Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

IS THE US ENTERING A DEBT SPIRAL LEADING TO A SOVEREIGN DEBT CRISIS?

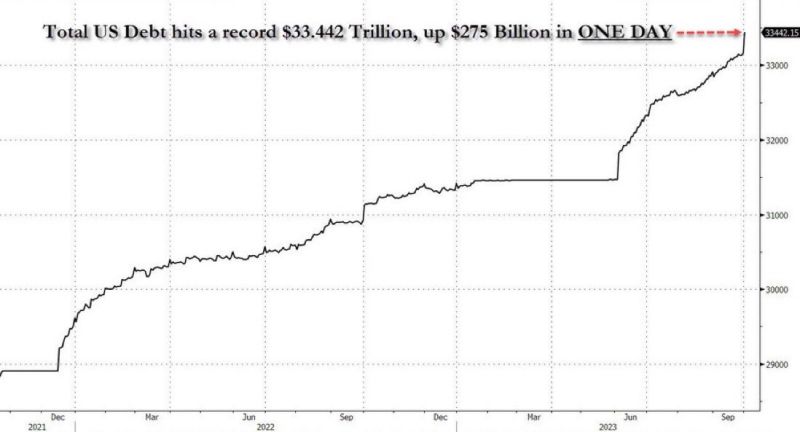

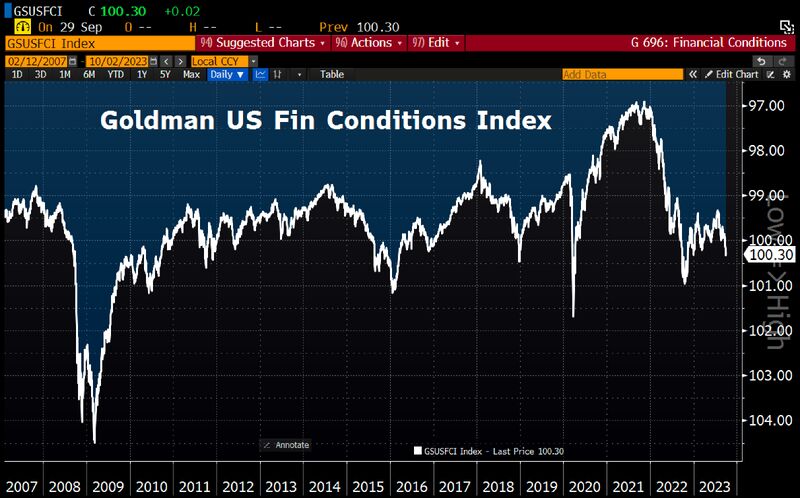

Goldman, JP Morgan and BofA pull the alarm US debt is going parabolic! Total US debt rose by $275 billion in just ONE DAY. The US has added $32 billion in debt per day for the last 2 weeks. At the current pace, the US will add $1 trillion of debt in a month. Meanwhile: - David Lebovitz of JPMorgan Asset Management says something will break if rates continue to rise at the pace they've been going - "Fed hiking cycles always end with default & bankruptcy of extended governments, corporations, banks, investors." - BofA - Goldman Sachs: "There is a significant risk that FCIs continue to tighten until something breaks… (...) All roads appear to be leading to a continued sell-off in US + DM Rates as the market struggles to find the right clearing level for bonds (...) Risks are growing of a sharp, impulsive negative feedback loop in to other markets Source: Max Keiser, www.zerohedge.com

