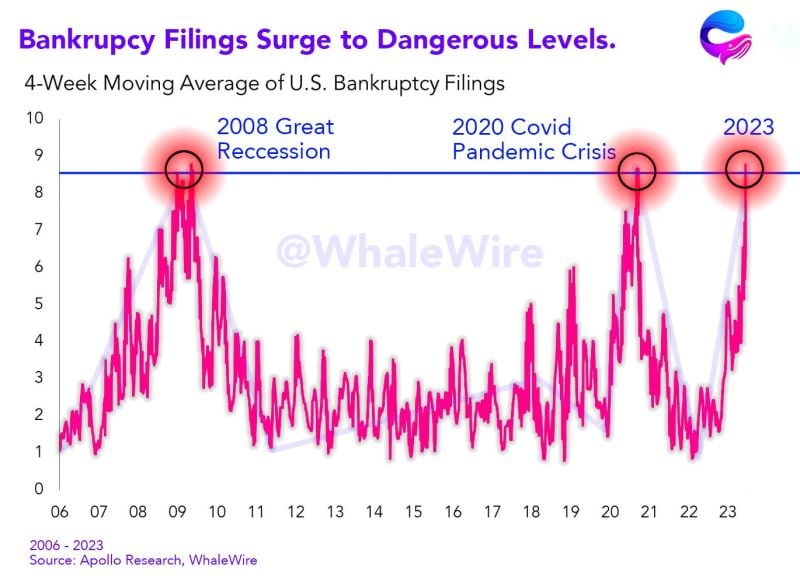

Bankruptcy filings have recently reached levels on par with the 2008 Great Recession and the 2020 COVID-19 pandemic

This indicator often suggests that the economy isn't performing well, and has historically always been followed by massive stock market crashes. Source: whalewire

Maybe this is why Powell said that a soft landing is not the core scenario...

Recession confirmed?

Inflation fear is NOT the driver of rising yields

Indeed, 10y real yields (10y nominal yields - 10y inflation expectations) jumped to 2.11%, the highest since 2009. In other words, investors are demanding higher REAL yields in the face of political chaos in Washington and high debt. Source: Bloomberg, HolgerZ

In case you missed it...

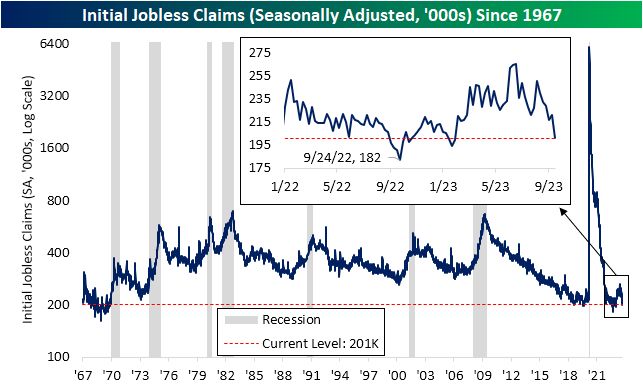

US Jobless Claims Fall to 201,000, Lowest Level Since January...There haven't been many times in the last 50+ years that #us initial jobless claims have been lower. Source: Bespoke

Investing with intelligence

Our latest research, commentary and market outlooks