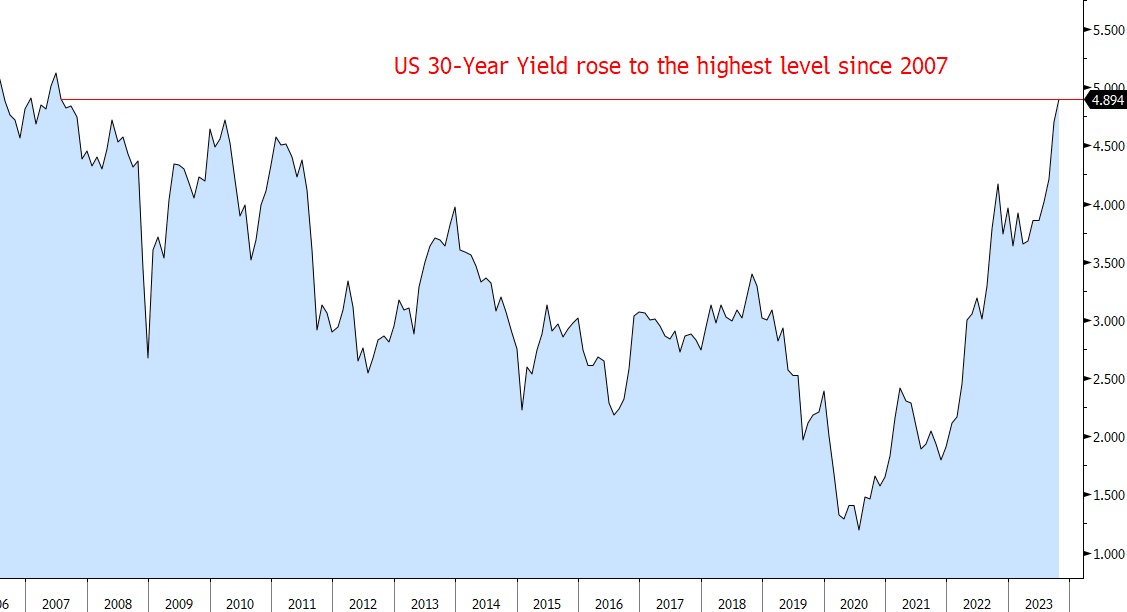

US 30Year Yield reaches 2007 High

The US 30-year yield rose to the highest level since 2007. This week's Treasury selloff came after US lawmakers managed to avert a government shutdown, prompting traders to increase bets that the Federal Reserve will raise rates in November.

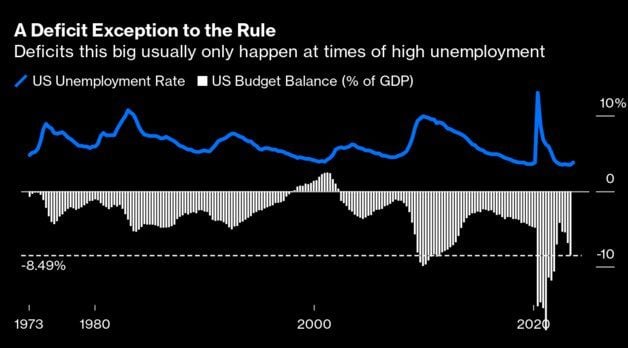

The US is running 10% deficit with record low unemployment

Imagine the deficit in next recession, whenever it may come. Enjoy these positive real rates as long as they last. Source: Michel A.Arouet, Bloomberg

For the next 45 days or so, the US government will NOT be shut down - this is most likely a relief for markets

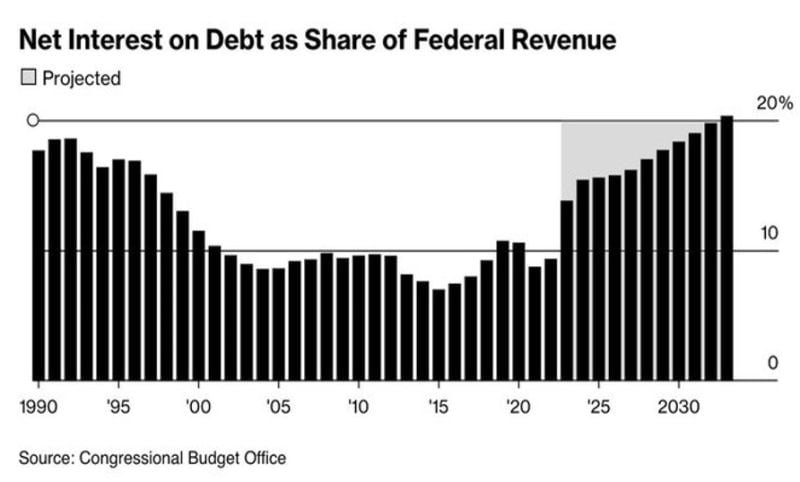

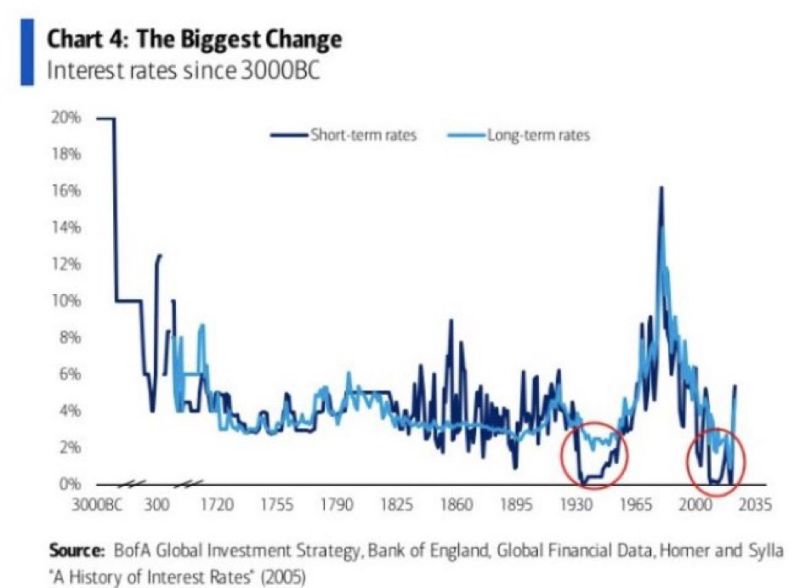

Still, this stopgap bill is only a temporary solution. They are just kicking the can down he road another time. Indeed, the House and Senate are both struggling to approve yearlong spending bills, and the gulf between the two parties remains vast. And as highlighted by the Kobeissi letter, there is still NO LONG-TERM PLAN. For nearly 20 years, it was effectively free for the US to issue debt as debt service costs were ~1.5%. Now, debt service costs have doubled to 3% and will rise toward 5% as rates skyrocket. To put this in perspective, 5% on $33 trillion is ~$1.7 trillion PER YEAR on interest expense. As deficit spending rises, rates are also rising as the US issues trillions in bonds to cover the deficit. It's a never ending cycle of borrowing to spend which is driving rates higher and leading to interest expense being 20% of US revenue... How are they going to fix this? Source: CBO, The Kobeissi Letter

In case you missed it:

The past few months have brought a very significant tightening of US financial conditions; the Goldman Sachs Financial Conditions Index is now at the most restrictive point since November 2022. (HT GS) Source: HolgerZ, Bloomberg

The longest time period chart on US interest rates you will ever find...

Source: BofA

While mega-caps tech stocks are recording huge returns on their cash pile thanks to the rise of interest rates, this is not the case for the rest of the market

Small cap companies are paying the most interest expense ever recorded and unfortunately their interest income is not keeping pace. This will become an even larger problem when small companies are forced to refinance at significantly higher rates. Source: FT, barchart

There we go again...

The game of chicken is on...The US government is now just 48 hours away from a SHUTDOWN. This comes less than 3 months after the largest debt ceiling crisis since 2011. Meanwhile, the government is borrowing over $14 billion PER DAY and spending $3 billion per day on interest expense alone. According to Goldman, a government-wide shutdown would reduce quarterly annualized growth by around 0.2% for each week it lasted after accounting for modest private sector effects. Goldman's baseline is that a shutdown could last for 2-3 weeks (the Trump government shutdown, the longest in history, lasted 35 days, from Dec 22, 2018 to Jan 25, 2019). - Meanwhile, Bloomberg also speculates that in an extreme tail event, the maximum hit to 4Q GDP would be a drag of 2.8% if the shutdown lasts for the entire quarter. Source cartoon: San Diego Tribune

Investing with intelligence

Our latest research, commentary and market outlooks